Indexed In

- CiteFactor

- RefSeek

- Directory of Research Journal Indexing (DRJI)

- Hamdard University

- EBSCO A-Z

- Scholarsteer

- Publons

- Euro Pub

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Research Article - (2023) Volume 11, Issue 4

Using the Big-data Concept to Create a Financial Risk Management Model

Mehmet Amirhan*Received: 17-Jul-2023, Manuscript No. RPAM-23-22223; Editor assigned: 20-Jul-2023, Pre QC No. RPAM-23-22223(PQ); Reviewed: 04-Aug-2023, QC No. RPAM-23-22223; Revised: 11-Aug-2023, Manuscript No. RPAM-23-22223(R); Published: 18-Aug-2023, DOI: 10.35248/2315-7844.23.11.412

Abstract

With the advent of the era of big data, although enterprises have certain strategic choices in the process of active early warning of financial operational risks, the effect of financial risk early warning method is not obvious due to lack of understanding. This paper will apply the idea of decision tree algorithm to the construction of financial risk management model, give full play to the advantages of big data, and try to digitize useful information, so as to find leading indicators to make early warning of financial crisis and control risks as soon as possible. The financial risk early warning management system based on decision tree algorithm can effectively and accurately prevent the financial management risks of enterprises, and effectively avoid the possible financial management risks in the process of business development. When the decision-making problem is in multi-stage and multi-level, the decision tree algorithm can conveniently express the correlation and mutual influence between each stage decision-making and the overall decision-making. When using the decision tree algorithm, we should collect data extensively, consult relevant experienced experts and managers, and repeatedly check and modify the probability distribution, so as to provide a reliable basis for financial decision-making of enterprises.

Keywords

Decision tree; Financial risk; Data mining; Early warning

Introduction

Although Small and Medium-Sized Enterprises (SMEs) are small in scale, they have strong flexibility and broad market, so SMEs can better understand the market demand in time, accurately and quickly [1]. Most managers of small and medium-sized enterprises often have the problem of blind investment because they excessively pursue short-term profitability and ignore the long- term development of enterprises [2]. The high unity of ownership and management right is a typical management mode of small and medium-sized enterprises, and the investor of the enterprise is also the manager of the enterprise. This old management concept is bound to have an adverse impact on the enterprise and lead to the rigidity of the internal management mode of the enterprise. The application of big data technology in financial management can give play to its advantages, realize the effective supervision of data and information by the financial department of small and medium-sized enterprises, and improve the accuracy and efficiency of accounting. This paper introduces how to apply the decision tree method to the financial risk data analysis of small and medium-sized enterprises, which has auxiliary effect and practical significance for managers to make more accurate and reasonable decisions.

With the increase of market uncertainty, the complex and changeable internal and external environment has brought certain business and financial risks to the development of small and medium-sized enterprises, and had a negative impact on normal production and operation. Financial risk exposure is often the last stage of overall risk exposure, that is, all potential problems begin to appear and are exposed in the form of financial risk [3]. Fundamentally speaking, the imperfect financial management system and insufficient capital operation capacity of small and medium-sized enterprises are important reasons for the financial risk of enterprises [4]. Due to their small scale, unstable profits, difficult fund-raising and limited ability to absorb credit, small and medium-sized enterprises are likely to cause difficulties in liquidity. Decision tree algorithm is one of many data mining algorithms. With the rapid development of data mining technology, relevant theories and applications are becoming more and more mature. Data mining does not require complex mathematical theoretical derivation. As long as data filtering is used, the hidden characteristics between data can be found [5]. This paper will apply the idea of decision tree algorithm to the construction of financial risk management model, give full play to the advantages of big data, and try our best to digitize useful information, so as to find leading indicators to make financial crisis early warning and risk control as soon as possible.

Under the background of big data, the financial management of small and medium-sized enterprises is gradually developing towards informatization, which not only brings convenience to the financial management of enterprises, but also makes the financial management of enterprises face many risks. In order to survive and develop, enterprises must pay attention to the investment effect and economic benefit, and make operational planning and scientific decision on the industry direction, economic scale and economic benefit of project investment in combination with their own technical and economic ability [6]. The main research content of this paper is to establish the enterprise financial risk analysis and financial crisis early warning model, find the discrimination rules with high trust, apply the decision tree algorithm to the enterprise financial risk analysis and crisis early warning, carry out crisis early warning for the existing financial risks of enterprises and provide reference for risk control decisions [7]. The financial risk early warning management system based on decision tree algorithm can effectively and accurately prevent enterprise financial management risks and effectively avoid the possible financial management risks in the process of enterprise operation and development. When the decision problem is in multi-stage and multi-level, the decision tree algorithm can easily express the correlation and interaction between each stage decision and the overall decision. Managers of small and medium-sized enterprises must change the business philosophy of blindly pursuing production scale and maximizing short-term interests, enhance their own awareness of financial risk management, improve their own level of financial risk management, and enable enterprises to find the financial risk points within the enterprise in time when and even before the financial risk occurs.

Literature Review

Through the study of historical data of industrial policies and the law of economic cycle, the financial risks of enterprises are measured by scientific methods, so as to estimate the expected investment income of enterprises and estimate the prices of financial products such as securities [8]. Brown et al. introduced the Logistic regression model in financial risk analysis and research, and after experiments on bank financial data, it got better results than Z-score model [9]. Ali et al. introduces the neural network model into the research of financial risk analysis, and through experiments, it is found that under the premise of selecting the same financial indicators, the risk analysis result of neural network model is better than Z-score model [10]. Runxiang applies Support Vector Machine (SVM) algorithm to the construction of enterprise financial risk analysis model, and achieves better experimental results than traditional methods. Martinez et al. constructs a SVM analysis model based on the pretreatment of principal factor analysis which is used in predict enterprise credit risk. Veiga et al. points out the relationship among the return on assets, the debt ratio of assets and the total cash flow in enterprise financial activities, and establishes an analysis model with financial ratio as a variable [11]. Wilson et al. used three-layer BP neural network in financial risk analysis and research, and it has good performance in small sample experiments. Boso et al. used multiple regression model prediction method to carry out risk analysis, and increased the number of financial indicators. Finally, the experimental conclusion showed that Logistic regression analysis had the best effect [12]. Norozpour et al. added rough set and neural network to the research of financial risk analysis model, and achieved good results in the analysis of real enterprise financial data in many fields [13]. Darbandi et al. preprocesses the financial risk impact indicators within the scope of listed companies in manufacturing industry and then carries out risk analysis, which improves the accuracy of judgment results [14]. This paper expounds the basic theory of enterprise financial risk management, applies decision tree algorithm to enterprise financial crisis early warning and risk control, gives full play to the advantages of big data, and tries to digitize useful information to provide reliable basis for enterprise financial decision-making.

Methodology

Theoretical basis of financial risk early warning

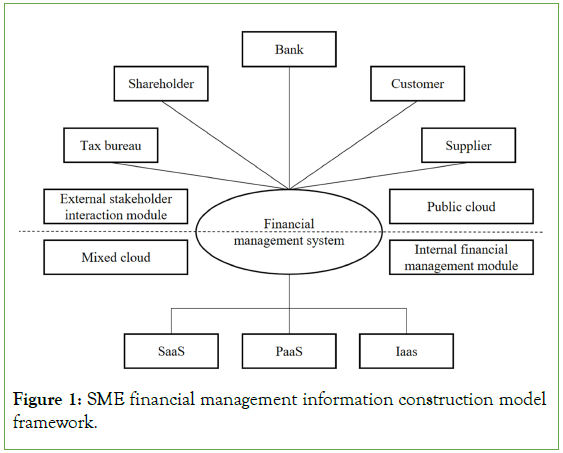

Financial risk:Generally speaking the enterprise financial risk early warning work runs through the whole process of an enterprise’s daily internal production and operation management activities, financing management activities and enterprise investment management activities. However, when enterprises carry out daily production, operation and management activities, strategic management, business management and management department management are often regarded as the main entry points. Generally speaking, financial risk in a broad sense refers to the uncertainty of financial losses and profits of enterprises [15]. This view holds that financial risk is uncertain, which may not only threaten the financial security of enterprises, but also bring opportunities to the future development of enterprises, which requires whether the managers of enterprises can seize the opportunities and meet the challenges. In a narrow sense, financial risk is the risk that an enterprise may lose its ability to repay its debts when raising funds from the outside world for its own development, thus leading to a decline in the expected return of investors. This view holds that due to the unreasonable financial structure of enterprises, improper financing when operating in debt, regardless of profit or loss, will have to repay the principal and interest, so that enterprises may lose their ability to pay debts, which will lead to the decline of investors’ expected income, resulting in financial risks. The financial management information construction mode framework of small and medium-sized enterprises is shown in Figure 1.

Figure 1: SME financial management information construction model framework.

The institutional requirements and corresponding standards of different levels of financial risk assessment and early warning are still very different, and the requirements and corresponding standards of different risk early warning institutions are different. On the basis of big data analysis technology, flexibly using relevant big data analysis technology to innovate and build enterprise financial risk assessment and early warning management mechanism can effectively help enterprises to quickly collect real information related to financial asset risk assessment and early warning, and on this basis, innovatively build enterprise property risk assessment and early warning management mechanism by flexibly using relevant big data analysis technology. Market competition risk means that the constant change and fierce competition in the external market will bring risks to the production and development of enterprises. For an enterprise, competition is a double-edged sword, which can not only become the driving force for the development of the enterprise, but also become the executioner of the enterprise [16]. When early warning of financial management risks is needed at different management levels, the corresponding statistical data resources of enterprises can be extracted in time for in-depth statistical analysis according to the business characteristics and needs of management levels, so as to meet the needs of early warning service of financial management risks at different management levels at the same time. Financial risks caused by internal factors include business risks, financial decision risks, financial personnel quality risks and abnormal financial data risks. Operational risk refers to the risk that the management of an enterprise makes mistakes in the management process, which leads to the decline of the profit of the enterprise and the expected return of investors.

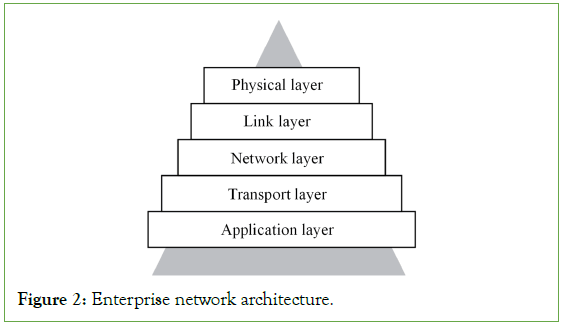

Enterprise early warning: According to the different types of management mechanisms, enterprise financial risk emergency early warning management mechanisms can be roughly divided into special and special risk early warning management mechanisms and normal risk early warning management mechanisms. The normal risk early warning management mechanism often runs through the whole process of daily risk financial activities of the whole enterprise. The special risk early warning management mechanism is often aimed at the critical time when enterprises make major financial decisions. Financial decision-making risk refers to the risks generated by enterprises in the process of financing and investment. The theory of enterprise adversity management explains the management errors and management fluctuations in the business activities of enterprises that can’t be explained by existing theories or have been neglected for a long time in the past, and these management errors and management fluctuations often determine the success or failure of enterprises [17]. When enterprises raise funds by issuing bonds and stock the risk of failure of issuance or higher-than-expected financing cost due to improper selection of issuance quantity price and timing. Or because of the lack of scientific and effective analysis of market interest rate changes in the future, enterprises take higher market interest rate as debt interest rate, and once the interest rate drops, enterprises have to pay a high cost to pay the bond interest [18]. The enterprise network architecture is shown in Figure 2.

Figure 2: Enterprise network architecture.

Technicians can make full use of computers to automatically collect a large amount of financial data related to the whole enterprise, industry or other macroeconomic policies in real time every day. In the stage of judging and grading enterprise risk categories, the risk warning and prompting mechanism must warn and classify industry risks in advance, which will directly determine whether enterprises need to make warning and grading prompts for enterprise risk categories [19]. All enterprises hope to get rich returns through investment, but there are also many uncertain factors in the process of investment, such as long investment time, poor liquidity, uncertainty of returns, etc. These factors will not only enlarge the current financial risks of investment enterprises, but also have a great impact on the future business development of enterprises [20]. Only in this way can the business activities of enterprises always be in a “safe” track. Enterprise adversity management is based on revealing the law of business activities in adversity to reveal the error prevention and correction mechanism of enterprises in normal circumstances.

Financial crisis early warning and risk control model

Dynamic data mining: With the deepening of the globalization of market economy and the development of social information technology, the competition among enterprises is becoming more and fiercer. Enterprises need a sound risk early warning system to minimize possible risks. Dynamic data mining is a data mining technology that extracts knowledge from dynamic databases and real-time databases. The key of dynamic data mining technology is to extract current data set on the basis of keeping smooth transition with historical data set, and to obtain subsequent data set smoothly [21]. Enterprises need to analyze this information from the long-term strategic development goals and business status, and implement the management and early warning of financial risks. However, from the actual risk early warning situation, there is a big difference between the financial risks analyzed by enterprises from different angles.

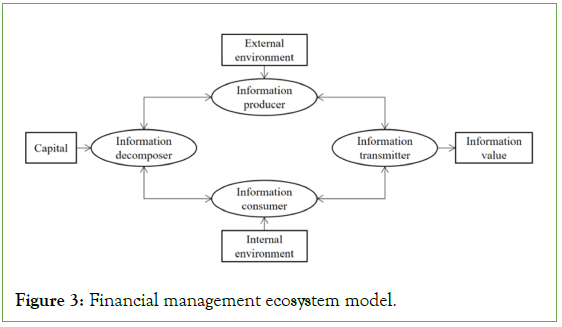

With the advent of information technology and the wide application of big data, big data thinking based on information management and early warning thinking based on scientific judgment can rely on big data management and analysis technology, improve the financial management level, dig out valuable information from data terminals such as business activities and important business processes of enterprises, and then realize information sharing among multiple business entities [22]. The financial ecosystem model is shown in Figure 3.

Figure 3: Financial management ecosystem model.

Data stream is a new data form in the field of information technology, which widely exists in banks, stock trading and meteorological observation. Its essence is to find a suitable schema structure to accelerate the data processing and mining process and improve the efficiency of streaming data mining according to the characteristics of streaming data. The financial risk early warning mechanism based on big data technology can not only timely and effectively analyze and collect accurate data and information, enhance enterprise risk early warning and response ability, and meet the actual operation needs of enterprises, but also conduct reasonable risk investment and business activities through risk early warning, help managers better integrate internal resources and effectively improve the actual benefits of enterprises. Real- time database refers to the database with time connection between data and transactions [23]. The correctness of the control system depends not only on the logical result of the specific research object, but also on the time when the logical result is generated. Its data model is mainly data flow model. From the point of view of database, the amount of data in real-time database is huge and the data generation rate is extremely fast. From the application point of view, it can obtain real-time and continuous query results. Data flow model has been widely used in many fields.

Financial risk early warning based on decision tree

Enterprises are the main components of an industry in which they are located. They are directly influenced by many factors, such as the overall development stage of the current industry society, the fierce competition in the industry market and the current development status of the industry, etc., and take the overall situation of the industry as the main index and the measurement index to evaluate the overall development status of the industry. With the rapid development of modern social market economy and information technology, the era of big data information has officially arrived [24]. However, at present big data information technology has not really attracted the attention of many enterprise managers, and the lack of correct understanding of enterprise financial risk management has led to the lack of financial risk early warning system and advanced financial management information technology in many enterprises.

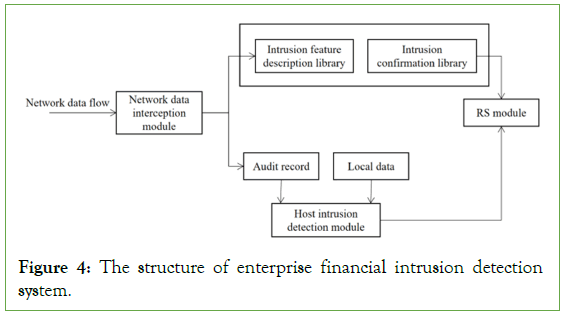

Flexible application of big data analysis technology can release and update quantitative management indicators in time, thus achieving the main purpose of obtaining more information in time and improving the early warning of data and the accuracy of analysis results. Figure 4 shows the structure of the enterprise financial intrusion detection system.

Figure 4: The structure of enterprise financial intrusion detection system.

Financial risk analysis, forecast and early warning is one of the most basic work management links of modern enterprises. The internal financial status of enterprises can generally be divided into abnormal financial status and normal financial status. The theory of enterprise financial crisis early warning is a comprehensive theory that includes multiple disciplines. It is a multidisciplinary knowledge covering enterprise risk management, project investment management, dynamic information technology, mathematical modeling and so on [25]. Under the new economic early warning and forecasting mechanism, relevant technical personnel can flexibly use big data- related technologies to collect, sort and analyze various relevant economic data of their companies in the past years, and analyze the economic impact of different industries on their companies in the past years, so as to determine their impact in a timely manner direction. The study of early warning of corporate financial crisis is to mine the rules with high trust in the fluctuation of financial indicators. When the fluctuation of the indicator exceeds a certain range, the system should issue an early warning.

The main requirement of the decision tree algorithm is to clarify the selection criteria of the test attributes of each node. It will not only affect the scale and prediction accuracy of the decision tree, but also the main link of the calculation amount of the decision tree [26].

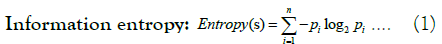

Among them, S is the sample set, n is the number of target attributes, and is the proportion of S belonging to category i.

Information gain:

Among them, Value (A) is the value set of attribute A, v is a certain value in Value (A), is the total number of samples, and is the number of samples whose attribute A takes the value of mouth.

Information gain rate:

Among them, to are a set of n samples formed by dividing S for attributes of n values.

The actual effect of financial risk management is closely related to the actual profitability of an enterprise. Although the financial risk management system has an important influence on the economic development process of Chinese enterprises, many managers of Chinese enterprises often ignore the needs of long-term development and the planning of long-term investment returns in order to blindly pursue short-term economic benefits, which leads to the general lack of a set of financial risk early warning system in Chinese enterprises [27]. Enterprises should establish a financial operation risk early warning system under the background of big data in time to effectively deal with the adverse effects of various financial risk management factors in commodity market price fluctuation market economy.

Data Analysis and Discussion

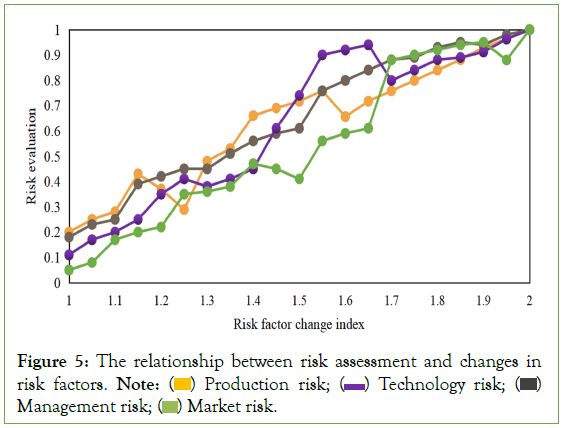

On the basis of big data analysis technology, flexibly using relevant big data analysis technology to innovate and build enterprise financial risk assessment and early warning management mechanism can effectively help enterprises to quickly collect real information related to financial asset risk assessment and early warning, and on this basis, innovatively build enterprise property risk assessment and early warning management mechanism by flexibly using relevant big data analysis technology. Most of the current risk management is limited to compliance and internal control. Although the management of these risks is very important, it is easy for organizations to ignore their subjective risks, and such risks are hard to avoid. The main goal of enterprise financial early warning is risk control, not only to foresee financial risks, but more importantly, to find out the factors that lead to problems in the company’s financial situation in time. The relationship between the risk assessment of a business and the change of risk factors is shown in Figure 5.

Figure 5: The relationship between risk assessment and changes in risk factors. Note:  Management risk;

Management risk;  Market risk.

Market risk.

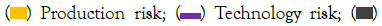

The analysis shows that the business is sensitive to business risks and less sensitive to financial risks. The quality of decision tree analysis mainly depends on the data and judgment. If the data and judgment are correct, the probability estimation provided will be more practical and accurate, and the greater the reliability of decisions made by decision tree analysis. Compare the indexes at the same level, and give the proportional scale score according to the relative importance of the indexes. The data relationship between weight and evaluation value is shown in Figure 6.

Figure 6: Financial risk weight and evaluation value. Note:  System data security risk;

System data security risk;  Industrial policy risk.

Industrial policy risk.

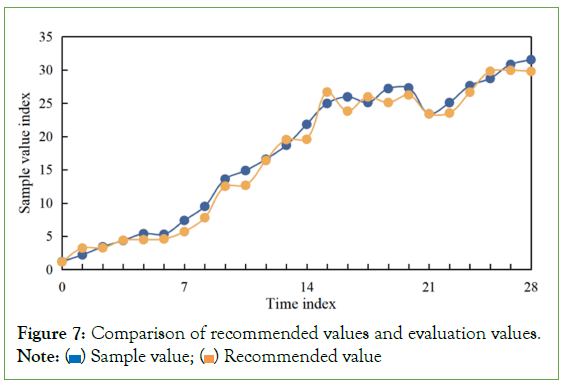

For small and medium-sized enterprises, mortgage is the main way to obtain loans. However, due to the imperfect current guarantee system, low quality of registered capital, defective operation and management methods and other reasons, the guarantee system has little help to small and medium-sized enterprises in financing. The decision tree algorithm model is applied to the risk prediction of sample data, and the prediction results are basically consistent with the recommended values given by experts, as shown in Figure 7.

Figure 7: Comparison of recommended values and evaluation values. Note:  Recommended value

Recommended value

Advanced modern scientific information technology and abundant modern information technology data fully reflect the fruitful results of China’s economic and social development. In the industry risk analysis, it is mainly aimed at enterprises whose main goal is enterprise early warning, and the situation of their industry will bring potential interference to enterprises, so scientific analysis is carried out. Big data gradually penetrates into the whole enterprise, and this trend will continue. However, many enterprises are still groping forward and facing greater risks. Strengthening the infrastructure of financial management risk monitoring and early warning system, and enhancing the sense of financial risk management responsibility of leaders at all levels and all employees of group enterprises are conducive to promoting the healthy and stable development of enterprises.

Conclusion

It is the main research content of this paper to apply the decision tree algorithm to enterprise financial risk analysis and crisis early warning, to make crisis early warning for enterprise financial risks and to provide reference for risk control decision-making. The quality of decision tree analysis mainly depends on the data and judgment. If the data and judgment are correct, the probability estimation provided will be more practical and accurate, and the greater the reliability of decisions made by decision tree analysis. The intelligent financial early warning method based on decision tree algorithm is to analyze the law of enterprise capital flow according to the business and financial objectives of enterprises, use big data technology to capture abnormal management signals and major mistakes in the process of capital flow in time, analyze and evaluate the effect of enterprise funds in the process of use, give an alarm in time, take corresponding measures, establish an immune mechanism, and enhance the ability of enterprises to resist financial risks. When using the financial decision tree analysis, we should collect data extensively, consult relevant experienced experts and managers, and repeatedly check and modify the probability distribution, so as to provide a reliable basis for the final financial decision. The main defect of decision tree is its high variance, and a small change of data will lead to a series of completely different splits, which will make the interpretation unstable. Therefore, how to improve the accuracy of decision tree in specific cases is a problem that needs to be further solved.

References

- Yang Y, Sun Z, Lu J. Financial Risk Early Warning Model Of Decision Tree Research Based On Z-Score Indicators. European Accounting Review. 2017;46(7):38-47.

- Karpijoki V. Security in ad hoc networks. In Proceedings of the Helsinki University of Technology. 2000.

- Darbandi M. Kalman filtering for estimation and prediction servers with lower traffic loads for transferring high-level processes in cloud computing. HCTL International Journal of Technology Innovations and Research. 2017;23(1):10-20.

- Darbandi M. Proposing new intelligence algorithm for suggesting better services to cloud users based on Kalman filtering. Journal of Computer Sciences and Applications. 2017;5(1):11-16.

- Darbandi M. Proposing new intelligent system for suggesting better service providers in cloud computing based on Kalman filtering. HCTL International Journal of Technology Innovations and Research. 2017;24(1):1-9.

- Seyedi S, Darbandi M, Navimipour NJ. Designing an efficient fault tolerance D-latch based on quantum-dot cellular automata nanotechnology. Optik. 2019;185:827-837.

- El Baz J, Laguir I, Marais M, Staglianò R. Influence of national institutions on the corporate social responsibility practices of small-and medium-sized enterprises in the food-processing industry: Differences between France and Morocco. Journal of Business Ethics. 2016;134:117-133.

- Massaro M, Handley K, Bagnoli C, Dumay J. Knowledge management in small and medium enterprises: A structured literature review. Journal of Knowledge management. 2016;20(2):258-291.

- Cravo T, Piza C. The impact of business support services for small and medium enterprises on firm performance in low-and middle-income countries: A meta-analysis. World Bank Policy Research Working Paper. 2016:7664.

- Li W, Liu K, Belitski M, Ghobadian A, O'Regan N. E-Leadership through strategic alignment: An empirical study of small-and medium-sized enterprises in the digital age. Journal of Information Technology. 2016;31:185-206.

- Boso N, Danso A, Leonidou C, Uddin M, Adeola O, Hultman M. Does financial resource slack drive sustainability expenditure in developing economy small and medium-sized enterprises? Journal of Business Research. 2017;80:247-256.

- Brown R, Liñares-Zegarra J, Wilson JO. Sticking it on plastic: Credit card finance and small and medium-sized enterprises in the UK. Regional Studies. 2019;53(5):630-643.

- Ali Z, Gongbing B, Mehreen A. Predicting supply chain effectiveness through supply chain finance: Evidence from small and medium enterprises. The International Journal of Logistics Management. 2019;30(2):488-505.

- Martinez LF, Ferreira AI, Can AB. Consultant–client relationship and knowledge transfer in small-and medium-sized enterprises change processes. Psychological reports. 2016;118(2):608-625.

- Godke Veiga M, McCahery JA. The financing of small and medium-sized enterprises: an analysis of the financing gap in Brazil. European Business Organization Law Review. 2019;20:633-664.

- Wilson N, Ochotnický P, Káčer M. Creation and destruction in transition economies: The SME sector in Slovakia. International Small Business Journal. 2016;34(5):579-600.

- Boso N, Story VM, Cadogan JW, Annan J, Kadić-Maglajlić S, Micevski M. Enhancing the sales benefits of radical product innovativeness in internationalizing small and medium-sized enterprises. Journal of Business Research. 2016;69(11):5040-5045.

- Darbandi M, Haghgoo S, Hajiali M, Khabir A. Prediction and estimation of next demands of cloud users based on their comments in crm and previous usages. In2018 International Conference on Communication, Computing and Internet of Things (IC3IoT) 2018; 81-86.

- Darbandi M, Shahbazi P, Setayesh S, Granmo OC. New novel idea for Cloud Computing: How can we use Kalman filter in security of Cloud Computing. In2012 6th International Conference on Application of Information and Communication Technologies (AICT) 2012;1-5.

- Kashefi F, Darbandi M. Perusal about influences of Cloud Computing on the processes of these days and presenting new ideas about its security. International IEEE Conf. AICT.2011.

- Wallo A, Kock H. HR outsourcing in small and medium-sized enterprises: Exploring the role of human resource intermediaries. Personnel Review. 2018;47(5):1003-1018.

- Roesel K, Dohoo I, Baumann M, Dione M, Grace D, Clausen PH. Prevalence and risk factors for gastrointestinal parasites in small-scale pig enterprises in Central and Eastern Uganda. Parasitology research. 2017;116:335-345.

- Cockfield G, Shrestha U, Waters C. Evaluating the potential financial contributions of carbon farming to grazing enterprises in Western NSW. The Rangeland Journal. 2019;41(3):211-223.

- Sokolinskiy O, Melamed B, Sopranzetti B. Precautionary replenishment in financially-constrained inventory systems subject to credit rollover risk and supply disruption. Ann Oper Res. 2018;271:971-997.

- Schwab L, Gold S, Reiner G. Exploring financial sustainability of SMEs during periods of production growth: A simulation study. Int J Prod Econ. 2019;212:8-18. [Crossref]

- Felderer M, Ramler R. Risk orientation in software testing processes of small and medium enterprises: an exploratory and comparative study. Softw Qual J. 2016;24:519-548.

- Hong-xi LI, Yu S. Dynamic financial early warning model based on time-dependent cox regression and empirical study. Int Ser Oper Res Manag Sci. 2020;29(8):17-27.

Citation: Amirhan M (2023) Using the Big-data Concept to Create a Financial Risk Management Model. Review Pub Administration Manag. 11:412.

Copyright: © 2023 Amirhan M. This is an open access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.