Indexed In

- Open J Gate

- Genamics JournalSeek

- Smithers Rapra

- RefSeek

- Directory of Research Journal Indexing (DRJI)

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- Scholarsteer

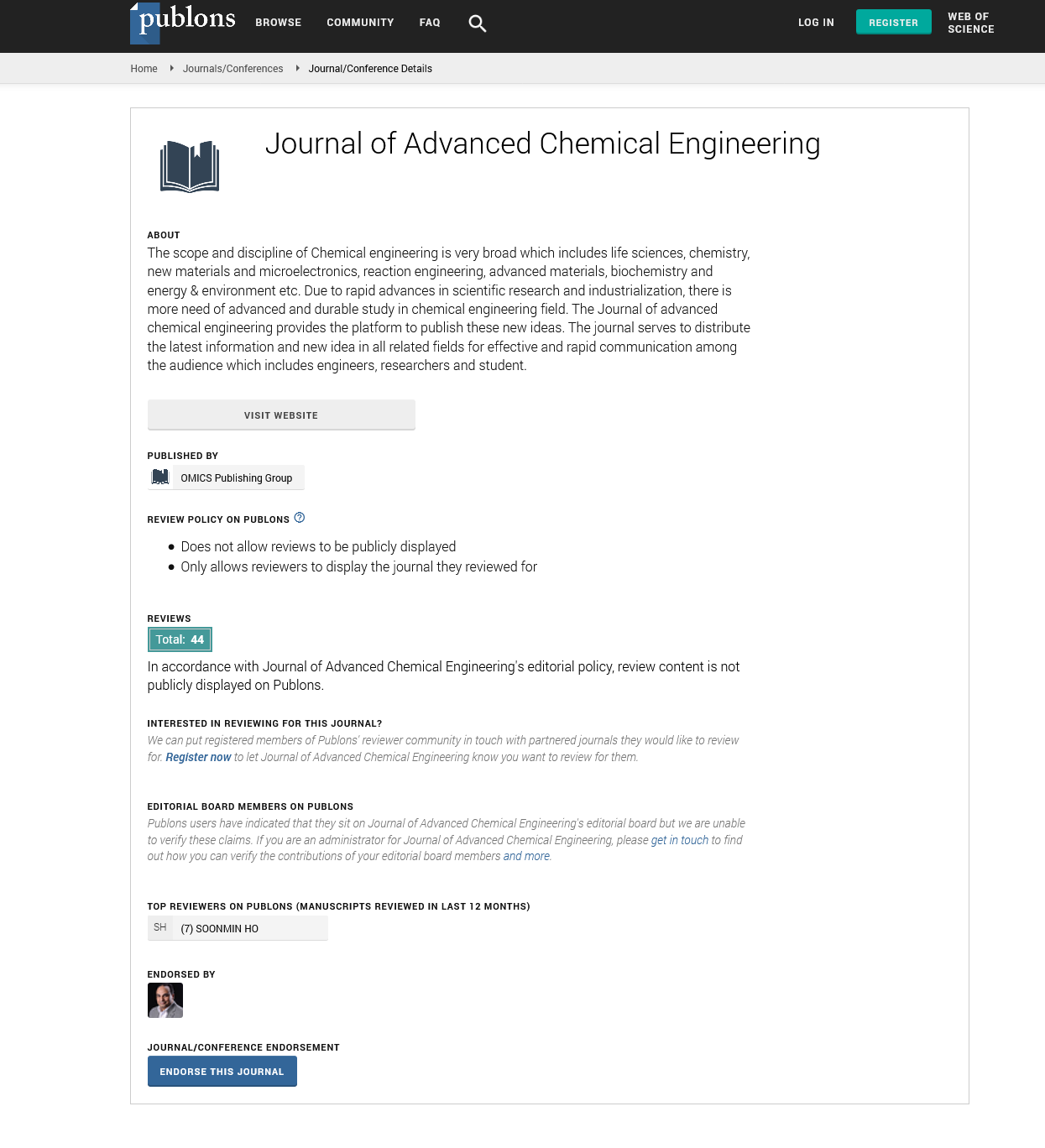

- Publons

- Geneva Foundation for Medical Education and Research

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Opinion Article - (2025) Volume 15, Issue 4

Emerging Markets and Growth Patterns in the Chemical Industry

Eleanor Simmons*Received: 18-Nov-2025, Manuscript No. ACE-26-30799; , DOI: 10.35248/2090-4568.25.15.387

Description

The chemical industry serves as a foundational component for multiple sectors, supplying products that are vital to agriculture, pharmaceuticals, manufacturing, energy and consumer goods. Over the past decade, the industry has experienced notable expansion, reflecting a combination of increasing global demand, technological development and regional economic growth. Understanding current market patterns is essential for companies seeking to optimize production, investment and strategic planning. Emerging markets are playing an increasingly significant role in global chemical production and consumption. Countries in Asia, Latin America and the Middle East have invested heavily in chemical manufacturing infrastructure, resulting in rising output capacities. China and India, in particular, have become central hubs for chemical production, due to lower production costs, large-scale manufacturing capabilities and growing domestic consumption. These regions continue to attract investment from multinational corporations seeking to expand operations and tap into rapidly growing industrial and consumer markets. Specialty chemicals are among the fastest-growing segments within the industry. These products include adhesives, coatings, lubricants and additives designed to improve performance in various applications. Growth in electronics, automotive, renewable energy and construction has contributed to increasing demand for specialty chemicals. Companies are investing in research and development to design products that meet specific application requirements, comply with environmental standards and enhance the durability and functionality of end-use products.

Industrial chemicals, such as acids, alkalis, solvents and polymers, remain fundamental to manufacturing processes. The production of these chemicals is closely tied to the performance of downstream industries. For instance, expansion in construction projects drives demand for adhesives, coatings and sealants, while growth in textile production increases the need for solvents and specialty fibers. Monitoring industrial trends allows chemical producers to anticipate changes in demand and adjust production schedules accordingly. Raw material availability and cost continue to influence the chemical industry’s operations. Petrochemicals, derived from crude oil and natural gas, are essential for the production of plastics, synthetic fibers and other chemical products. Fluctuations in global oil prices directly impact production costs and pricing strategies. Similarly, agricultural inputs, such as plant-based oils and minerals, affect the supply of chemicals used in fertilizers, pesticides and food additives. Supply chain management and procurement strategies are therefore critical to maintaining efficiency and profitability. Sustainability and environmental practices are becoming central to market positioning. Regulatory frameworks in Europe, North America and parts of Asia have encouraged the adoption of energy-efficient production methods, waste reduction strategies and cleaner chemical processes. Consumer preference for environmentally friendly products further motivates companies to explore bio-based chemicals and biodegradable alternatives. Firms that integrate sustainability into product development and operations are likely to gain competitive advantage and meet increasingly stringent regulatory standards.

Regional differences shape market trends. While Asia continues to dominate chemical production due to scale and cost advantages, Europe and North America focus on high-value specialty chemicals and research-intensive products. Emerging markets in Latin America and the Middle East are growing due to infrastructure development, foreign investment and industrial expansion. Companies operating across multiple regions must navigate varying regulatory standards, raw material availability and consumer preferences to maintain competitiveness. Economic trends, including industrial output, consumer spending and construction activity, strongly influence chemical market demand. Periods of economic growth support higher consumption of both basic and specialty chemicals, whereas economic slowdowns can reduce production and constrain revenue. Global trade policies, tariffs and geopolitical events can further affect the flow of chemical products, impacting pricing and availability. Businesses need to remain agile to respond to these external factors. Technological developments and process improvements are also influencing the industry. Adoption of digital solutions, automation and data analytics enables more precise production planning, improved efficiency and better market forecasting. Companies investing in research and development are creating innovative products that meet evolving technical and environmental standards. These strategies not only improve operational efficiency but also enhance market competitiveness.

Conclusion

In conclusion, the chemical industry continues to expand globally, driven by growth in emerging markets, increasing demand for specialty chemicals and technological advancements. Understanding regional market dynamics, raw material supply, regulatory frameworks and sustainability considerations is essential for companies seeking to optimize production and investment strategies. By staying informed about market trends and proactively responding to changing economic and industrial conditions, chemical manufacturers can strengthen their position and ensure long-term growth.

Citation: Simmons E (2025). Emerging Markets and Growth Patterns in the Chemical Industry. Adv Chem Eng. 15:387.

Copyright: © 2025 Simmons E. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution and reproduction in any medium, provided the original author and source are credited.