Indexed In

- Open J Gate

- Genamics JournalSeek

- SafetyLit

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

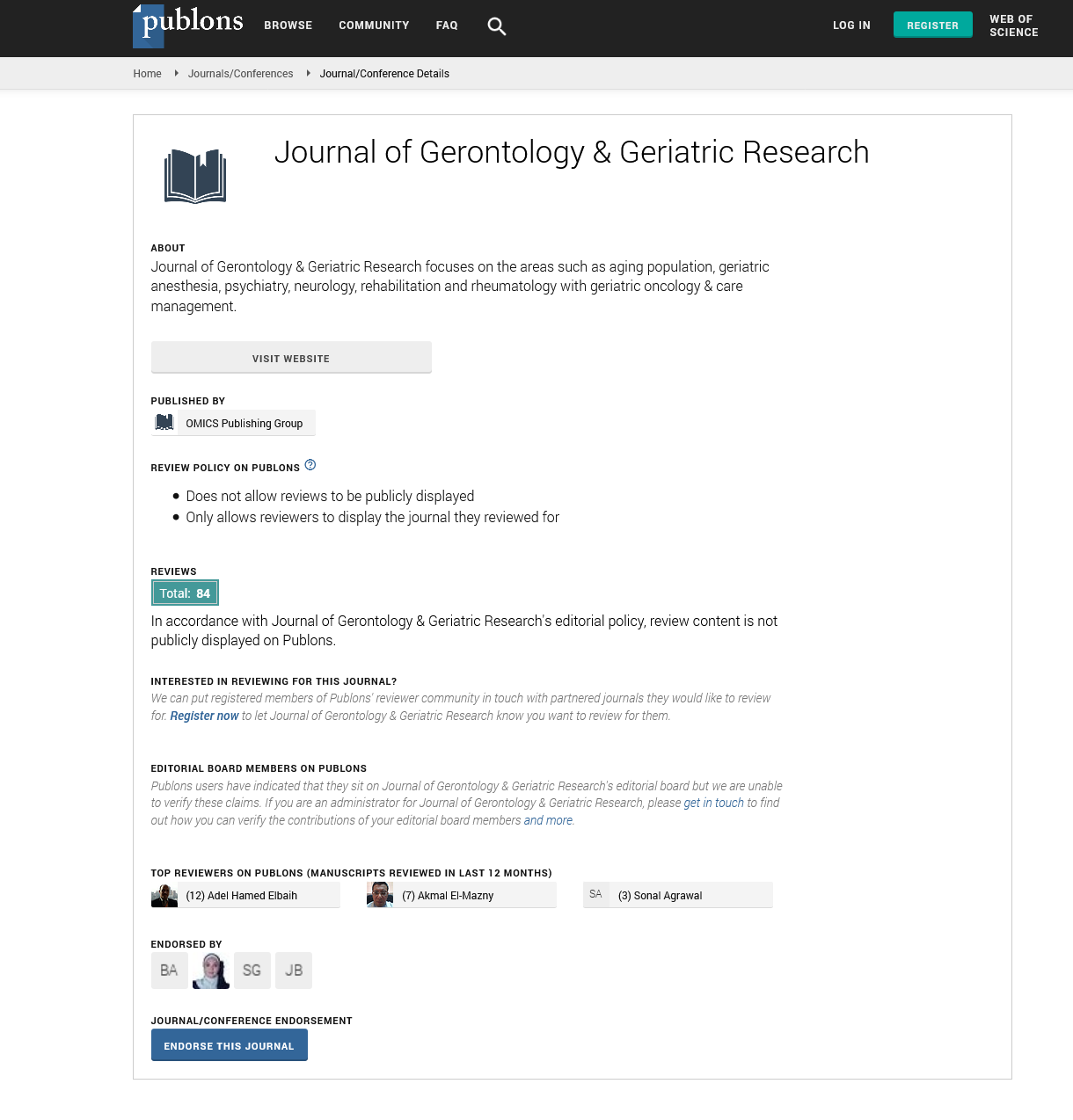

- Publons

- Geneva Foundation for Medical Education and Research

- Euro Pub

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Mini Review - (2022) Volume 11, Issue 7

Public Long-Term Care Insurance Plan On Care Management and Care Planning

Sally Miller*Received: 02-Jul-2022, Manuscript No. JGGR-22-18151; Editor assigned: 04-Jul-2022, Pre QC No. P-18151; Reviewed: 14-Jul-2022, QC No. Q-18151; Revised: 20-Jul-2022, Manuscript No. R-18151; Published: 25-Jul-2022, DOI: 10.35248/2167-7182.2022.11.622

Introduction

Many people get long-term care insurance to assist cover out-ofpocket costs when they are unable to rely on their children or other family members for support. Otherwise, long-term care costs would swiftly exhaust a person's and/or their family's funds. While long-term care expenses vary by region, they are often very high. According to a report on long-term care published by Genworth, the average annual cost of a private room in a skilled nursing facility or nursing home in 2020 was $105,850. The average annual cost of a home health assistant is $54,912. Medicaid in the US offers assistance to persons with low incomes or to those whose savings and investments have been depleted due to care costs. Every state has its own laws [1].

The word "long-term care" is frequently misunderstood to mean an insurance plan. Long-term care includes everything from long-term care services, support, and assisting to manage finances to where you will live and how you will handle the variety of legal, family, and social variables along the road, while insurance may be a part of your strategy. The majority of people prefer not to consider the potential of requiring long-term care. But as we age, the possibility that we will require assistance increases significantly. To meet your needs for personal care, you may require a variety of services and supports known as long-term care. The majority of long-term care, sometimes known as assistance with daily living activities, is not medical care. Referred to as "activities of daily living," they include: dressing, using the restroom, getting in or out of bed or a chair, caring for incontinence, eating, and bathing [2].

Description

A specified number of medical bills must be paid in order to be eligible for Medicaid Spend-Down. It is known as your deductible. Depending on their income, each family often has a different deductible. All of your medical expenses, including receipts for connected purchases like doctor's appointment transportation, durable medical equipment, in-home care, and over-the-counter medications, should be saved. Even older medical costs that haven't been fully paid off may be included. Your premiums and co-pays can be added to the total if you have Medicare. You can be qualified for Medicaid if your medical expenses are sufficient to cover your deductible. You should speak with the issuer of your current long-term care insurance to learn more about a Long-Term Care Partnership policy if you already have one. If you do not currently have a long-term care policy, you should speak with a life/ health producer, look at the DIFS' list of long-term care writers, or conduct an online search for businesses that provide long-term care insurance that is accepted by the Long-Term Care Partnership. Only policies that meet Partnership requirements are eligible for the consumer asset protection. The Medicaid asset protection is the biggest and most distinctive advantage of a Long-Term Care Partnership programme. The Medicaid asset protection makes a Partnership policy different from a non-Partnership programme [3].

Conclusion

With the exception of locations in Canada or Mexico, long-term care insurers cannot restrict or exclude paying benefits based on the illness you have, the type of healthcare provider treating you, your location, the treatment you are receiving, your medical condition, or whether an accident caused your condition. If, however, your need for long-term care services results from a car accident, the individual's no-fault auto insurance will cover your long-term care requirements in accordance with the Michigan No-Fault Law. Although the business cannot deny or restrict your coverage based on the sickness you have, it may do so for ailments for which you have previously received a diagnosis. The cost of long-term care may be high. The price is determined by the type, quantity, and location of the care you require. The average annual costs for care in a nursing home, an assisted living facility, and your own home are provided in this article. Where you live may affect the price of longterm care. Long-term care is frequently included in the delivery of healthcare in many nations, which presents challenges for both cost analysis and interpreting policyholder coverage. This is related to the fact that when policyholders think about purchasing private health insurance, the coverage in relation to public health care is frequently ambiguous or complicated, making it difficult for them to determine if private health insurance would be advantageous [4].

The amount of the premiums and the prices are also very important, with affordability being a major barrier to a greater uptake of private health and long-term care insurance. This is especially evident when high-income persons or those who are members of organisations that give group health insurance. In connection with this, the level of out-of-pocket expenses for medical treatment and long-term care Deductibles will influence how much private insurance you buy. Capital requirement for insurance and regulation related to products will also impact take up of private health and long-term care insurance. For example, capital requirements of insurers may become prohibitive for insurers when mortality and morbidity rates are taken into account in long-term care insurance in some markets [5].

REFERENCES

- Bruno Soares M & Dessai S. “Barriers and enablers to the use of seasonal climate forecasts amongst organisations in Europe.” Climatic Change. 2016;137: 89-103.

- Dilling L & Lemos MC. “Creating usable science: Opportunities and constraints for climate knowledge use and their implications for science policy.” Global Envir Change. 2011; 21: 680-689.

- Eriksen SH. “Reframing adaptation: The political nature of climate change adaptation.” Global Environ Change. 2015;35: 523-533.

- Goddard L. “Providing seasonal-to-interannual climate information for risk management and decision-making.” Proc Envir Sci. 2010;1:81-101.

- Golding N. “Improving user engagement and uptake of climate services in China.” Climate Services. 2017;5:39-45.

Google Scholar, Crossref, Indexed at

Google Scholar, Crossref, Indexed at

Google Scholar, Crossref, Indexed at

Google Scholar, Crossref, Indexed at

Citation: Miller S (2022) Public Long-term Care Insurance Plan on Care Management and Care Planning. J Gerontol Geriatr Res. 11: 622.

Copyright: © 2022 Miller S. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.