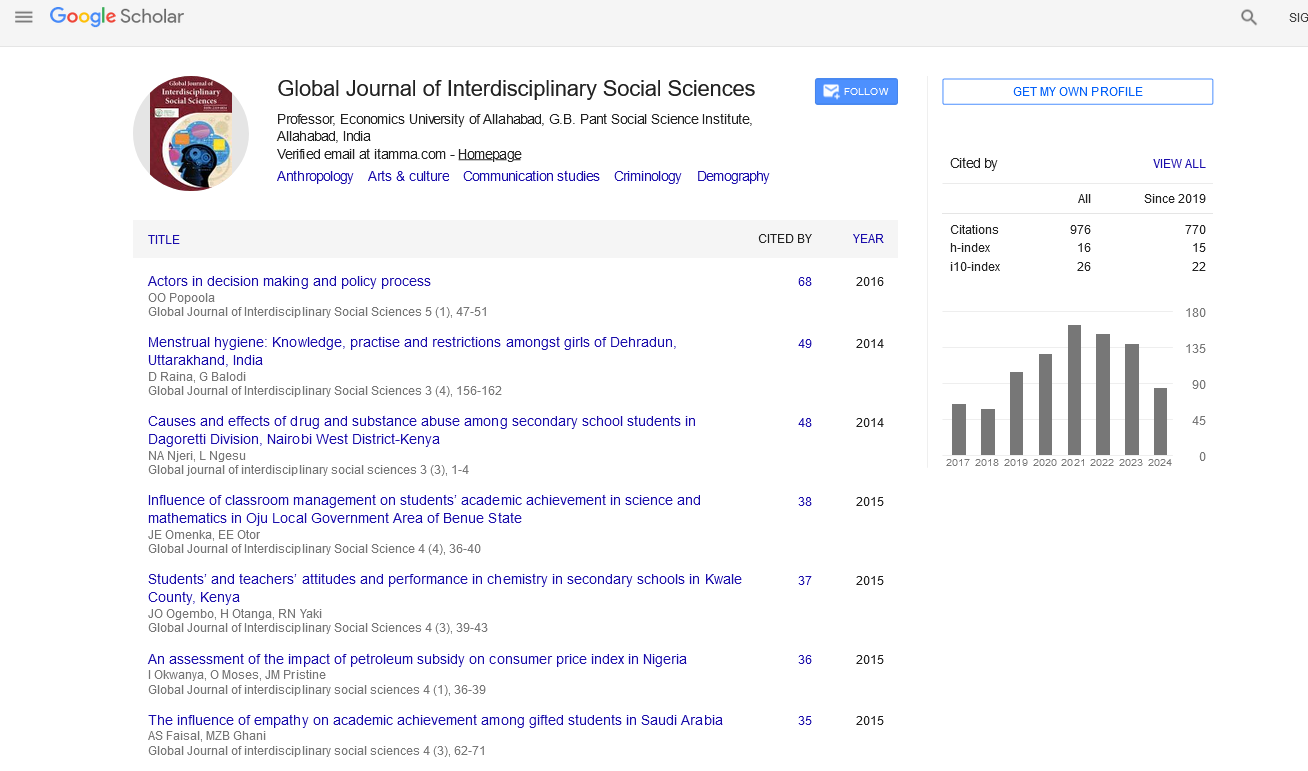

Indexed In

- JournalTOCs

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Review Article - (2022) Volume 11, Issue 5

Institutional Quality and Development Nexus in Africa Revisited: ARDL Panel Approach

Hammed A. Adefeso* and Isiaka O. AransiReceived: 01-Jul-2022, Manuscript No. GJISS-22-17277; Editor assigned: 04-Jul-2022, Pre QC No. GJISS-22-17277(QC); Reviewed: 19-Jul-2022, QC No. GJISS-22-17277; Revised: 01-Sep-2022, Manuscript No. GJISS-22-17277(R); Published: 07-Sep-2022, DOI: 10.35248/2319-8834.22.11.030

Abstract

This study re-examines short and long run links between institutional quality and development in 51 African countries panel from 1972-2020 by estimating Panel Autoregressive Distributive Lag (ARDL) model. The study employs principal component analysis to generate data for political institution, economic institution and legal institution as well as total/overall institution. The study finds evidence of long run relationship between the quality of institutions and development in African countries. Specifically, the study finds insignificant positive relationship between all institution indexes and GDP per capita in the short run with exception of economic institution, which has negative impact. In the long run however, all institution indexes have significant negative relationship development except legal institution, which has insignificant impact. Estimate from overall institution reveals positive and negative relationships in the short run and long run respectively and generally insignificant in Africa. The study recommends that African leaders should improve and ensure strong institution for development.

Keywords

Institutional quality; Development; ARDL; Africa; Insignificant

Introduction

There exists a plethora of studies on the theoretical link between institutions and growth. Central to these recent studies is the recognition of institution as a crucial determinant of development across countries as there are increasing and convincing empirical supports to this theoretical exposition that differences in the quality of economic institutions, more than culture, luck, or geography, stimulate disparities in income per capita across countries. Therefore, understanding the nature of institutional quality across the globe is of paramount importance and critical to the development process. Surprisingly, few of these studies that examined the link between institutions quality and development have been reported from African countries that are still facing the major development challenges [1-3].

Economic growth rates in these countries are not strong enough to drive, stimulate and translate to development as the number of people living in poverty has increased tremendously with low standard of living. Extreme poverty has exhibited a downward trend in other regions, excluding Sub-Saharan Africa and the little progress made is being marred by the population growth. Though, some of these countries have witnessed economic recession in the recent past few years or decades while it is still ongoing in others, yet Africa has witnessed growth resurgence around the mid 1990 with more than half of the ten fastest rising economies domiciled in the region, but such growth has been recently confirmed as jobless or immiserising growth. Specifically, life expectancy for example, in Africa is as low at 52.5 years, with Lesotho and Zimbabwe recording 45 in 2009. African countries have recorded the least GDP per capita and highest level of poverty. For 2017, the United Nation reported 0.537, lowest among other regions as the Human Development Index (HDI) for (sub-Sahara) Africa compared with the world’s HDI of 0.728 (UNDP, 2018).

Acknowledging the fact that researches on the nexus between development and some traditional variables such as technical progress, and accumulation of both physical and human capita have known a peak, numerous studies have yielded largely positive results, but at times with the same attributes produce varying results across divergent societies, groups, and regions.

This paper challenges this conclusion by adopting Autoregressive Distributed Lagged (ARDL) model. This research adds to the existing studies by establishing the macro-level relationship, the direct effect and the contribution of each type of institution as well as overall institutions to the development in the African countries as there is yet no consensus in the literature on the kind of institution required for inclusive and sustained growth toward achieving Millennium Development Goal (MDGs). Specifically, this study details information on the degree to which disparities in the development can be attributed to divergences in institutional quality and this study departs from other studies which have concentrated on selected developing economies from other regions by focusing on developing economies from African countries alone. Also, the study examines several alternative measures such as political, economic and legal institutions, which culminate into overall institutions on development in African countries. Furthermore, principal component weighted is employed to generate data on each type of institution as well as overall institutions and then estimate Autoregressive Distributed Lag (ARDL) specification. A 51 African country panel from 1972 to 2020 is constructed, which the study thereafter uses in the estimation of the error correction kind of the original ARDL specification using tripartite alternative methods: Pool Mean Group (PMG), Dynamic Fixed Effect (DFE), and the Mean Group (MG) estimations [4-6].

Extant literature on the institutional quality and development nexus are extensive and have yielded mixed results. Several studies have established a positive relationship, surprisingly; having taken into consideration the econometrics problems of endogeneity and heterogeneity raised by Hoed makers in his study and by adopting a more advanced econometrics method, this paper still finds evidence in support of Hoed makers. There is a weak institutional effect on development in Africa. The coefficients of political, economic and legal institutions are sensitive to the selection and even manipulation of control and dependent variables, both in the short and long run. To have a meaningful examination on institutional quality and development nexus in Africa, a thorough and careful assessment of variables employed is a necessity. The study therefore, hypothesized that there is no significant impact of institutional quality on development in African countries. The remaining parts of this paper are organized as follows. The second section explicitly describes the literature review. Section 3 captures variables and data. Econometrics issues and results are contained in section 4, and finally, the fifth section contains the conclusion.

Literature Review

Extant studies on the development institutional quality nexus are wide and have shown largely mixed and arguably inconclusive results. From an empirical perspective, the quality of data and heterogeneity, data manipulation, and differing techniques of estimation are plausible reasons for the differing results. These existing empirical results have been discussed in two categories for the purpose of this study. Section 2.1 presents existing studies on institutional quality development nexus in Africa alone, while section 2.2 reveals literature on institutional quality development nexus in developed and developing countries.

Empirical studies from African countries

Carraro and Karfakis examine economic freedom, institutions and structural transformation in eleven African countries. Using a panel data model, the study reveals a significantly positive effect of the quality of institutions and economic freedom measures on the structural transformation between sectors. Epaphra and Kombe investigate the institutions-growth link in Africa. Using the Random Effect (RE), Fixed Effects (FE) and the Generalized Method of Moment (GMM) models over a period of 1996-2016, the study finds political stability to be the most significant factor determining the growth of real GDP per capita in Africa among the indicators of institutional quality. Iheonu, Ihedimma and Onwuanaku employed static panel estimation and panel two stage least on square techniques on a panel of twelve countries in the western part of Africa/Africa over twenty years when considering institutional quality and the performance of the economy. Rule of law, government effectiveness, control of corruption, and regulatory quality were adapted to proxy institutions in those selected countries. The study found that all indicators of institutions had a significant and positive effect on the performance of the economy, when random and fixed effect models were employed, but only government effectiveness was significant in the case of panel two-stage least square model [7-9].

Owusu-Sekyere and Jonas considered whether democracy enhances economic growth in Anglophone West African countries. The study employed dynamic panel estimation on the selected countries in Africa: Ghana, Sierra Leone, Nigeria, Gambia, and Liberia/Africa over 35 years. The study adopted Polity score from Polity IV as a measure of democracy. A negative link was found between growth and democracy. Hoed makers also examined the institution growth nexus in African countries from 1999 to 2014. Using data from the World Governance Indicator (WGI) average from 2010 and the International Country Risk Guide (ICRG) aggregate from 2011. The study highlighted that institutions that can stimulate economic development in the countries are not strong. The study further noted that results will be sensitive to selective data collection, including manipulation of data, and called for thorough assessment of variable used for institution. Leyaro examined the political form of institutions, trade and growth in sub-Saharan Africa. Static panel and GMM estimation were employed for 46 sub-Saharan African countries/Africa from 1996 to 2012. The study adopted the six Worldwide Governance Indicators (WGI) as institutional variables and concluded that institutional improvement is crucial for the recent growth in Africa. Chuku considered the governance growth nexus in 43 African countries/Africa, using kernel regression technique on WGI variables over 17 years. Findings from the study revealed that only regulatory quality, control of corruption and rule of law has an effect on growth.

Aggad examined the economic growth democracy nexus in 15 African countries in the West from 1970–2009. Using polity score gathered from Polity IV, the study finds evidence in support the established empirical findings that growth in the economy improves democracy. In the same vein, Chisadza and Bittencourt investigated whether democracy was eluding sub Saharan Africa in a dynamic data framework. The study gathered data for 48 countries from 1960–2010 on polity score. The study found a significantly negative link between democracy and income. Alexious, Tsaliki and Osman examined institutional quality and growth in Sudan using time series data between 1972 and 2008 by applying an ARDL approach using civil liberties and political rights as proxies of institutional quality. Findings of the study showed that weak quality of institution is a disincentive to economic prosperity as a negatively significant result was found. Fayissa and Nsiah in examining what impact governance has on the growth of the economy in Africa adopted random and fixed effect models, in addition to the Arellano Bond panel data estimation models for 39 countries in Africa from 1995 to 2004. The study used world governance indicators and found that all indicators of governance exerted significantly positive effects on growth. However, the study noted that the significance and magnitude of the impact were dependent on the governance index used [10-13].

Kilishi, Mobolaji, Yaru and Yakubu in their study examined institutions and the performance of 36 sub-Saharan Africa economies while adopting World Governance Indicators (WGI) to proxy institution. Using Generalized Method of Moment (GMM) for a period of 1996–2010, the study showed that institutions were of great significance for the performance of the sub-Saharan African economy. Thy study further revealed that regulatory quality and rule of law were the most vital to enhance economic performance in the region.

Empirical review from developed and developing countries

Using a sample of 113 countries for a period of 2006-2016, Radzevica and Bulderberga in their research examined institutional quality’s role in the growth of the economy of Baltic States using GMM technique. The study discovered that the strength of investor protection, regulatory quality, government effectiveness, the tax burden, efficacy of corporate boards, and strength of auditing and reporting standards, monetary freedom, and financial freedom had impacted growth positively. However, Nguyen, Su and Nguyen analyzed the effect that the quality of institutions had on the growth of emerging economies using a System GMM technique over 14 years. The study found a positively significant impact between the two variables. Zouhaier and Karim examined the institutions growth link using a static panel data model on 37 selected countries over a period of 1975–2000. Using political and economic freedom as proxies for institution, the study found that economic institutions exerted a dominant effect on economic growth [14].

Yildrim and Gokalp reviewed the impact of institutional parameters on developing countries economic performance. The study focused on 38 selected developing countries for a period of 2000-2011 in a panel data model. Impartial courts, judicial independence, political stability, and legal enforcement of contracts, government intervention, and protection of property rights, political freedom, civil freedom, and freedom to trade internationally, the quality of regulations and bribery and favoritism were used to proxy institutions in selected developing countries. The study revealed that regulations on trade barriers, law system integrity, restriction of foreign investments and the share of the private sector in the banking system and employment dismissal affect the macro-economic performance positively, while other variables like civil freedom, judicial independence, the black market exchange rate, transfer and subsidies, government expenditures, political stability and collective bargaining had an adverse effect on the economic performance of the countries.

Tamilina and Tamilina analysed the influence of variations in institutional quality on economic growth in post-communist transition economies for a period of 1996–2008. Corruption control in government, government effectiveness, regulatory quality and voice and accountability were used to represent institution. Using panel data model, the study provided evidence to support the idea that the influence of economic institutions on growth differs depending on the manner of emergence of such institutions. Using 13 developing economies of Asia in an Autoregressive Distributed Lagged (ARDL) framework, Asghar, Qureshi and Nadeem examined what impact institutional quality has on economic growth from 1990 to 2013. After considering the quality of legal institutions, economic and political institutions, the study found that there was a need to improve institutional quality for increasing growth in the economy. Nawaz, Iqbal and Khan studied the influence institutional quality exerts on growth in 35 Asian countries in a dynamic and static panel from 1996 to 2012. The study employed regulatory quality, control of corruption, government effectiveness, voice and accountability, rule of law, and political stability and absence of violence/terrorism to proxy institutions. The study concluded that differing set of institutions were required by different countries to promote growth in the long term [15-19].

Gathering data from 181 countries across the globe and adopting static panel data model for a period of 1950–2009, Helgason investigated a comparison across developmental stages, the role that institutional quality played in economic growth. The study used quality of government, the number of veto players, and civil liberties to proxy institutions. The study concluded that the quality of institutions had a positive significant connection with growth. Siddiqui and Ahmed examined a cross-country study on the institutions economic growth debate. The study considered 141 countries on GMM instrumental variable estimation for a period of 1988–2003. The study adopted the index of institutionalized social technology as surrogate for institution. The study found a strong causal relationship between institutional quality and growth, with the former being significantly positive. Acemoglu conducted a research on oligarchic versus democratic societies in the selected 25 countries. The study observed that higher democracy enhanced growth as it lessened the degree to which existing oligarchies could limit entrance by prospective competitors. Butkiewicz and Yanikkaya investigated whether democratic institutions or the rule of law maintenance or both are the major challenge to growth. The study selected 100 countries in a panel model from 1970 to 1999. The study adopted government repudiation of contracts, rule of law, and the risk of expropriation, corruption, bureaucratic quality, democracy, political regime type, civil liberties, political rights, and autocracy as a surrogate for institutional quality. The study found that not democracy, but the rule of law, enhanced growth.

Data and measurement of variables

Data: The concept of “institutions” has generated numerous definitions in the literature. Following North, “institutions are formal and informal rules of the game, and their enforcement characteristics in a society or, more formally, are the humanly devised constraints that shape human interaction.” In an earlier study of North, institutions were classified as “constitutional rules (such as the constitution and basic legislation), operating rules (legislation) and behavioral rules (aimed at legitimizing the first two groups).” The study buttresses the pillar of his classification. The informal institutions entail the latter group, while formal institutions embody constitutional and operating rules. Institutions are inherent qualities within the system of the economy and it is difficult to find a single index that captures the quality of institutions, which led to interrelated composite indicators. Recent studies have built on North’s classification, which has resulted in three kinds of formal institutions: Political, Economic and Legal institution or political power. The informal institutions entail social institution, which includes belief, norms, civic cooperation and trust. This study is based on formal institutions. This study constructed 51 African countries panel over the period of 1972-2017. All institution data are gathered from Polity IV; International Country Risk Guide (ICRG); Heritage Foundation; Freedom House; World Bank Database of Political Institutions while others data are gotten form World Development Indicator (WDI) as shown in Table 1.

Measurement of variables

The dependent variable is log of GDP per capita (lgdpkit). Political institution index (lpolit) in this study is a proxied of a combination of data from three variables namely: Regime type; checks and balances; and political rights. Legal institution index (legalit) is also, pooled from a combination of three variables: civil liberties; law and order and religion in politics. The economic institution index (leconit) is collected from a combination of three variables: Business freedom, financial freedom and investment profile. Data gathered on these classifications are encoded to follow the same interpretation. Principal component analysis is adopted on each categorical index of institution and subsequently used for estimation. Data on overall institution are gotten through the combination of all indexes from the three categories of institutions earlier mentioned. Here, the same process is followed on all nine variables from the components of the three categories of institutions stated above. The factor scores are thereafter normalized and converted to percentages. The control variables: gross capita formation (lgcf), number of telephones (ltel); primary school enrolment rate (lpser) all sourced from World Development Indicator (WDI). GDP per capita is measured as the ratio of GDP and total population. The major limitation facing this research work is constraint of data availability required for the period of study. The study used political institution in the polity IV as source of data. Regime type, which is calculated as the difference between the index of democracy and authoritarianism was adopted and 10 was added to remove negative signs. Check and balances and political right and other proxies for legal institutions and economic institutions were also sourced as shown in Table 1 before adopting Principal Component Analysis (PCA) to generate single variable for each type of institutional variable.

| Institution variables | Proxies | Sources |

|---|---|---|

| Political institutions (lpolinst) | Regime typecheck and balances political right | Polity IV The database of political institution freedom house |

| Legal institutions (llegalinst) | Law and order civil right religion in politics | International Countries Risk Guide (ICRG) International Countries Risk Guide (ICRG) Freedom house |

| Economic institutions (leconinst) | Business freedomfinancial freedom investment profile | Heritage foundation Heritage foundationInternational Countries Risk Guide (ICRG) |

| Infrastructure (ltel) | Fixed telephone subscription lines per 100 people | World Development Indicator (WDI) |

| Gross capital formation (lgcf) | Gross capital formation | World Development Indicator (WDI) |

| Human capital (lpser) | Primary school enrolment rate | World Development Indicator (WDI) |

Table 1: Composition of variables and sources of data.

Discussion

Econometrics issues

The study specifically estimates a dynamic panel model of growth and development with an ARDL specification. This is because the ARDL result is unbiased with valid t-statistics and appropriate lag selection, it eliminates the correlation in the residuals and thus endogeneity problem is mitigated. The ARDL is capable of correction of the outliers with impulse dummies. The study therefore, constructs 51 African country panel from 1972 to 2020 and there after employed error correction form of the original ARDL specification by the three options Pooled Mean Group (PMG), Dynamic Fixed Effect (DFE), and Mean Group (MG) estimations. Following the proposition of Pesaran and Smith; Pesaran, Shin and Smith, this study starts with a panel data representation of the time series ARDL (p,q) model that includes lagged dependent and independent variables:

In the equation above, for i=1, 2,…,……… N; and t=1, 2, ………., T; k=1, 2,............., p; and j=0, 1, 2…………., q. Also, μi is the group specific effect; i is the number of groups; t is the number of years or periods; p and q are the lags for the dependent and independent variable respectively. While yit was proxies by the log of GDP per capita,`x'i,t is the log of vector of key explanatory variables as shown in Table 1.

Equation 1 can be rewritten in a way that accommodates the long and short run estimates as

Equation 2 is re specified in error-correction form as

From the above, the long and short run estimates for institutional quality and development nexus are

Table 2 reports the summary of descriptive statistics of the study. The variables of interest of the study, political institution (lpolinstit) legal institution (legalistit) and economic institution (lemoniestit). The average values of these variables are within the 30 and 40 and their standard deviation ranges from 20 to 25. Their minimum values range from 0 to 3 with maximum values which fall within approximates of 84 and 88. The dependent variable, GDP per capital (lgdpkit) has minimum value and maximum value of 0 and 25303. The average value of this variable is 1321.278 with standard deviation of 2571.151. Other variables are as presented in the Table 2.

| Variable | Obs | Mean | Std dev. | Min | Max | time period |

|---|---|---|---|---|---|---|

| lgdpkit | 2,346 | 1321.278 | 2571.151 | 0 | 25303.1 | (1972-2020) |

| lgcfit | 2,346 | 18.44169 | 16.12569 | -2.42436 | 219.069 | (1972-2020) |

| itelit | 2,346 | 1.99872 | 4.007478 | 0 | 32.6526 | (1972-2020) |

| lpsenit | 2,346 | 65.74988 | 44.05452 | 0 | 207.234 | (1972-2020) |

| lpolinstit | 2,346 | 32.36337 | 20.81388 | 3 | 87.9286 | (1972-2020) |

| llegalinstit | 2,346 | 38.47656 | 21.48746 | 0 | 85.8571 | (1972-2020) |

| leconinstit | 2,346 | 31.58949 | 25.07115 | 0 | 83.6111 | (1972-2020) |

Table 2: Descriptive statistics of the variables

To adopt the PMG, DFE and MG estimators, the study tested for the stationary nature of the variables deployed in the regressions to know if they are of order zero or order one, i.e., I (0) or I (1), respectively since our dataset includes the time period that is long enough (45 years). Various tests including those developed in Harris and Tzavalis; Im, Pesaran, and Shin; Breitung and Levin Lin and Chu are performed (Table 3). As shown by the results, concerning the variables in levels, the null hypothesis that the panel contains a unit root would not be rejected significantly for few of them; thereby showing the unit root presence, but the null hypothesis is significantly rejected for all adopted variables when the tests are performed in their first difference. As a result, the entirety of the variables adopted in our regressions is first order stationary (i.e., I (1)), although not all of them are stationary with order zero (i.e., I (0)). That unit roots are present in a number of variables necessitated running cointegration test given the consistency of the estimators. This study conducted three (3) panel cointegration tests, which are Wasteland; Pedroni; and Kao. The last two panel tests are premised on the assumption that the error correction speed is equal for every section and analyzed the option that at least one section of the panel is integrated while Wasteland developed four error correction based panel cointegration tests and made allowance for heterogeneous specifications of short and long run coefficients of the error correction model with p=q=1. The two groups mean tests do not need the error correction speed toward the long run equilibrium to be equal. They are thus designed to test the alternative hypothesis that the panel is integrated as one. When the cointegration among GDP per capita (lgdpkit) and its explanatory variables (lpolit, llegalit, leconit) are evaluated, the null hypothesis of no cointegration is repudiated at both 1% and 5% levels of significance, which revealed long run relationships among our variables of interest. Also, when the null hypothesis of “no cointegration” is evaluated for all variables in our models, the null hypothesis is rejected at even less than 1% level of significance (Table 3).

| Levin Lin Chu (LLC) test | Im Pesaran Shin (IPS) test | Breitung test | Harris Tzavalis (HT) test | |||||

|---|---|---|---|---|---|---|---|---|

| Level | Difference | Level | Difference | Level | Difference | Level | Difference | |

| lgdpkit | -4.594*** | -19.262*** | -3.034*** | -24.68*** | 5.6663 | -19.81*** | 0.8798*** | -0.188*** |

| lgcfit | -3.095*** | -15.855*** | -4.106*** | -26.79*** | -5.666*** | -26.12*** | 0.8509*** | -0.073*** |

| lpserit | 0.4707 | -25.407*** | -8.983*** | -32.01*** | -4.818*** | -34.61*** | 0.5554*** | -0.324*** |

| ltelit | -3.560*** | -13.684*** | -2.583*** | -24.44*** | 1.9981 | -28.09*** | 0.8735*** | 0.0112*** |

| lpoligalinstit | -4.067*** | -21.115*** | -1.1804 | -26.34*** | -0.1769 | -16.28*** | 0.9137*** | 0.0788*** |

| llegalinstit | -8.536*** | -29.452*** | -7.430*** | -28.85*** | -3.061*** | -20.80*** | 0.8229*** | -0.101*** |

| leconinstit | -4.479*** | -23.525*** | 0.1905 | -28.96*** | 0.5146 | -26.81*** | 0.9283 | -0.064*** |

Note: Adjusted t* is reported in LLC test, Zt-bar is reported in IPS test, Rho is reported in HT test and Z statistic was reported for Hadri test *p<0.10; **p<0.05; **p<0.01

Table 3: Panel unit root tests.

The three models estimated in this study are MG; PMG and DFE. The MG estimator of Pesaran and Smith “involves estimating N time series regression and averaging the coefficients.” With this estimator, the intercepts, slope coefficient and error variances are all permitted to vary across groups. The PMG estimator of Pesaran, Shin and Smith combines both pooling and averaging of coefficients. The main feature of PMG is that it allows the following to be heterogeneous country by country: short run slope coefficients and intercepts, the speed of adjustment to the long run equilibrium values as well as error variances while restricted long run slope coefficients to be homogenous across countries. The application of PMG is essential when there are reasons to expect that the long-run relationship among our variables of interest is similar across the selected countries or at least, subset of the countries under study. The short run adjustment is permitted to be country specific because of widely differential nature, characteristics and developmental impact of institutions in African countries. The second estimator, MG, introduced by Pesaran and Smith suggests estimating separate regressions for each country and calculating the coefficients as unweighted means of the estimated coefficients for individual countries without imposing any restriction. Essentially, MG allows all coefficients to vary and be heterogeneous both in the short run and long run. The DFE estimator just like PMG, it imposes restrictions on the slope coefficient and error variances to be equal across all countries in the long run. Also, DFE estimator further limits the speed of adjustment coefficient and short run coefficient to be equal too. It supposes homogeneity in all coefficients long and short run across groups, albeit for the country specific intercepts.

Our primary estimation results of PMG, DFE and MG estimators for political institution are presented in Table 4, where GDP per capita is employed as dependent variables. Of note, the first row in the table reveals that the error correction coefficients are significant and negative across all estimations, indicating the existence of and the convergence to the long-run relationship between political institution (lpolinstit) and GDP per capita (lgdpkit) in the Table 4. The speed of convergence in our model shows Africa is “catching-up” slow. Table 4 reports the results of PMG, DFE and MG estimation along Hausman test purposely to measure the comparative consistency and efficiency of the results. Table 4 shows the long and short run coefficient of political institution (lpolinstit). The estimated result reveals that in the long run, (lpolinstit) has a negative influence on GDP per capita (lgdpkit) in both PMG and MG but highly significant in the PMG only. It is positively insignificant in the DFE estimation. In the short run, however, (lpolinstit) has a positive effect in both PMG and MG and negative in DFE but none of the effect is statistically significant. In order to properly interpret both the long and short run relationships between political institution and development from this estimated result, the study conducted pairwise comparison between MG and PMG estimators and between MG and DFE. The Hausman test confirms that PMG estimate is the efficient estimator over MG and DFE. Using PMG estimator, the result indicates that (lpolinstit) has a negative and significant relationship in the long run with GDP per capita, but has an insignificant positive influence in the short run.

| Methods | PMG | MG | DFE |

|---|---|---|---|

| Dependent Variable: lgdpkit | |||

| Error-correction (coefficient) | -0.112668*** | -0.202*** | -0.151*** |

| -0.019 | -0.025 | -0.011 | |

| Long-run Coefficient | |||

| Lpolinstit | -0.254** | -0.617 | 0.0317 |

| -0.107 | -2.052 | -0.305 | |

| Lgcfit | 0.503*** | 1.002*** | 0.8259166*** |

| -0.059 | -0.327 | -0.109 | |

| Lpserit | 0.0547** | -0.0787 | -0.06985 |

| (0.023) | -0.0974 | -0.0696 | |

| Itelit | 0.2926605*** | 1.473** | 0.3792185*** |

| (0.0345) | -0.731 | -0.124 | |

| Short-run coefficient | |||

| D. lpolinstit | 0.216 | 0.0514 | -0.00098 |

| -0.236 | -0.0998 | -0.05 | |

| D. lgcfit | 0.2500538*** | 0.1556663** | 0.2905794*** |

| -0.084 | -0.061 | (0.030) | |

| D. lpserit | -0.00279 | -0.00528 | -0.00236 |

| -0.004 | -0.009 | -0.011 | |

| D. itelit | 0.0183 | -0.148* | -0.06106 |

| -0.118 | -0.0835 | -0.038 | |

| Constant | 0.713*** | -0.332 | 0.681*** |

| -0.116 | -0.783 | -0.181 | |

| Observations | 2295 | 2295 | 2295 |

| Number of countries | 51 | 51 | 51 |

| Hausman test | MG VS. PMG | MG VS. DFE | |

| Chi square | 8.05 | 0.48 | |

| Prob> Chi square | 0.0899 | 0.9753 | |

Notes: The parenthesis (.) is the standard error, ***denotes significance at the 1% level, **at 5% and *at 10%.

Table 4: Estimated results of political institution and GDP per capita nexus in Africa.

Table 5 shows our main estimation results of PMG, DFE and MG estimators for economic institutions (leconinstit). The first row reveals that the error correction coefficients are significantly negative across every estimation, indicating the existence of and the convergence to the long run relationship between economic institutions (leconinstit) and GDP per capita (lgdpkit) and economic institutions (leconinstit). The speed of convergence is also slow for the developmental effect of economic institutions in African countries. In Table 5, with PMG estimator, in the long run, leconinstit has a statistically significant negative relationship while it has negative and positive relationship but not significant in MG and DFE, respectively, with lgdpkit. However, in the short run, it has non-statistically significant negative relationship in PMG, MG and DFE. The Hausman test, again, confirms that PMG estimate is the efficient estimator over DFE and MG, which indicates that leconinstit has a significant but negative relationship in the long run with lgdpkit but an insignificant and also, negative relationship in the short run.

| Methods | PMG | MG | DFE |

|---|---|---|---|

| Dependent variable: lgdpk | |||

| Error-correction (coefficient) | -0.12049*** | -0.219105*** | -0.150487*** |

| -0.019 | -0.024 | -0.011 | |

| Long-run coefficient | |||

| Leconinstit | -0.204** | -0.836 | 0.0101 |

| -0.0812 | -1.662 | -0.229 | |

| Lgcfit | 0.469*** | 2.835 | 0.827*** |

| -0.054 | -2.218 | -0.108 | |

| Lpserit | 0.0109 | -0.211 | -0.07 |

| (0 .022) | -0.263 | -0.0696 | |

| Itelit | 0.216*** | 1.049** | 0.3796105*** |

| -0.037 | -0.46 | -0.129 | |

| Short-run coefficient | |||

| Leconinstit | -0.0686 | -0.14259 | -0.00264 |

| -0.08 | -0.122 | -0.0383 | |

| Lgcfit | 0.251146*** | 0.1359635** | 0.2904694*** |

| -0.0825 | -0.063 | (0 .030) | |

| Lpserit | -0.00266 | 0.00908 | -0.00235 |

| -0.003 | -0.017 | -0.011 | |

| Itelit | 0.020002 | -0.158501** | -0.06112 |

| -0.119 | -0.075 | -0.038 | |

| Constant | 0.751109*** | 0.493 | 0.692*** |

| -0.113 | -0.354 | -0.151 | |

| Observations | 2295 | 2295 | 2295 |

| Number of countries | 51 | 51 | 51 |

| Hausman test | MG VS. PMG | MG VS. DFE | |

| Chi square | 6.7 | 0.57 | |

| Prob>chi square | 0.1527 | 0.9662 | |

Notes: The parenthesis (.) is the standard error, ***denotes significance at the 1% level, **at 5% and *at 10%.

Table 5: Estimated result of economic institutions and GDP per capita nexus.

Table 6 is our main estimation results of PMG, DFE and MG estimators for legal institutions. Of major significance, the first row in both Table 6, shows that the error correction coefficients are significant and negative in every estimation, indicating the existence of and the convergence to the longrun relationship between developments proxied by GDP per capita. The speed of adjustment is also slow for the developmental effect of economic institutions in African countries. In the Table 6, PMG estimator reveals that in the long run, (llegalit) has statistically insignificant negative effect while MG estimator reveals that it has a positive effect and significant at 10% but insignificant positive effect on lgdpkit when considering DFE estimator. In the short run, however all estimators such PMG, MG and DFE show that legality has an insignificant positive effect on lgdpkit. The Hausman test, again, confirms that PMG estimate is the efficient estimator over MG and DFE, which indicates that llegal it has an insignificant negative effect in the long-run but positive and insignificant effect on lgdpkit in the short run.

| Methods | PMG | MG | DFE |

|---|---|---|---|

| Dependent variable: lgdpk | |||

| Error-correction (coefficient) | -0.1200849*** | -0.217*** | -0. 152*** |

| -0.019 | -0.0261 | -0.011 | |

| Long-run coefficient | |||

| Llegalinst it | -0.00358 | 1.360* | -0.233 |

| 0.0808 | 0.791 | 0.19 | |

| Lgcf it | 0.514*** | 0.808*** | 0.831*** |

| -0.0579 | -0.199 | -0.107 | |

| Lpser it | 0.031 | -0.0424 | -0.0621 |

| (0 .022) | 0.097 | -0.069 | |

| Itel it | 0.2804207*** | -0.0344 | 0.383*** |

| (0 .034) | 0.55 | -0.123 | |

| Short-run coefficient | |||

| Llegalinst it | 0.05552 | 0.0476 | 0.0394 |

| 0.049 | 0.0647 | 0.0408 | |

| Lgcf it | 0.2321408*** | 0.103* | 0.289*** |

| 0.083 | 0.057 | (0 .030) | |

| Lpser it | -0.00197 | -0.00761 | -0.00306 |

| 0.005 | 0.009 | 0.011 | |

| Itel it | 0.013598 | -0.112 | -0.0624* |

| 0.119 | 0.077 | 0.038 | |

| Constant | 0.640*** | 0.684*** | 0.825*** |

| 0.093 | 0.247 | 0.125 | |

| Observations | 2295 | 2295 | 2295 |

| Number of countries | 51 | 51 | 51 |

| Hausman test | MG VS. PMG | MG VS. DFE | |

| Chi square | 3.61 | 0.55 | |

| Prob >chi square | 0.4615 | 0.968 | |

Notes: The parenthesis (.) is the standard error, ***denotes significance at the 1% level, **at 5% and *at 10%.

Table 6: Estimated result of legal institution and GDP per capita nexus

Finally, the Table 7 presents estimated result of the overall institution (loverallinstit), which is derived by applying Principal Component Analysis (PCA) on the components of all types of institutions (legal, economic and political institution). In our main estimation results of MG, DFE and PMG estimators, of significant interest is also the first row of Table 7, which reveals that the error correction coefficients are negative and significant across all estimations, implying that evidence of convergence and long run relationship between development and overall institutions exists. Table 7 shows the nexus between the loverallinstit and GDP per capita (lgdpkit). The result indicates that in the long run, PMG and MG estimators show that loverallinstit has an insignificant negative effect on lgdpkit but positive and insignificant with DFE estimator. In the short run, however MG and DFE estimators show that loverallinstit has an insignificant negative effect on lgdpkit but positive and insignificant with PMG estimator. The Hausman test, again, confirms that PMG estimate is the efficient estimator and preferred to DFE and MG, and it indicates that loverallinstit has an insignificant negative effect in the long run and insignificant positive effect on lgdpkit in the short run. Also, the Hausman test confirms that PMG estimate is the efficient estimator and preferred to DFE and MG. PMG reveals that loverallinsit has an insignificant negative effect in the long run and insignificant positive effect on lgdpkgrit in the short run.

| Methods | PMG | MG | DFE |

|---|---|---|---|

| Dependent variable: lgdpk | |||

| Error-correction (coefficient) | -0.1192932*** | -0.222*** | -0.151*** |

| -0.019 | -0.027 | -0.011 | |

| Long-run coefficient | |||

| Loverallinstit | -0.0233 | -0.688 | 0.155 |

| -0.0974 | -2.797 | -0.187 | |

| Lgcfit | 0.495*** | 0.768*** | 0.839*** |

| -0.0584 | -0.196 | -0.109 | |

| Lpserit | 0.0515** | -0.102 | -0.0716 |

| (0 .023) | -0.116 | -0.0696 | |

| Ltelit | 0.276*** | 0.860** | 0.390*** |

| (0 .0340) | -0.337 | -0.125 | |

| Short-run coefficient | |||

| Loverallinstit | 0.145 | -0.294 | -0.012 |

| -0.156 | -0.28 | -0.051 | |

| Lgcfit | 0.239*** | 0.127** | 0.289*** |

| -0.083 | -0.062 | (0 .030) | |

| Lpserit | 0.00153 | 0.00586 | -0.00229 |

| -0.008 | -0.0131 | -0.011 | |

| Ltelit | 0.00754 | -0.123* | -0.0621* |

| -0.116 | -0.074 | -0.038 | |

| Constant | 0.641*** | -0.455 | 0.605*** |

| -0.0945 | -1.26 | -0.132 | |

| Observations | 2295 | 2295 | 2295 |

| Number of countries | 51 | 51 | 51 |

| Hausman test | MG VS. PMG | MG VS. DFE | |

| Chi square | 5.41 | 0.31 | |

| Prob>Chi square | 0.2477 | 0.9893 | |

Notes: The parenthesis (.) is the standard error, ***denotes significance at the 1% level, **at 5% and *at 10%.

Table 7: Estimated result of overall institution and GDP per capita nexus.

The study finds insignificant positive relationship between institutional indexes and development in exception of economic institution in the short run, while in the long run, there significant negative relationship for political and economic institutional indexes in relation with development. Legal and overall institutional indexes insignificant negative relationship in the long run. The study discovers that there is a need to improve institutional quality for improving development in the region and this submission is in line with Asghar, Qureshi and Nadeem and that the inconclusiveness in the literature on the developmental impact of the institutions depends largely on the proxy of the institution in the model and this is also supported by Hoed makers.

Conclusion

This study examines the long and short run nexus between institutional quality and development for a 51 African country panel from 1972 to 2020. Through the estimation of the error correction equation of an ARDL dynamic panel, the study found that a significant and positive long run connection exists between institutional quality and development in Africa. The study found evidence in support of Hoed makers and Asghar, Qureshi and Nadeem. The empirical results from this study reveal a weak institutional effect but largely negative in the long run and positive in the short run with exception of economic institution on development in Africa. Also, the coefficients of proxy for institutions are sensitive to the choice of the dependent variable and control variables both, in the short run and long run. The study advocates for a thorough and careful assessment of variables employed in examining institutional quality and development nexus in Africa, thereby aligning with the submission of Hoed makers as each category of institution reveals different interpretation in the region.

REFERENCES

- Acemoglu, D. Introduction to Modern Economic Growth. Department of Economics, Massachusetts Institute of Technology. New Jersey: Princeton a University Press. 2009.

- Acemoglu D, Johnson S, Robinson JA. The colonial origins of comparative development: An empirical investigation. Am Econ Rev. 2001;1(5):1369-401.

- Acemoglu D, Johnson S, Robinson JA. Reversal of Fortune: Geography and Institutions in the making of the modern World Income Distribution. Q J Econ. 2002;117:1231-1294.

- Acemoglu D, Johnson S, Robinson JA. Institutions as a Fundamental Cause of Long-Run Growth. Hand Econ Grow. 2005;1:385–472.

- Aggad K. Democracy and Economic Growth: Empirical Analysis of the Economic Community of West African States. J Econ Manag Strategy. 2014.

- Akobeng E. Growth and institutions: A potential medicine for the poor in sub‐Saharan Africa. Afr Dev Rev. 2016; (1):1-7.

- Alesina A, Perotti R. Income distribution, political instability, and investment. Eur Econ Rev. 1996;40(6):1203-28.

- Alexiou C, Tsaliki P, Osman HR. Institutional quality and economic growth: Empirical evidence from the Sudanese economy. Econ Ann. 2014;59(203): 119-37.

- Ali A, Crain WM. Institutional distortions, economics freedom, and growth. Cato J. 2001; 21:415.

- Asghar N, Qureshi S, Nadeem M. Institutional Quality and Economic Growth: Panel ARDL Analysis for Selected Developing Economies of Asia. JS Asian stud. 2015;30(2):381-403.

- Asongu, S. Growth and Institutions in African Development by Augustin K. Fosu Afr Dev Rev. 2016;18:113-123.

- Bardhan P. Corruption and development: a review of issues. Poli Cor. 2017; 12:321-38.

- Barro RJ. Democracy and Growth. J Econ Growth. 1996;1(1):1–27.

- Barro RJ. Determinants of Economic Growth: A Cross-Country Empirical Study. MIT Press. 1997.

- Barro RJ. Determinants of Democracy. J Polit Econ. 1999;107(2):158- 183.

- Breitung J. Nonparametric tests for unit roots and cointegration. J Econom. 2002;108:343–363.

- Butkiewicz JL, Yanikkaya H. Institutional quality and economic growth: Maintenance of the rule of law or democratic institutions, or both. Econ Model. 2006;23(4):648-61.

- Campos NF. JB Nugent. Development Performance and the Institutions of Governance: Evidence from East Asia and Latin America. World Dev. 1999;27(3):439-452.

- Chisadza C, Bittencourt M. Is Democracy Eluding Sub-Saharan Africa? Department of Economics, University of Pretoria. 2014; 1-25.

Citation: Adefeso HA, Aransi IO (2022) Institutional Quality and Development Nexus in Africa Revisited: ARDL Panel Approach. Global J

Interdiscipl Soc Sci. 11:030.

Copyright: © 2022 Adefeso HA, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License,

which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.