Indexed In

- Genamics JournalSeek

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- Publons

- Euro Pub

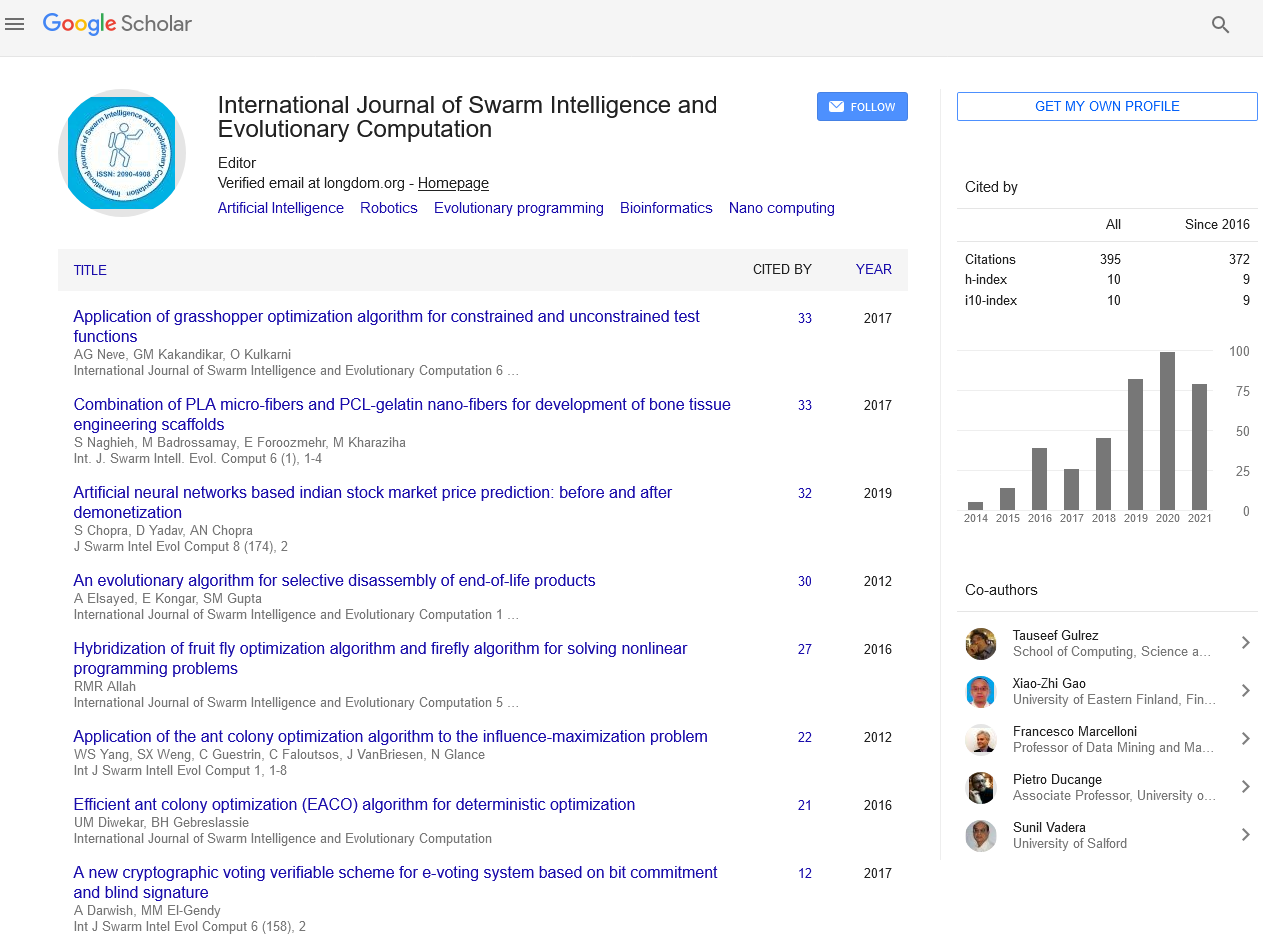

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Abstract

Chaos-Induced Self-Organized Criticality in Stock Market Volatility-An Application of Smart Topological Data Analysis

Smart Topological Data Analysis (STDA), previously employed to research the epidemiological dynamics associated with SARS-CoV-2, is applied to stock market sessions’ trading amplitudes for financial indexes and individual stocks, combining chaos theory, topological data analysis and machine learning. The methods employed uncover evidence of chaos-induced self-organized criticality in the daily trading amplitudes, used as a trading session’s volatility measure. The topological structure of the reconstructed attractors is researched upon, allowing us to characterize the dynamics of the underlying chaotic attractors and to link the main chaotic features to the markers of self-organized criticality, the implications of the research for finance, risk science and the complexity research are also addressed.

Published Date: 2023-09-29; Received Date: 2023-08-26