Indexed In

- CiteFactor

- RefSeek

- Directory of Research Journal Indexing (DRJI)

- Hamdard University

- EBSCO A-Z

- Scholarsteer

- Publons

- Euro Pub

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Research Article - (2025) Volume 13, Issue 1

The Effect of Liquidity on the Profitability of Microfinance: Evidence from Microfinance Institutions in Ethiopia

Idris Ali Yimer* and Habtamu KinduReceived: 26-Feb-2024, Manuscript No. RPAM-24-25032; Editor assigned: 29-Feb-2024, Pre QC No. RPAM-24-25032 (PQ); Reviewed: 14-Mar-2024, QC No. RPAM-24-25032; Revised: 07-May-2025, Manuscript No. RPAM-24-25032 (R); Published: 14-May-2025, DOI: 10.35248/2315-7844.25.13.476

Abstract

Micro-finance institutions have a bold contribution to the day-to-day financial system by addressing different economical transactions to customers who cannot access the conventional banking service in developing as well in developed countries. The prominent objective of the paper was to examine the liquidity impact on the profitability of 12 microfinance institutions in Ethiopia specifically. Explanatory research design, balanced fixed effect panel regression model and E-views software were used for the data among 12 selected institutions that are currently operating in Ethiopia. Sample period covered from 2005 to 2014. Return on assets used as the proxy of profitability to evaluate the financial healthiness of MFIs. The study identified that the deposit loan ratio has a statistically significant negative impact on profitability, whereas the debt to equity ratio has a negative influence on the profitability of MFIs but statistically insignificant. The impact regarding size and deposit asset ratios was positive and significant on MFIs’ profitability of Ethiopia. Based on findings, the study recommended that microfinance institutions managing the body should give greater consideration to statistically significant variables to maintain an optimal level of liquidity and sustainable profit.

Keywords

Profitability liquidity; Return on asset; Microfinance; Ethiopia

Introduction

Micro-finance is one of the financial service providers for societies who have low income, unemployed or entrepreneur can be individual(s) or groups. To start a small business society borrows from microfinance as per their financial need. Microfinances have a huge contribution to every country’s economic growth. This type of financial tradition is empowered to address especially poor societies. In most developing courtiers outskirts population number is incredibly increasing from time to time. Swope explained as micro-finances are providers of financial service to poor people in which the credit amount is to be repaid in installment or in full against the loaned money. Small enterprises and poor societies have a limited way of deposit and credit facilities informal financial institutions. The micro-finance institution's role is one of progressively and attractively escalating the financial segment of investment, especially in developing countries. The sector provides numerous financial services such as cash loans, deposit savings accounts and insurance availability comparatively in small amounts to lower-income societies. Financial institutions aimed to ensure adequate liquidity of assets to meet up their customer's demand and to live-long profitably in the sector. The availability of adequate liquidity secures the capacity of institutions in converting assets into cash to address customers' interest in fund withdrawal, loan demand and to assure borrowers as per their need. As cited by Rahman & Mazlan, around 90 percent of the societies in developing countries have no access to institutional financial services. Because of that in such countries, investors prefer to involve by investing their assets in the expansion of microfinance institutions. Liquidity and profitability of businesses are an imperative concern in the development and continued survival of microfinance and the capability to hold required short term and long term assets in optimum level [1].

According to Shafana, financial institutions are greatly involved in securing liquidity of assets than non-financials satisfy their customers’ demand and to retain in competitive system profitably. Having adequate liquidity in micro-finance institutions there is a high-level possibility in converting financial transactions into cash in easily way. The contribution of liquidity to settle short-term obligations is not a comparable issue. Organizations invest in current assets to cover dues of their short-term debt in particular. Although the Institution’s liquidity position strengths when they hold surfeit current assets but it shrinks the opportunity of profitability. Alshatti, stated that liquid assets have less profitable circumstances than fixed assets. In other words, investment in current assets does not generate production or sale because of that less profit occurs. Thus, appropriate measurement is required to settle issues of liquidity and profitability [2].

In Ethiopia, microfinance institutions are established by proclamation in the year 1996. The sector is acceleratingly addressing a large number of societies since it launched. National Bank of Ethiopia (NBE) report depicts that registered MFIs carried out total capital and total asset in 2011/12 were $200 million and $710 million respectively. Microfinance institutions contribute to the country’s rapid economic growth in different aspects. Among the mentionable contributions, they are giving service as a bridge or as a financial intermediary for the money savers and the investors. Sympathetic impacts of liquidity as well as drivers of MFIs liquidity for that matter are indispensable and critical to the steadiness of the financial system. Even if broad research studies, have not been conducted to look into liquidity impact on micro-finance intuitions profitability in Ethiopia.

There are a lot of research studies about liquidity to examine its impact on the financial performance of institutions. The previous studies mainly focused on the relation leverage, profitability and firm size. The conducted studies outlined as a contradictory and inconsistent correlation between profitability and liquidity of the firm in different countries [3].

In Ethiopia, most of the conducted researches are focused on determinants of liquidity rather than in examining the impact of liquidity on the profitability of the financial institutions. Therefore, one of the aims of this paper was to examine relationships between Debt to Equity Ratio (DER), total Deposit to Asset Ratio (DAR), Deposit to Loan Ratio (DLR), size (LNTA) and Return On Asset (ROA) throughout 2005 to 2014. Thus, based on the above studies, there is no empirical research done regarding the liquidity impact on the profitability of Microfinance Institutions (MFIs) in Ethiopia. The main objective of this research paper is to examine the impact of liquidity on the profitability of microfinance institutions by developing a unique approach and to identify the variables that have a prominent effect on the profitability of the microfinance. As it is known every institution has its vision and mission to maintain sustainable development by generating more profit from different day-to-day financial transactions. However, financial institutions are facing a shortage of current assets such as cash and cash equivalents, receivables and prepaid expenses for their instant transaction need. On the other hand, they have more illiquid assets and more debts. If these two problems cannot be balanced the financial institutions unable to keep up the sound full financial system their competitors will take the upper hand on them. This struggle of steadiness motivates the researchers in filling the gap by putting our contribution to microfinance institution success [4].

The hypothesis of the study

To realize the objectives of the study, researchers developed the following four hypotheses:

H1: Deposit to loan ratio has a positive and significant relationship with the profitability of microfinance institutions.

H2: Debt to equity ratio has a negative and significant relationship with the profitability of microfinance institutions.

H3: The size of microfinance institutions has a positive and significant relationship with the profitability of microfinance institutions.

H4: Deposit to asset ratio has a positive and significant relationship with the profitability of microfinance institutions.

Theoretical review of micro-finances

Micro-finance institutions are institutions which mainly operating to facilitate the credit and saving systems for the lowerincome societies. They are categorized under small scale financial services providers especially in developing countries. The micro-finance sector is becoming the dominant growth device for various countries in the world. Developing countries count it as an important device to bring prosperous and suitable countries for citizens. The societies which have low income may necessitate options to generate money and to improve their income by getting financial and non-financial supports from the government. Financial supports may include borrowing money, fulfilling infrastructure and creating conducive surroundings. Awareness creation mechanisms, consulting how to overcome day to day hindrances are among non-financial supports from the governing body and the potential individuals of the country. As per the Ethiopian Proclamation No.626/2009 article 3(2) micro-finance business count as the provision of financial services accomplishing activities such as accept savings, draw and admit drafts payable and extend credit providing money transfer services. Micro-finance institutions are supporting societies in terms of job creation and self-empowerment. It is a decisive substitute to encourage innovation and to reduce unemployment for developing countries in general and Ethiopia in particular. Institutions that are engaging in the microfinance area may have a different source of income as per the rationale bases of the owners. If they are established by private investors, they may directly concentrate on generating more profit in their day to day transactions. Nevertheless, if they are undertaken by the government or deliberately established by, they may focus on providing various welfare services for the societies on the base of satisfaction. So, the motive and the measurement of the microfinance performance are differing based on the owner [5].

As Melese and Kantham cited from Yeager and Seitz liquidity is the ability to meet all legitimate demands for funds of financial institutions. Institutions which has good in liquidity position can cover their obligation as per the agreed period. Because of various reasons and the existence of uncertainty, micro-finances may not cover their short term obligation on time. Thus, financial institutions hold liquid assets to maximize their profitability. In general, this study mainly revolved on the following liquidity theories, namely:

Quantitative liquidity theory: This theory recognized the dynamic situation of cash flow to have optimal liquidity and adequate cash balance by considering the benefits and costs of cash. Holding huge or excessive amounts of cash directly affects the institutions and it forces to incur additional costs like holding costs and safeguarding costs. Inversely, if the institutions have not an adequate level of cash it affects in shortage of cash. So, the theory recognizes the fluctuation of current assets and sided to maintain an optimal level of liquidity in order to assure profitability. The amount of cash in and out fluctuates in the day-to-day activities of business enterprises [6].

Liquidity motive theory: This theory is based on three motives of the reasons of demand and prefer liquidity. The motives are (1) transactional motive, as per this motive microfinance institutions hold cash to satisfy the need for cash inflow and outflow. (2) Precautionary motive, in case of emergency the institutions hold cash to meet short term obligations. (3) Speculative motive, it aims to use different types of opportunities to get an advantage in the future by converting what they hold in the special circumstances. However, it contradicts theory of corporate liquidity as they proposed is based on an assumption that choice of liquidity will depend on institutions' access to capital markets and the weight of future firm’s investment. To get the overhand of the competitors' institutions have an option to hold what they motive invest or either to expand their undertakings. In all of the initiations, different features are reflected in the companies because of the level of liquidity.

Shift ability theory: it deals with shift able or sold assets to lenders or investors in terms of cash. The theory further intends that there will be an excellent source of liquidity if the institution held highly marketable securities. In this theory, financial institutions are more prefer to exchange their movable or immovable properties into cash. Cash is the most liquid element of asset and also it is the blood of all firms to exist successfully in the business environment.

Review of related empirical studies

The following researchers have examined liquidity and profitability issues in wide aspects. Each empirical studies are accomplished by different scholars and presented below:

Buseretse studied on the liquidity effect focused on profitability in Kenya. His study used 9 micro-finance institutions secondary data obtained from the Central Bank of Kenya (CBK) which were operating from the year 2011 to 2014. The study composed data of Return On Assets (ROA) and Deposit To Loan (DTL) ratio aimed to measure profitability and liquidity of the financial institutions. Descriptive statistics and regression analysis was used to examine the correlation between the variables. The Buseretse study revealed that as there was a weak correlation in liquidity and profitability of the institutions. He recommended that microfinance managers need to maintain liquidity at the optimal level to continue on profitable juncture [7].

Tewodros and Gedion revealed that as there is a negative correlation between Return on Asset (ROA) and liquidity in his determinants of financial institution profitability study. Hence, as to his finding liquidity level of financial institutions included in the study (Loan-to-deposit ratio) has no significant relationship on ROA. On the other hand, he found that there is a negative correlation exists between Return on Equity (ROE) and liquidity.

Khan and Ali examined the association of liquidity and profitability of financial institutions in Pakistan. For the study, the researchers were used correlation and regression tools. They used 5 years of secondary data. Their study paper found that liquidity and profitability of the financial institution have a significantly positive relationship [8].

Saleem took five (5) years for twenty-six firms and examined the relationship between the liquidity of firm and profitability. The outcome indicated that there is a positive relationship between a firm’s liquidity and profitability. Besides, in the study, they also indicated that unlike Return on Investment (ROI), Return On Equity (ROE) has been greatly affected by current and quick ratios.

Wang reveals that there is a positive relationship between liquidity and operating performance. The researcher took seventeen (17) years of data of sampled firms. They investigated the relationship between profitability. Meanwhile, the research also reveals that there is a positive relationship between liquidity and profitability. The result was also consistent with Zhang, suggestion as there was a significant positive relationship between the firm’s liquidity and profitability [9].

According to Eljelly, the study which was mainly dealt with the exploratory of profitability and liquidity relationships, shown as it is strongly significant and negatively correlated with each other. Eljelly tried to measure the relationship with the current ratio. The study also pointed out that the cash gap can measure liquidity at the industry level.

As Majakusi studied selected financial institutions’ liquidity and profitability effect is descriptive research with the regression analysis model. The investigator incorporated five years from 2010 to 2014 secondary data. Based on the examination Return on Asset (ROA) has been significantly affected by liquidity ratio and they correlate positively to each other.

Wuave, et al. examined on their study about liquidity effect on the financial performance of financial institutions in Nigeria. They used secondary data from the year 2010 to 2018. In the study liquidity ratio, loan to deposit ratio, cash reserve ratio and deposit ratio was used as a proxy of liquidity management, whereas, return on asset, return on equity and return on net interest margin, were for profitability. As per their investigation concerning liquidity management, had a significant effect on return on asset.

Melese and Kantham, examined financial institutions'’ liquidity determinants aimed to identify liquidity factors. They took a sample of ten financial institutions data from the year 2007 to 2013 of Ethiopia. The variable was analyzed by the fixed effect regress model. Their study revealed that return on assets has a significant impact on the liquidity of financial institutions of Ethiopia. However, Loan growth is found as it has an insignificant impact on the period [10].

As Yirsaw studied on 6 selected micro-finance which were operating in Ethiopia. The study focused on the profitability and sustainability trends of the institutions by taking five years (2002 to 2006) secondary sources. Based on the study majority of MFIs have a strong liquidity impact on their performance. Alemayehu found that majority of microfinance institutions were used their assets for principal purposes. In other words, they used their assets for loaning to small scale entrepreneurs and obtaining funds from the borrowed amount.

According to Zemedkun, a study that was focused on analysis on the effect of credit risk management on the profitability of financial institutions used annual reports and the National Bank of Ethiopia secondary data from the year 2000 to 2018. The study employed a regression model to analyze the findings. The result indicated that the existence of a negative and significant effect between credit risk management and return on asset (profitability). Thus, the researcher suggested that the financial credit risk management should provide strong curiosity for the credit management system [11].

To sum up, the empirical literature indicated that there is a strong relationship between the liquidy and profitability of micro-finance institutions. liquidity can be maintained by giving appropriate consideration in all institution’s elements.

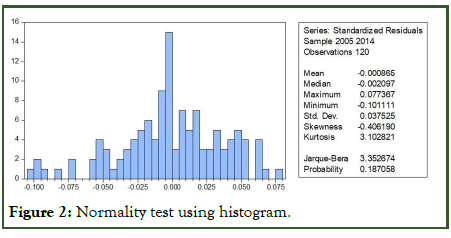

Conceptual framework

A conceptual framework helps the reader to promptly understand the relationship of the variables in a simplified manner. The study consisted of two variables, the dependent and independent variable. Independent variables were a loan to deposit ratio, deposit to asset ratio, debt-to-equity ratio and size of MFIs. The dependent variable of the study was returned on assets of microfinance institutions. The following conceptual framework is constructed to show the relationship between the dependent and independent variables of the study (Figure 1).

Figure 1: Self-constructed conceptual framework.

Materials and Methods

The study used explanatory research design. The research design was furthermore supported by a quantitative research approach to examine the impact of liquidity on the profitability of selected microfinance institutions. The researchers employed secondary sources of data that were collected from the audited financial descriptions of the MFIs and taken from the association of microfinance institutions in Ethiopia. The research was focused on the population of all MFIs’ which were register by the National Bank of Ethiopia (NBE). As per NBE (2015/16) annual report (see appendix IV) 34 microfinance institutions were operating in Ethiopia [12].

The study was used a purposive sampling method to select a sample of twelve MFIs, which are OCSSCO ACSI, DECSI, OMO ADCSI, SFPI, AVFS, Meklit, Gasha, Busagonfa, PEACE, and Wasasa from the total population of 34 MFIs in the country due to limited data for other microfinance institution the researcher was selected the above MFIs purposively.

The reason for selecting MFIs was based on the availability of full-year audited financial data starting from the year 2005 to 2014 (i.e., 10) years of the operating period. Therefore, based on the sample size and the covered period, the sample consisted of 120 observations.

Methods of data analysis

The collected panel data from 12 microfinance institutions were used to get adequate information in a cross-sectional approach. The data included cross-sectional data to have the advantages of handling individual variability and capturing of the dynamic character of the data. It is also suggested by Gujarati, as of when more variable data ensure to more degree of freedom, more efficiency and less collinearity among variables [13].

Thus, the panel data analyzed using descriptive statistics, correlations and multiple linear regression models. To analyze, the tendencies mean, standard deviation, maximum and minimum figures were used in descriptive statistics. To show the relationship of dependent and independent variables multiple linear regression model is used. The Ordinary Least Square (OLS) done using E-VIEWs 7 software package. Heteroscedasticity, autocorrelation, multi-colinearity and normality tests were incorporated. In addition to this, to choose the appropriate model between the random effect and fixed effect models, the Hausman specification test was employed for the study. Based on the test result, the fixed-effect model has gotten as appropriate [14].

According to Brooks, if the p-value for the Hausman test is less than 5%, this shows the fixed effects model is appropriate than the random-effects model. According to Table 1 below, the Hausman specification tests show that the model has a P-value of 0.0001. This indicates that the fixed effect model is preferred because of a P value less than 0.05. Therefore, in this study, the fixed-effect model was used to test the impact of liquidity on MFIs profitability (Table 2).

| Correlated random effects-Hausman test | |||

| Equation: Untitled | |||

| Test cross-section random effects | |||

| Test summary | Chi-Sq. statistic | Chi-Sq. d.f. | Prob. |

| Cross-section random | 24.83147 | 4 | 0.0001 |

Table 1: Hausman test for fixed versus random effect models.

The following multiple regression model was used to perform the correlation along with the study variables:

Yit=β0+β1 (DLRit)+β2 (DARit)+β3 (DERit)+β4 (LNTAit)+εit

I-point to observation number, Yi-dependent variable, ROAprofitability indicator, α-constant term, β-coefficient of the function, Xi-independent variables value, εi-isturbance or error term, LDR-Loan to Deposit Ratio, DAR-Deposit o Asset Ratio, DER-Debt to Equity Ratio and LNTA-size

| Variable | Definition | Mathematical expression | Expected sign. | |

|---|---|---|---|---|

| Explained variable | Return on Asset (ROA) | The ratio of net income divided by equity | ROA=Net income/Total assets | NA |

| Explanatory variable or control variables | The Debt to Equity Ratio (DER) | It shows the percentage of a company’s debt to its total asset | DER=Total liability/Total equity | - |

| Deposit to assets ratio | It helps to show the impact of deposit or no deposit financing on profitability | DAR=Total deposit/Total Assets | + | |

| Loan to deposit ratio | It helps to measure utilized funds from the deposit for the period | DLR=Total loan/Total deposit | + | |

| Size | It helps to analyze the impact based on the size of firms | Size=LNTA (Total asset) | + | |

Table 2: Variables, their measures and expected sign.

Results

Descriptive statistics

The descriptive statistics for the endogenous and exogenous variables are presented in Table 3 below:

|

|

ROA |

DER |

DLR |

DAR |

SIZE |

|---|---|---|---|---|---|

|

Mean |

0.025829 |

2.304158 |

0.335917 |

0.29205 |

8.16431 |

|

Median |

0.03 |

1.99 |

0.29 |

0.246 |

7.948683 |

|

Maximum |

1.2 |

11.15 |

4.556 |

5.923 |

9.927381 |

|

Minimum |

-1.494 |

-0.14 |

0 |

0 |

6.713233 |

|

Std. dev. |

0.184019 |

1.852835 |

0.43535 |

0.554585 |

0.852592 |

|

Observations |

120 |

120 |

120 |

120 |

120 |

Table 3: Descriptive statistics of dependent and independent variables (E-views).

As measured in the above Table 3, the mean value of ROA, a measure of profitability (dependent variable) which is computed by dividing net income by total asset of the institution has a mean value of 0.0258. The result revealed to on average for every birr investment in MFIs would earn a 2.5 percent return. The other measure, the median which is not affected by extreme values similarly shows that microfinance institutions have a return of 3 percent financed through their profit. The higher figure indicates that the institution management is more efficient in using its funds and be a sign of the ability to generate profits from MFIs. The maximum ROA was 1.2 and the minimum value was 1.494. This implies that the most profitable MFI earns 1.2 cents income and not profitable MFI loss was -1.494 cents income a birr investment in the institution’s profit. The standard deviation of 0.184 shows the existence of a discrepancy in a generated profit value across the sampled MFIs [15].

The debt-to-equity ratio of MFIs has a mean and median value of 2.304158 and 1.99 respectively. This means the selected MFIs funding assets by using 2.3 percent of the debt. This implies that the mean value of the sampled microfinance was higher than the proposed standard of 1.5. As it is seen maximum and minimum values are 11.15 and -0.14 respectively. The values of the debt-equity ratio head off from its mean by 1.8 percent to both sides.

Another independent variable, deposit-to-asset ratio measured by dividing the sum of customers deposit to assets ratio of the sampled microfinance institutions during the period implied 29 percent, it reveals that total deposit represents on average 29 percent of total asset of microfinance institutions in Ethiopia. In microfinance institutions when the deposit to asset ratio varies from the mean by 5.5 present, there was 5.923 percent the highest deposit to asset ratio in the specified period and 0 figure of minimum ratio.

As it is indicated, the mean value of the natural logarithm (size) was 8.164. Simultaneously the maximum and minimum figures were 9.92 and 6.713 respectively. Moreover, figure 0.852592 was shown as the standard deviation variance in size.

The table indicated that the mean value of 0.335917 under the deposit-to-loan ratio in MFIs. The value discloses as the loan represents to a great extent above the deposit of financial institutions. The maximum LTD ratio was 4.556 and the minimum was 0. This implies that MFIs advances loans from both deposit and non-deposit sources of finance for their customers.

Correlation analysis of the variables

The correlation matrix effect between the dependent variable (ROA) and independent variables (DER, DLD, DAR and SIZE) is presented in Table 4 below:

|

|

ROA |

DER |

DLR |

DAR |

SIZE |

|---|---|---|---|---|---|

|

ROA |

1 |

0.064732 |

-0.63787 |

-0.56295 |

0.051481 |

|

DER |

0.064732 |

1 |

-0.01809 |

-0.07141 |

0.37809 |

|

DLR |

-0.63787 |

-0.01809 |

1 |

0.900846 |

0.307936 |

|

DAR |

-0.56295 |

-0.07141 |

0.900846 |

1 |

0.144048 |

|

SIZE |

0.051481 |

0.37809 |

0.307936 |

0.144048 |

1 |

Table 4: Correlation matrix for dependent and independent variables.

The result indicated in the table above DLR and DAR had a negative correlation to ROA with a coefficient of correlation -0.63787 and -0.56295 respectively. DER and SIZE of MFIs had a positive correlation to ROA with 0.064732 and 0.051481 respectively. Hence, a positive signal of the coefficient means a positive linear relationship with return on asset and vice versa.

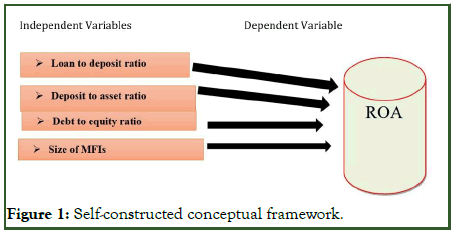

Normality assumption test

The normality assumption test shows the outline of variables data distribution in the graph. The researcher employed Bera- Jarque for a property of random variable which normally distributed and that the entire distribution is characterized by the first two instants mean and variance. In this study, the Bera- Jarque test was used by the researchers to check the assumption of the normality test [16].

Figure 2 below connotes that, kurtosis has come near 3 (i.e., 3.10) and the Bera-Jarque statistic p-value was not significant at 5% coefficient level and p-value has 0.18 form. For this reason, the null hypothesis is normally distributed and not rejected. Thus, it is possible to say that there is no problem of normality on models because residuals are normally distributed in this study.

Figure 2: Normality test using histogram.

As in Table 5, shown, the fixed effect regression result of R2 is 0.666526 which indicates that the independent variables which used in the study elucidated 66.6 present of the dependent variable. On the other hand, factors that are not included in this study took 33.3 present.

| Method | Panel least squares | ||||

|---|---|---|---|---|---|

| Dependent variable | ROA | ||||

| Date | 05/10/19 | Time 16:48 | |||

| Sample | 2005 2014 | ||||

| Periods included | 10 years | ||||

| Cross-sections included | 12 MFIs | ||||

| Total panel (balanced) observations: 120 | |||||

| Variables | Coefficient | Std. error | t-statistic | Prob. | |

| C | -1.81164 | 0.274696 | -6.59509 | 0 | |

| DER | -0.00698 | 0.010286 | -0.67854 | 0.4989 | |

| DLR | -0.85759 | 0.102014 | -8.40661 | 0 | |

| DAR | 0.434905 | 0.076029 | 5.720275 | 0 | |

| SIZE | 0.246759 | 0.034768 | 7.097236 | 0 | |

| Specification effects | |||||

| Cross-section fixed (dummy variables) | |||||

| R-squared | 0.666526 | Mean dependent var | 0.025829 | ||

| Adjusted R-squared | 0.618429 | S.D dependent var | 0.184019 | ||

| S.E. of regression | 0.113671 | Akaike info. criterion | -1.38745 | ||

| Sum squared resid | 1.343791 | Schwarz criterion | -1.01579 | ||

| Log-likelihood | 99.2472 | Hannan-Quinn criter | -1.23652 | ||

| F-statistic | 13.85791 | Durbin-Watson stat | 1.36597 | ||

| Prob. (F-statistic) | 0 | ||||

Table 5: Results of the fixed effect panel data regression analysis.

Coefficient significant at 1% and **Coefficient significant at 5%

As Table 5 above indicates, deposit to asset ratio, size and loan to deposit ratio had a positive and statistically significant influence at 1% level on MFIs profitability (ROA), but debt to equity ratio had a negative effect on the profitability of MFIs in Ethiopia of which statistically insignificant influence at 5% level. P-value (F-Statistic) 0.000000 indicates that strong statistical significance, which improved the steadfastness and soundness of the model.

Discussion

Deposit to loan ratio

H1: Deposit to loan ratio has a positive and significant relationship with the profitability of microfinance institutions.

The outcome of the fixed-effect model Table 5 indicated that deposit to loan had a negative relationship with profitability (return on asset) and statistically significant with p-value=0.000 at a 1% coefficient level. This implies that every Ethiopian currency birr 1 change in MFIs loan to deposit ratio keeping other things constant had ensuing change of -85 cents (Coeff.=-0.857590) on profitability (return on asset) in the opposite direction. Thus, hypothesis 2 (H2) was rejected.

Debt-to-equity ratio

H2: Debt to equity ratio has a negative and significant relationship with the profitability of microfinance institutions.

The fixed-effect model result in Table 5 is shown as the coefficient of the Debt to Equity Ratio (DER) negative-0.006979 and statistically negative insignificant level at 5%. This validates that the covered period in the study starting from 2005 up to 2014 liquidity of MFIs have a positive relationship with return on the asset in consideration profitability as a proxy. This points to all other variables holding constant, decreasing DER by one unit to ROA -0.006979 by units which means it decreases the financial health of the institutions. When ROA increases the profitability of the institutions was decreases. Therefore, hypothesis 2 (H2) was accepted because the data support the hypothesis.

H3: The size of microfinance institutions has a positive and significant relationship with the profitability of microfinance institutions.

The natural logarithm is taken to measure the size for the total asset of the MFIs, the coefficient was positive (0.246759) and it was statically significant to be taken in as a significant variable in the study. As per the result of table 4.3 firms’ size had positive relationships with the profitability of microfinance institutions and statistically significant p-value (0.0000), at a 1% significant level coefficient. Here, it notes that every 1 percent vary increase in the MFI size keeping other things constant had a resulting 24.6 percent change on the profitability simultaneously. The output suggested as of the MFI getting bigger in its asset size, the more profitable it becomes. The possible reason is that larger firms are that much more flexible than smaller ones for having a better return. Therefore, hypothesis 3 (H3) was accepted.

Deposit to asset ratio

H4: Deposit to asset ratio has a positive and significant relationship with the profitability of microfinance institutions.

The figure in Table 5 shows as there was a positive correlation with statistically significant strongly (p-value of 0.000) at a 1% coefficient level. This indicates that every 1 Ethiopia currency (birr) change in MFIs deposit to asset ratio keeping others steady had a result varies of 43 cents (Coeff=0.434905) on the profitability in a parallel direction. The table result also demonstrates that financing with deposit has a positive impact on the profitability of MFIs. The result is as expected i.e hypothesis 4 (H4) was accepted. The summary of the actual and expected sign is presented in the following Table 6 below:

| No. | Hypotheses | Outcome |

|---|---|---|

| H1 | Deposit to loan ratio has a positive and significant relationship with the profitability of microfinance institutions | Rejected |

| H2 | Debt to equity ratio has a negative and significant relationship with the profitability of microfinance institutions | Accepted |

| H3 | Size of microfinance institutions has a positive and significant relationship with the profitability of microfinance institutions | Accepted |

| H4 | Deposit to asset ratio has a positive and significant relationship with the profitability of microfinance institutions | Accepted |

Table 6: The summary of the actual and expected sign is presented.

Conclusion

The main objective of this study was to examine the impact of liquidity on the profitability of microfinance institutions in Ethiopia and additionally the relationships between the other four explanatory variables. The study mainly concentrated on three theories of liquidity namely qualitative liquidity theory, liquidity motive theory and shift-ability theory. To achieve the intended objectives the study used quantitative approaches panel data analysis methodology. The audited financial statements were collected from selected twelve Microfinance institutions from 2005 GC to 2014. The collected data were analyzed by supporting the fixed-effect model using the statistical package of E-views 7.0.

The results of the fixed effect model indicated liquidity which measured by deposit to asset ratio had a statistically significant positive correlation with profitability. The other variable debt to equity ratio had a statistically insignificant and negative relationship with profitability. Correspondingly, the loan to deposit ratio had also a negative and statistically significant relationship with profitability. Moreover, size and profitability have a positive and statistically significant relationship. Generally, we can conclude that the findings of the study indicated as liquidity has a significant impact on the profitability of microfinance institutions. Microfinance institutions should have to develop techniques, to generate more profit, and to manage their liquidity in an effective and efficient approach. Developing techniques and procedural tools strengthen institutions on controlling of assets as well as debts in an appropriate manner. Furthermore, microfinance institutions secure an adequate balance of cash as per their motives. If there is effective and efficient liquidity management practice they will have an optimum level of liquidity. The optimality in their liquidity leads to generate more profit.

Limitations

This study examined micro-finances liquidity impact on profitability by using debt-to-equity, deposit-to-asset, deposit-toloan ratios and size as dependent variables and return on an asset as an independent variable. Lack of empirical study was the most face up hindrance task for this study. Since the complexity of the financial environment, it’s recommended for further researchers to study by developing unusual variables and research design for advancement.

Acknowledgment

We would like to extend our gratitude for the Department of Accounting and Finance of Wolkite University to facilitate accurate data of the AEMFI bulletin that has provided us the relevant data for the study. Finally, we would like to thank the individuals who forwarded valuable comments and contributions to the outshining of this research work.

References

- Almeida H, Campello M, Cunha I, Weisbach MS. Corporate liquidity management: A conceptual framework and survey. Annu Rev Financ Econ. 2014;6:135-162.

- Alshatti AS. The effect of the liquidity management on profitability in the Jordanian commercial banks. Intern J Bus Manag. 2015;10(1):62.

- Buseretse VA. The effect of liquidity on profitability of microfinance banks in Kenya (Doctoral dissertation, University of Nairobi). 2015.

- Khan RA, Ali M. Impact of liquidity on profitability of commercial banks in Pakistan: An analysis on banking sector in Pakistan. Global J Manag Busi Res. 2016;16(1):53-59.

- Majakusi J. Effect of liquidity management on the financial performance of commercial banks in Kenya (Doctoral dissertation, University of Nairobi).

- Saleem Q, Rehman RU. Impacts of liquidity ratios on profitability. Inter J Res Busi. 2011;1(7):95-98.

- Shafana MA. Liquidity and profitability of financial institutions in Sri Lanka. 2015.

- Wuave T, Yua H, Yua PM. Effect of liquidity management on the financial performance of banks in Nigeria. Euro J Busi Innovat Res. 2020;8(4):30-44.

- Zakout W, Wehrmann B, Torhonen MP. Good governance in land administration. World Bank: Washington, DC, USA. 2006.

- van Ryzin MJ, Dishion TJ. From antisocial behavior to violence: A model for the amplifying role of coercive joining in adolescent friendships. J Child Psychol Psychiatry. 2013;54(6):661-669.

[Crossref] [Google Scholar] [PubMed]

- Shulman EP, Steinberg LD, Piquero AR. The age–crime curve in adolescence and early adulthood are not due to age differences in economic status. J Youth Adolesc. 2013;42:848–860.

[Crossref] [Google Scholar] [PubMed]

- Adu-Mireku S. Fear of crime among residents of three communities in Accra, Ghana. Int J Comp Soci. 2002;43(2):153-168.

- Alexander C, Pain R. Urban security: Whose security? Everyday responds to fears. In: Ceccato, V. (ed.). The urban fabric of crime and fear. New York and London, Springer, 2012:37-53.

- Aning EK. An overview of the Ghana Police Service. J Secur Sector Manag. 2006;4(2):1-37.

- Appiahene-Gyamfi J. Urban crime trends and patterns in Ghana: The case of Accra. J Criminal Justi. 2003;31(1):13-23.

- Owusu G, Owusu AY, Oteng-Ababio M, Wrigley-Asante C, Agyapong I. An assessment of households' perceptions of private security companies and crime in urban Ghana. Crime Sci. 2016;5(5).

Citation: Yimer IA, Kindu H (2025) The Effect of Liquidity on the Profitability of Microfinance: Evidence from Microfinance Institutions in Ethiopia. Review Pub Administration Manag. 13:476.

Copyright: © 2025 Yimer IA, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.