Indexed In

- Academic Journals Database

- Open J Gate

- Genamics JournalSeek

- JournalTOCs

- China National Knowledge Infrastructure (CNKI)

- Scimago

- Ulrich's Periodicals Directory

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

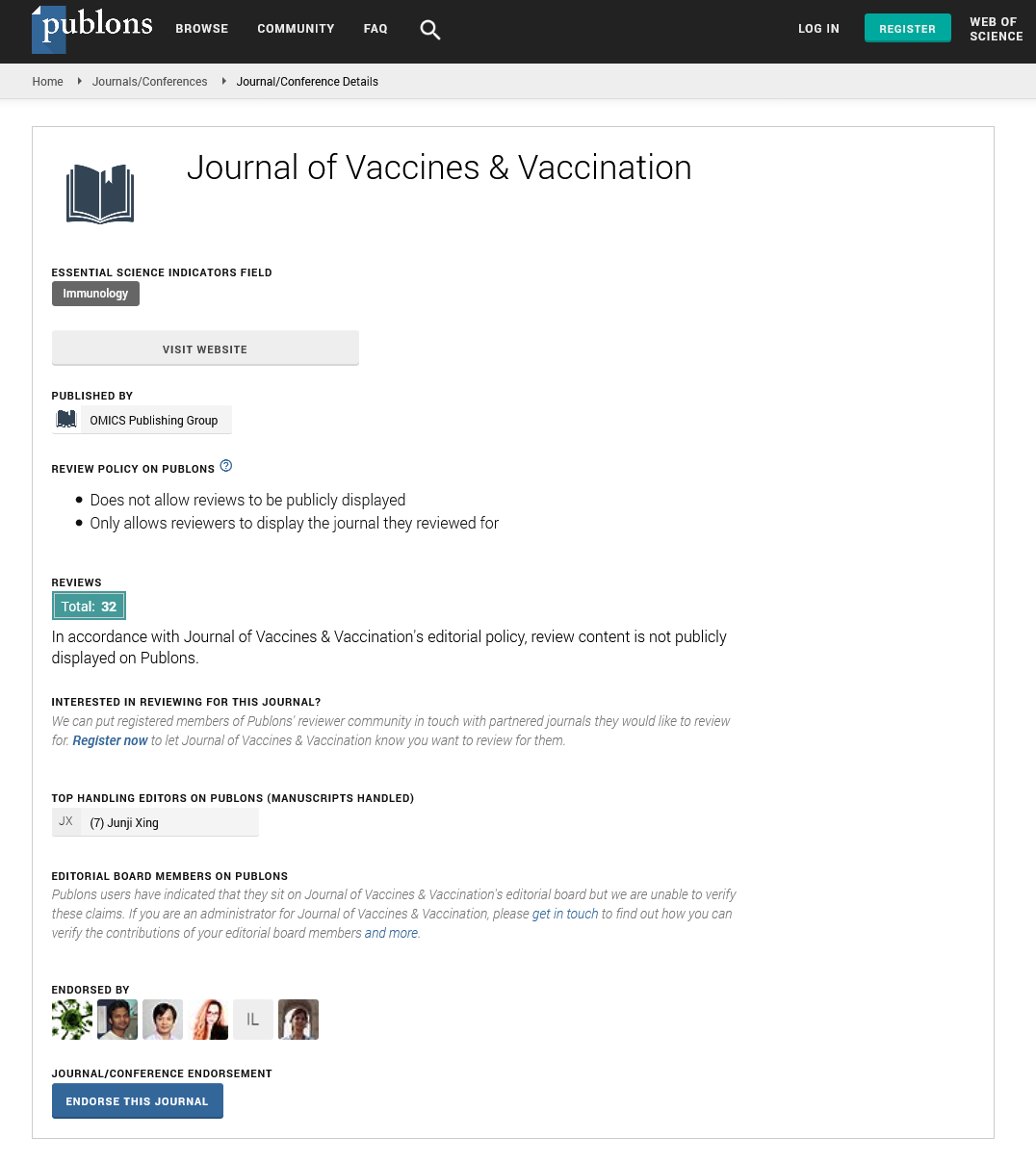

- Publons

- MIAR

- University Grants Commission

- Geneva Foundation for Medical Education and Research

- Euro Pub

- Google Scholar

Useful Links

Share This Page

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Assessment of the design and implementation challenges of the National Health Insurance Scheme in Nigeria: A qualitative study among sub-national level actors, healthcare and insurance providers

39th Euro Global Summit and Expo on Vaccines & Vaccination

July 05-06,2021 | WEBINAR

Gbadegesin O. Alawode

University of Ibadan, Ibadan, Nigeria

Scientific Tracks Abstracts: J Vaccines Vaccin

Abstract:

Background: Health insurance is an important mechanism to prevent financial hardship in the process of accessing health care. Since the launch of Nigeria’s National Health Insurance Scheme (NHIS) in 2005, only 5% of Nigerians have health insurance and 70% still finance their healthcare through Out-Of-Pocket (OOP) expenditure. This study explored the perspectives of sub-national level actors/stakeholders on the design and implementation challenges of Nigeria’s NHIS. Methods: A descriptive case study design was used in this research. Data were collected in Ibadan, Oyo State in 2016 from health insurance regulators, healthcare providers, and policymakers. Key informant interviews (KII) were conducted among purposively selected stakeholders to examine their perspectives on the design and implementation challenges of Nigeria’s National Health Insurance Scheme. Data were analysed using inductive and deductive thematic approaches with the aid of NVIVO software package version 11. Results: Implementation challenges identified include abject poverty, low level of awareness, low interest (in the scheme), superstitious beliefs, inefficient mode of payment, drug stock-out, weak administrative and supervisory capacity. The scheme is believed to have provided more coverage for the formal sector, its voluntary nature and lack of legal framework at the subnational levels were seen as the overarching policy challenge. Only NHIS staff currently make required financial co-contribution into the scheme, as all other federal employees are been paid for by the (federal) government. Conclusions: Sub-national governments should create legal frameworks establishing compulsory health insurance schemes at subnational levels. Effective and efficient platforms to get the informal sector enrolled in the scheme is desirable. CBHI schemes and the currently approved state supported health insurance programmes may provide a more acceptable platform than NHIS especially among the rural informal sector. Awareness and education should also be raised to enlighten citizens. Stakeholders need to address these gaps as well as poverty.