Indexed In

- JournalTOCs

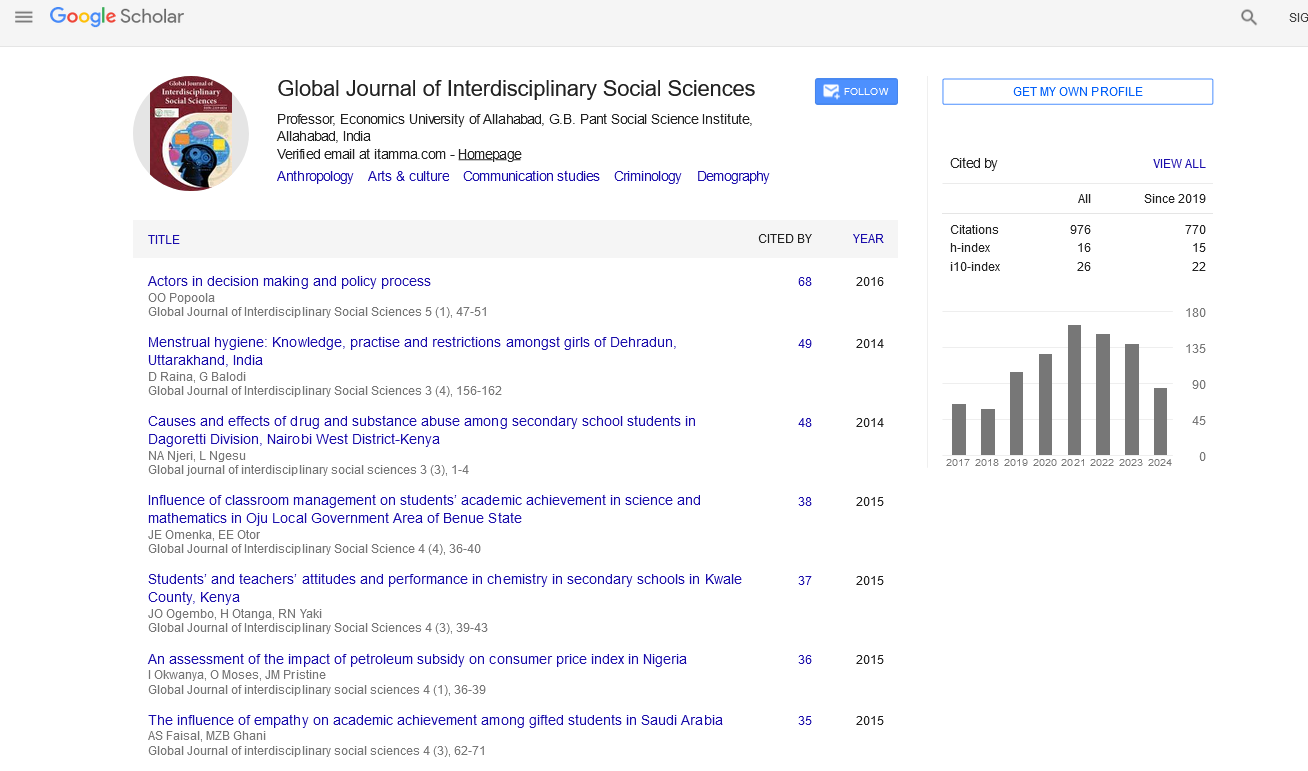

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Commentary - (2024) Volume 13, Issue 1

The Growth of Microfinance in Arab Countries: A Comprehensive Analysis

Ahmed El-Sayed*Received: 28-Feb-2024, Manuscript No. GJISS-24-27880; Editor assigned: 01-Mar-2024, Pre QC No. GJISS-24-27880 (PQ); Reviewed: 15-Mar-2024, QC No. GJISS-24-27880; Revised: 22-Mar-2024, Manuscript No. GJISS-24-27880 (R); Published: 29-Mar-2024, DOI: 10.35248/2319-8834.24.13.083

Description

Microfinance, defined as the provision of financial services to individuals and small enterprises that lack access to conventional banking, has rapidly evolved in Arab countries over the past few decades. This growth has been supported by a confluence of factors, including economic necessity, social changes, and international support initiatives. While the impact of microfinance has been predominantly positive, there are negative aspects that merit examination. This article seeks to explore the historical context of microfinance in Arab countries, important persons who have contributed to its development, and a balanced view of its positive and negative outcomes.

The roots of microfinance can be traced back to the mid-20th century, with the Grameen Bank initiative in Bangladesh founded by Muhammad Yunus in the late 1970s. Although initially concentrated in South Asia, the microfinance model spread globally, particularly in the developing world. In Arab countries, the formal growth of Microfinance Institutions (MFIs) began in the 1990s, driven primarily by socio-economic factors such as prevalent poverty, unemployment, and a burgeoning informal sector.

The Arab spring of 2011 catalyzed significant political and economic changes across the region, further fueling the need for microfinance. Countries like Egypt, Tunisia, and Morocco witnessed an urgent demand for financial inclusion as traditional employment pathways reduced. The contemporary Arab microfinance environment is characterized by innovation in service delivery, controlling technology to enhance access to financial products.

The role of international organizations cannot be overlooked. The United Nations Development Programme (UNDP), for instance, has been instrumental in providing technical assistance and funding to regional MFIs. The Arab Microfinance Network (AMN), a coalition of microfinance providers, has furthered collaboration, training, and advocacy efforts among practitioners in the region.

The positive impact of microfinance in Arab countries is considerable. First and foremost, microfinance has facilitated financial inclusion. By providing access to credit for low-income individuals and small businesses, microfinance institutions have empowered previously marginalized populations, particularly women, to engage in entrepreneurial activities. For example, a 2017 report by the Microfinance Gateway indicated that women borrowers in Tunisia experienced a 60% increase in their incomes after accessing microloans.

Moreover, microfinance has led to job creation and economic diversification. Small enterprises supported by microfinance are critical to reducing unemployment rates, especially among youth in urban areas. A study conducted by the International Labour Organization (ILO) reported that microfinance contributed to the creation of over 1 million jobs in various Arab countries over a span of five years. Furthermore, the rise of digital financial services, such as mobile banking and online platforms, has significantly enhanced the accessibility of microloans. Digital microfinance solutions are streamlining application processes and reducing transaction costs, making financial services more reachable to those in remote areas.

Despite its successes, microfinance in Arab countries is not without challenges. One major concern is over-indebtedness; borrowers may take out multiple loans from various institutions, increasing their financial burden. Reports from the Arab Monetary Fund have highlighted that some regions, particularly in Egypt and Jordan, have seen alarming rates of loan default, straining the financial sustainability of MFIs.

Additionally, the focus on profit-making has led some microfinance institutions to prioritize high-interest loans over the social mission of reducing poverty. This has sparked criticism regarding the commercialization of microfinance, particularly given its original objective of social empowerment. Critics argue that the shift towards a profit-driven model may compromise the effectiveness of microfinance as a tool for poverty reduction.

Citation: El-Sayed A (2024). The Growth of Microfinance in Arab Countries: A Comprehensive Analysis. Global J Interdiscipl Soc Sci. 13:083.

Copyright: © 2024 El-Sayed A. This is an open access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.