Indexed In

- JournalTOCs

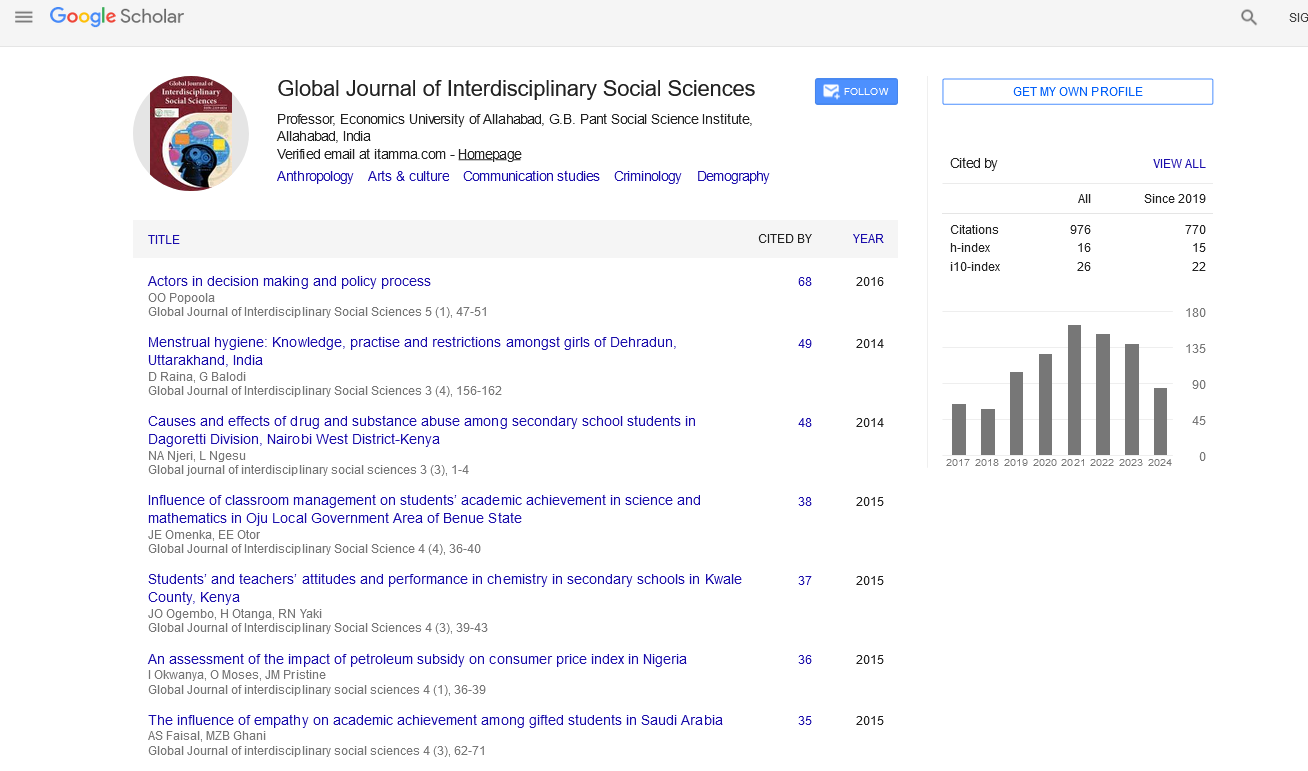

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Short Communication - (2022) Volume 11, Issue 2

Facts Related to Financial Budget

Ashok Chakravarthy*Received: 02-Mar-2022, Manuscript No. GJISS-22-16287; Editor assigned: 04-Mar-2022, Pre QC No. GJISS-22-16287(PQ); Reviewed: 18-Mar-2022, QC No. GJISS-22-16287; Revised: 23-Mar-2022, Manuscript No. GJISS-22-16287(R); Published: 31-Mar-2022, DOI: 10.35248/2319-8834/22.11.019

Description

India is the second most populated nation with a population of 1.2 billion in the world spread over 28 States and 8 Union Territories. India is a high-growth low-income country, with around 68.84% of the rural population. The majority of these populations have limited interactions with money due to their social status, employment status, education background, housing amenities, barriers to financial access and several other factors. The limited interaction with money deprived them of the basic necessities of life and this prolonged deprivation leads to exclusion. The exclusion and its associated factors and the need for interference for its reduction are significant concerns for policy and research. The majority of the rural population is struggling with access to financial services and social services. Lack of access to basic financial services leads to financial exclusion and lack of access to social services leads to social exclusion. Such exclusion separates them from the mainstream. The primary issue is to include these rural populations into the main streamline through their financial and social inclusion.

The purpose of financial and social inclusion is to make an inclusive society. In all societies, there are groups of people who are systematically marginalized the movement towards an inclusive society is a continuous process promoted by financial and social policies intended to reduce poverty, discrimination and inequality. Financial and social inclusion is emerging as a critical facilitator of economic growth and development that play a significant role in driving away poverty and inequality. Countries with a better financial system are experiencing faster economic growth, further reducing poverty and income inequality. The government plays a vital role in building an effective financial system. Social justice and equity are integral elements of development and growth. Financial and social inclusion are crucial drivers for attaining sustainable development goals.

The development of a country's financial system is one of the most reliable indicators of its overall economic growth. Financial inclusion can reduce income inequality by increasing education and entrepreneurship opportunities among the marginalized.

Financial inclusion is intended to create equal opportunities for economically and socially excluded people through delivering affordable financial services. The different financial services include bank accounts, saving, insurance, payments and remittances, credit and financial advice. The increasing attention of government, policymakers, and researchers reflects the significance of financial inclusion for social and economic growth.

Conclusion

The majority of the poor are not able to use formal financial services. Owning a bank account is the first step towards financial inclusion because it helps individuals to deposit, send and receive money. Despite the increase in the number of saving bank accounts in India, financial exclusion is still persistent. Only having a bank account will not serve the purpose of financial inclusion. Globally, 13 percent of adults have reported owning an inactive bank account. Forty-eight percent of the total account holders own an inactive bank account in India that has not seen any transactions in the last 12 months. Hence, India has a severe usage problem though the World Bank has cited a lack of opportunity to use a new bank account under the Pradhan Mantri Jan DhanYojna scheme.

REFERENCES

- McChesney FS. Government as definer of property rights: Indian lands, ethnic externalities, and bureaucratic budgets. J Leg Stud. 1990;19(2):297-335.

[Google scholar] [Indexed].

- Unnikrishnan S, Iqbal R, Singh A, Nimkar IM. Safety management practices in small and medium enterprises in India. Saf Health Work. 2015;6(1):46-55.

[Crossref] [Google scholar].

- Sekhar S, Bidarkar S. Municipal budgets in India: comparison across five cities. Economic and political weekly. 1999:1202-1208.

- West S, Friedline T. Coming of age on a shoestring budget: Financial capability and financial behaviors of lower-income millennials. Social work. 2016;61(4):305-312.

[Crossref] [Google scholar].

- Beckett-Camarata J. An examination of the relationship between the municipal strategic plan and the capital budget and its effect on financial performance. J Public Budg Account Financ Manag. 2003.

[Crossref] [Google scholar].

Citation: Chakravarthy A (2022) Facts Related to Financial Budget. Global J Interdiscipl Soc Sci. 11:019.

Copyright: © 2022 Chakravarthy A. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.