Indexed In

- Open J Gate

- Genamics JournalSeek

- Academic Keys

- JournalTOCs

- The Global Impact Factor (GIF)

- China National Knowledge Infrastructure (CNKI)

- Ulrich's Periodicals Directory

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- Publons

- Geneva Foundation for Medical Education and Research

- Euro Pub

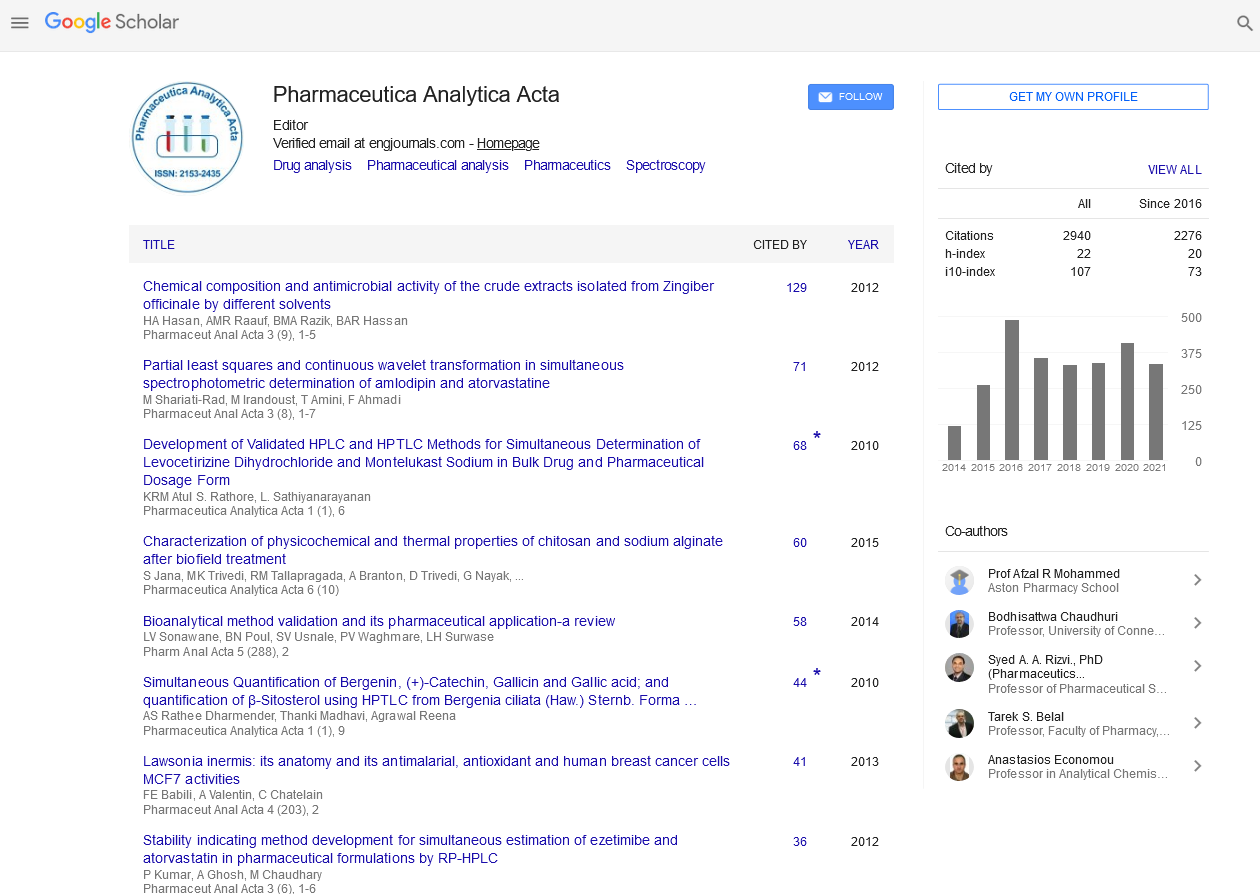

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Opinion - (2023) Volume 14, Issue 4

Pharmaceutical Industry Mergers and Acquisitions: Impact on Drug Competitiveness

Hans Roget*Received: 01-Aug-2023, Manuscript No. PAA-23-22963; Editor assigned: 04-Aug-2023, Pre QC No. PAA-23-22963 (PQ); Reviewed: 18-Aug-2023, QC No. PAA-23-22963; Revised: 25-Aug-2023, Manuscript No. PAA-23-22963 (R); Published: 01-Sep-2023, DOI: 10.35248/2153-2435.23.14.749

Description

The pharmaceutical industry is characterized by intense competition, high research and development costs, and stringent regulatory requirements. To maintain profitability and achieve economies of scale, pharmaceutical companies often engage in Mergers and Acquisitions (M and A) activities. These M and A transactions can have a profound impact on drug competitiveness, affecting pricing, availability, and innovation. This article explores the consequences of consolidation within the pharmaceutical industry and its implications for patients, healthcare systems, and the broader market.

Pharmaceutical M and A activities have been a common occurrence for decades. These transactions range from mergers of equals to acquisitions of smaller companies with potential drug pipelines. The motivations behind these deals are multifaceted. Companies seek to enhance their drug portfolios, expand into new markets, and achieve cost efficiencies through economies of scale. However, it's essential to note that the impact on drug pricing is complex and may vary depending on the specific drugs involved, therapeutic areas, and regional market dynamics. In some cases, competition authorities may impose conditions or require divestitures to mitigate potential anti-competitive pricing effects. While M and A activities can affect drug pricing, they can also impact patients' access to medications. On one hand, a merged pharmaceutical company may have the resources and infrastructure to expand access to certain drugs in underserved regions. On the other hand, there is a risk that M and A deals could lead to the discontinuation of less profitable drugs or reduced investment in research and development for certain conditions.

Patients and healthcare providers often closely monitor M and A activities to assess potential disruptions to drug availability. In some cases, divestitures may be required to maintain competition and ensure that patients continue to have access to essential medications. Pharmaceutical companies invest heavily in Research and Development (R and D) to bring new drugs and innovative drugs to market. When mergers and acquisitions occur, priorities and strategies may change. The impact on innovation within the industry is a topic of significant interest and concern.

On one hand, consolidation can lead to increased budgets and collaboration between research teams, potentially accelerating drug development. However, there is a counterargument that larger pharmaceutical companies may focus more on maximizing profits from existing drugs rather than investing in riskier, innovative research. The balance between short-term profitability and long-term innovation is a critical consideration in pharmaceutical M and A activities. Regulators and industry stakeholders often scrutinize mergers and acquisitions to ensure that they do not stifle innovation or reduce competition in research and development efforts.

Pharmaceutical mergers and acquisitions are subject to regulatory oversight in many countries to safeguard competition and protect the interests of patients and healthcare systems. Regulatory authorities, such as the Federal Trade Commission (FTC) in the United States and the European Commission, conduct thorough assessments of proposed transactions to evaluate potential anticompetitive effects.

Conclusion

Pharmaceutical industry mergers and acquisitions are complex transactions with far-reaching implications. While they can provide opportunities for companies to enhance their drug portfolios, expand into new markets, and achieve cost efficiencies, they also raise important questions about drug pricing, access to medications, innovation, and market competition.

Citation: Roget H (2023 Pharmaceutical Industry Mergers and Acquisitions: Impact on Drug Competitiveness. Pharm Anal Acta. 14:749.

Copyright: © 2023 Roget H. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.