Indexed In

- CiteFactor

- RefSeek

- Directory of Research Journal Indexing (DRJI)

- Hamdard University

- EBSCO A-Z

- Scholarsteer

- Publons

- Euro Pub

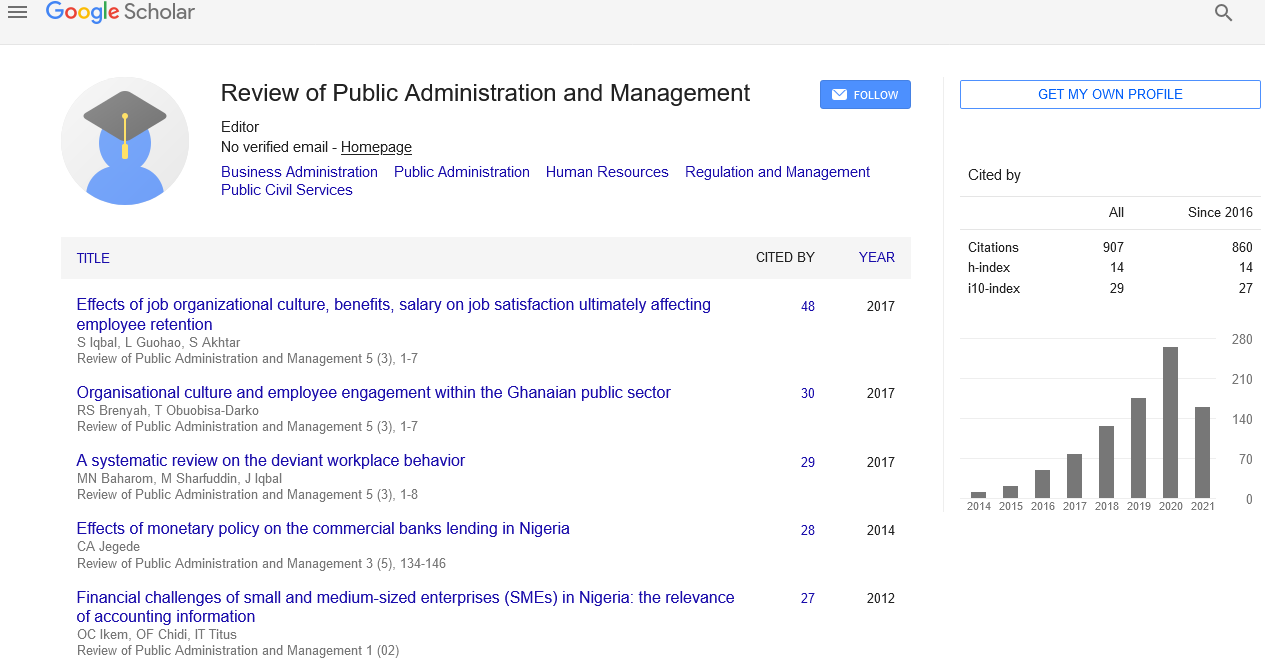

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Abstract

The Effect of Poor Implementation of Tax Policies on Developing Economies. A study of Nigerian Economy, (1999-2010).

Echekoba Felix Nwaolisa, Ezu Gideon Kasie

This study investigated â????The Effect of Poor Implementation of Tax Policies on Developing Economies; A Study of Nigerian Economy, (1999-2010)â????. Past studies have largely focused on challenges and prospects of taxation in Nigeria. This study found it expedient to explore the rationale behind poor tax system in Nigeria. To achieve the objective of the study, the following objectives were set out by the researcher: to examine the causes of double taxation by different levels of government on Nigerian citizens and non-citizens alike: to examine the perceived seriousness of tax evasion vis-?? -vis various legal offences. Analytical research method was used since the researcher made use of secondary data obtained from the office of Federal Inland Revenue Service. The results show that that the expected revenue mapped out by Federal Inland Revenue Service could not be met due to poor implementation of tax policies in Nigeria. It was recommended that the Nigerian Tax system should be simple (easy to understand by all), certain (its laws and administration must be consistent) and clear (stakeholders must understand the basis of its imposition).