Indexed In

- Open J Gate

- Academic Keys

- JournalTOCs

- ResearchBible

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

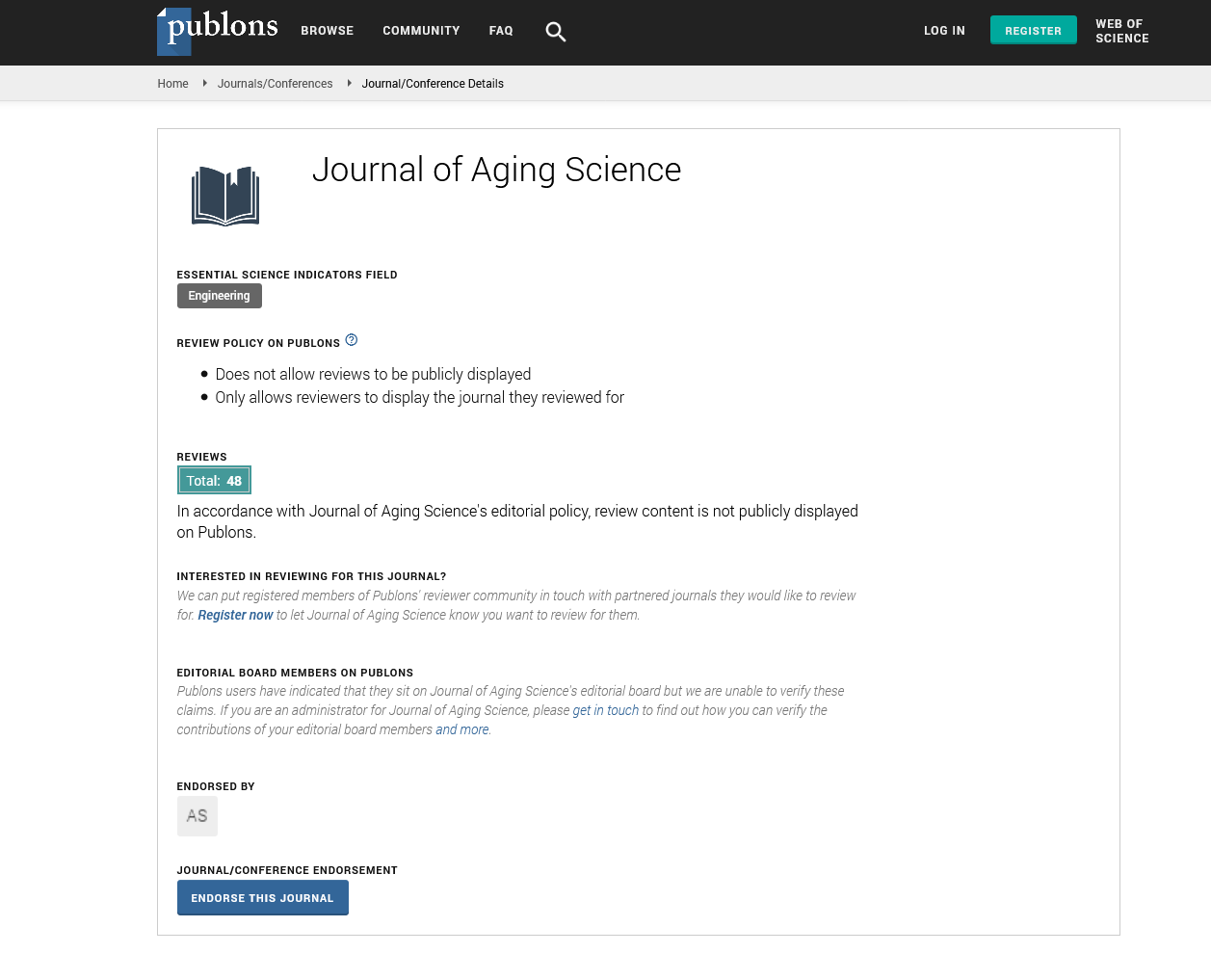

- Publons

- Geneva Foundation for Medical Education and Research

- Euro Pub

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Abstract

Aging of Society and New Medical Technology: The Challenge for Health Insurers to Meet the Expectations of Consumers and Governments

Peter Zweifel

During the past decades, new medical technology has been cost-increasing rather than cost-reducing, unlike technological innovation in the industry. New medical technology thus has importantly contributed to the surge in healthcare expenditure (HCE), which falls also on health insurers both social and private. At the same time, medical advances continue to result in increasing life expectancy and improved quality of life, creating pressure on health insurers to include them in their list of benefits. However, contributions in particular to social health insurance have not kept pace with the promised future benefits, causing a financing gap in most Western countries.

In this situation, health insurers are under pressure from two sides. One the one hand, governments expect them to slow the rise in HCE and in contributions. On the other hand, the insured seem to be keen to have access to the latest medical innovations. This conflict of interest is exacerbated by the suspicion occasioned by the finding that HCE increases substantially with closeness to death regardless of age, reflecting the use of medical innovation benefitting people who do not survive for long. HCE reflecting the use of the latest medical technology, therefore, would often constitute an investment in the health of very limited return.

This contribution seeks to shed light on these issues. Its point of departure is an ideal of (Western) man, viz. ‘to remain perfectly healthy and to drop dead when the time comes’; however, there are cultural differences, as pointed out by. This desire induces efforts to bridge the gap between effective and ideal health status, which is most wide just prior to death. Therefore, much medical care is employed precisely then, resulting in a ‘cost explosion just before death’.

Now social insurers, being monopolistic schemes, can resort to a variety of measures to reign in the rise of HCE, such as limiting provider choice to cost-conscious physicians and hospitals as in Managed Care, excluding or at least delaying coverage of new medical technology, rationing its use (especially by the aged), and imposing copayments. These measures are also available to private health insurers in principle; however, they must be acceptable to their members, who are accustomed to having expanded rather than restricted choice in health care.

Since preferences with regard to health insurance cannot be measured easily, this paper presents evidence from four experiments of the discrete choice (DCE) type, where respondents are made to repeatedly choose between a status quo and a hypothetical alternative. The first DCE suggests that both managed care-type restrictions copayments are rejected by members of social insurance both in the Netherlands and Germany, although not always most strongly by the older ones. To overcome this resistance, consumers would have to be compensated substantially by reduced health insurance premiums. The second study shows that at least among Swiss consumers, a delay of a mere two years in access to new medical technology would also have to be compensated by premium reductions of more than 30 percent in the top age group. Turning to specific cases of medical innovation, a DCE involving elderly Swiss citizens finds that their willingness to pay for a hip protector designed to reduce their risk of breaking the femur is negative. Therefore, including hip protectors in the benefit list of health insurance would not have made sense at the time. The fourth study goes all the way to apply the cost-benefit criterion to medical innovation. It pits estimated willingness to pay by German members of social insurance against the extra cost (and hence insurance contribution) caused by including a new drug for the treatment of diabetes in the benefit list. If this value exceeds the extra cost, a private insurer can safely accept the innovation without running the risk of members canceling their policies because their willingness to pay for the new medical technology falls short of its cost in terms of premium. Thus, the benefit-cost criterion helps insurers both social and private to meet the expectations of their members (who want access to innovation but dislike paying higher contributions) and governments (who want to see HCE stabilized).