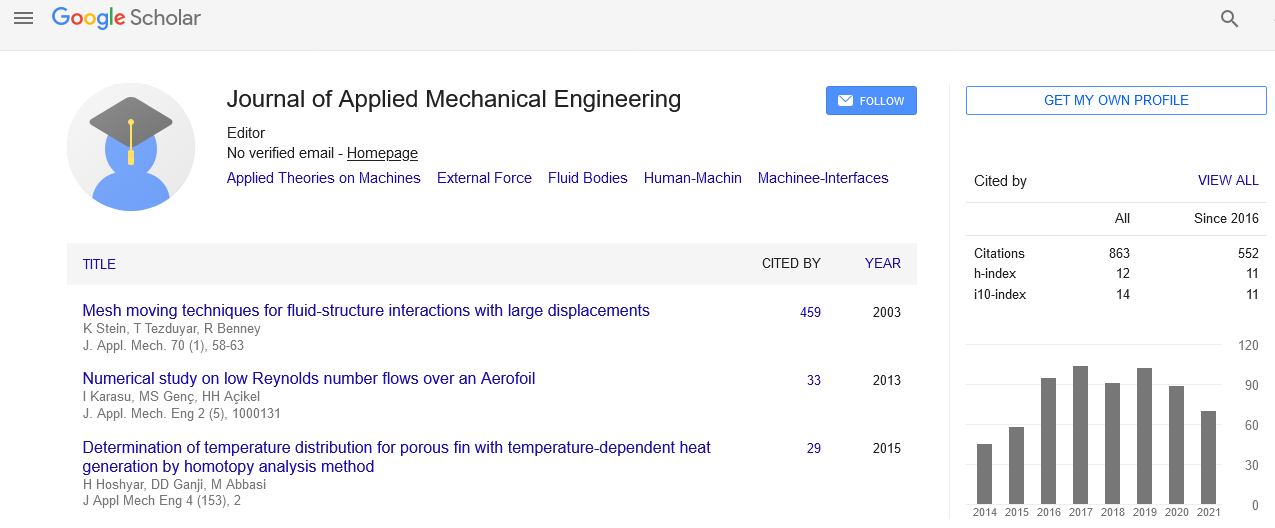

Indexed In

- Genamics JournalSeek

- JournalTOCs

- CiteFactor

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- Publons

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

A game theoretic approach to assessing additive manufacturing as a strategic choice

Joint Event on 2nd International Conference on Advanced Robotics, Mechatronics and Artificial Intelligence & 3rd International Conference on Design & Production Engineering

December 03-04, 2018 | Valencia, Spain

D C McFarlane, M Ahmed and K J D Chan

University of Cambridge, UK

Posters & Accepted Abstracts: J Appl Mech Eng

Abstract:

This paper studies the potential of additive manufacturing (AM) to address demand uncertainty by studying three wellknown levels of any operational strategy i.e. on a strategic level as an enabler of competitiveness; on a tactical level to hedge against uncertainties; and on paper uses game theory to analyze the impact of competition and demand uncertainty on a firm???s technology selection (additive manufacturing AM or conventional tool-based dedicated manufacturing DM) as well as on its capacity investment decision. More specifically, we model two competing firms in two markets under demand uncertainty to help them make three sequential decisions: choice of technology represented by ???technology game???, capacity investment by ???capacity game??? and production quantities by ???production game???. In the first-stage technology game, three subgames can potentially emerge depending on the technology choices: a mixed subgame (A,D) or (D,A) with profit ? in which one firm invests in AM and the other in DM; an additive subgame (A,A) with profit ? #; and a dedicated subgame (D,D) with profit ?$. Since we are unable to predict the equilibrium of the first stage technology game up front, we proceed by analyzing the second and third stage capacity and production choices in all three possible subgames. In the second- stage capacity game, we compute each firm???s expected optimal profit for all three subgames through backward induction using information about quantities from the third stage production game. Although companies make three sequential decisions (A, B and C), however, it is in fact necessary to assess the decisions in the reverse order as highlighted in Figure 1. In each of the three stages, firms play a simultaneous-move non- cooperative game for which we seek a pure-strategy Nash equilibrium. We then develop the best response function for each firm in the technology game and compare how competing firms respond to a given flexibility premium (AM). Initial results of these analyses will be presented in the paper. The research will offer an industrially accessible decision support tool for the adoption and effective deployment of AM in a production environment.

Biography :

E-mail: ma603@cam.ac.uk