Indexed In

- Open J Gate

- The Global Impact Factor (GIF)

- Open Archive Initiative

- VieSearch

- International Society of Universal Research in Sciences

- China National Knowledge Infrastructure (CNKI)

- CiteFactor

- Scimago

- Ulrich's Periodicals Directory

- Electronic Journals Library

- RefSeek

- Directory of Research Journal Indexing (DRJI)

- Hamdard University

- EBSCO A-Z

- Publons

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Research - (2023) Volume 13, Issue 5

Economic Analysis of Biogas Production from Pineapple Waste as Alternative Source of Energy in a Pineapple Processing Plant, Case of Del Monte Kenya Limited

Edwin Ochieng Otieno1*, Robert Kiplimo1,2 and Urbanus N.Mutwiwa32Department of Marine Engineering and Maritime Operation, Jomo Kenyatta University of Agriculture and Technology, Nairobi, Kenya

3Agricultural and Biosystems Engineering Department, Jomo Kenyatta University of Agriculture and Technology, Nairobi, Kenya

Received: 16-Aug-2023, Manuscript No. IJWR-23-22645; Editor assigned: 18-Aug-2023, Pre QC No. IJWR-23-22645(PQ); Reviewed: 08-Sep-2023, QC No. IJWR-23-22645; Revised: 15-Sep-2023, Manuscript No. IJWR-23-22645(R); Published: 22-Sep-2023, DOI: 10.35248/2252-5211.23.13.551

Abstract

This study assesses the economic feasibility of harnessing biogas derived from pineapple waste as an energy source within the operations of Del Monte Kenya Ltd (DMKL), a prominent exporter of canned pineapple products. DMKL operates on a vast expanse of approximately 10,000 acres dedicated to pineapple cultivation. The company’s processing capacity of 100,000 tons of pineapple yearly produces approximately 23,000 tons of pineapple waste per year. Currently these wastes are sold to local farmers as animal feed at $20 per ton. A study was conducted at Jomo Kenyatta University of Agriculture and Technology (JKUAT) that revealed that a ton of pineapple waste has the potential to generate 7.41 m3/day of biogas. Cost comparative analysis was conducted between employing anaerobic digester to treat pineapple wastes to generate biogas for usage within the plant and selling the waste to locals for feeding the livestock. The results revealed that it is more economical to use wastes to generate biogas as an alternative source of energy in the processing lines. The Net Present Value (NPV) of $1,939,019 Internal Rate of Return (IRR) of 16% and Payback period of 4 years was estimated. The positive value of NPV shows that the project is viable.

Keywords

Biogas; Pineapple waste; Net present value; Internal rate of return; Payback period

Introduction

Rising prices of fossil fuels and risks of global warming have prompted industries to seek renewable sources of energy. In Kenya biomass has contributed 70% to final energy demand and meets energy needs for more than 90% of rural household. The access of electricity in Kenya is still low despite the government’s enthusiastic target to escalate electricity connectivity from the 15% to at least 65% by the year 2022[1]. Kenya depends on imported fossil fuels to meet its energy demands and the country spends nearly half of its yearly foreign exchange on petroleum and oil imports. The government is keen on lowering the cost of production by diversifying the sources of energy as well as identification of the best energy mix. Thus time is ripe to evaluate the full potential of alternative energy sources including biomass. Kenya has the ability to generate electricity from biomass sources originating from agricultural waste such as those from sugar cane (biogas), sisal, timber (sawdust) and meat industries [2].

The main sources of biomass in Kenya consist of wood fuel, charcoal and agricultural waste [3]. An attractive way for treating the agricultural waste is transforming them into biogas technologies. These biogas technologies are capable of reducing the amount of waste, generating clean and renewable energy, reducing emissions of greenhouse gases and improving the living conditions in developing countries.

In Kenya biogas is broadly generated with more than 8000 biogas energy plants using several raw materials such as, household wastes, slaughterhouse waste, agricultural wastes, municipal wastes among others, however the situation is amorphous. In the sense, that there is no solid data on biogas production making it difficult in determining the country’s general capacity [4]. A Kenyan food processing company, Del Monte Kenya Limited, operates in the cultivation, production, and canning of pineapple products [5]. Del Monte’s pineapple plantation is estimated to produces around 2,000 tons of pineapple on a daily basis. Taking into consideration such huge production line, the extent of waste generation is enormous. Thika municipality bore the brunt of environmental pollution from the greenhouse gases emitted by such pineapple wastes. These waste demands proper means of disposal as per the regulation by National Environmental Management Authority, NEMA [6].

The solid waste from the pineapples is normally sold to the local people that use the waste as animal feeds. The remaining waste is heaped to decay where it is later collected and taken to the farm as manure [6].This is not an adequate solution as a great fraction of these wastes still contaminates the environment through foul smell and GHG emissions. Therefore, an assessment is required to establish a sustainable business model out of these wastes to encourage investors to invest and make profits from investment.

The key objective of this study was to determine economic analysis of biogas generation from the pineapple wastes produced from the factory to generate biogas as a substitute source of energy in the plant. This study considered the use of Multi-Criteria Analysis (MCA) in selecting anaerobic digestion technology. MCA is a tool used to make decision when one is faced with numerous alternatives and expectations to solve a problem and is in need of the perfect solution with regard to contrasting and often varying objectives. MCA is based on the assessment of various options according to particular criteria [7]. This consists of a performance matrix where the rows represent the options and the columns the performance of the criteria for each option. Technologies evaluated in this study included; tubular, fixed dome and floating drum. Criteria of evaluation were based on the investment cost, structure, lifespan and sizing.

The techno-economic evaluation was set up on the anaerobic digestion technology selected. In this study, the Net Present Value (NPV), the Internal Rate of Return (IRR) and payback period were evaluated when biogas was considered for direct heating in the factory processing lines.

Material and Methods

Determining the AD technology

Selection of anaerobic technology was based on research reviews and other sources with information regarding small-scale biogas technologies in Kenya. These components were evaluated based on the features of the pineapple wastes generated from Del Monte Kenya Ltd., in order to identify effective digester for treating pineapple wastes. Multi-Criteria Analysis (MCA) was the method used to compare technologies.

Multi-criteria analysis: The MCA is a useful tool when making decision and it is based on the assessment of various options according to particular criteria. It is used to determine the most desired option, giving ranking to the options and determining acceptable and unacceptable possibilities [7].

There are eight steps in development of MCA according to as highlighted below [7]:

1. Establish the decision context. What are the aims of the MCA, and who are the decision makers and other key players?

2. Establish the options.

3. State the objectives and criteria that reflect the value associated with the consequences of each option.

4. Describe the expected performance of each option against the criteria.

5. Assign weights for each of the criteria (weighting) to reflect their relative importance to the decision.

6. Combine the weights and scores for each of the options to derive and overall value.

7. Scrutinize the results.

8. Perform a sensitivity analysis of the results to changes in scores or weights.

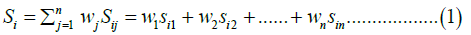

This method consists of a performance matrix where the rows represent the options and the columns the performance of the criteria for each option [7]. Table 1 below illustrates the performance matrix used.

| Criteria | |||||

|---|---|---|---|---|---|

| Criteria 1 | Criteria 2 | Criteria 3 | ……… | Criteria n | |

| Options | W1 | W2 | W3 | ……… | Wn |

| Options 1 | S11 | S12 | S13 | ……… | S1n |

| Options 2 | S21 | S22 | S23 | ……… | S2n |

| Options 3 | S31 | S32 | S33 | ……… | S3n |

| - | - | ||||

| - | - | ||||

| Options i | Si1 | Si2 | Si3 | ……… | Sin |

Note: Where;

Wn: represent the weight of the criterion n

Sin: represent the score of option i corresponding to the criterion n

Table 1: The performance matrix of the Multi-Criteria Analysis (MCA).

For consistency in scoring between the criteria, it is standard to use a scale of range between 0 and 100, where the value 0 is assigned to the lowest performance and 100 to the highest one [7]. When the two extreme values correspond to the values 0 and 100, this generates a linear graph where the vertical axis represents the score and the horizontal axis the value of the option for the criteria. In such away, the scores for the other values can be directly obtained by interpreting the vertical axis of the graph.

Another rating technique is the direct rating. This technique is applied in the case where there is no set scale of measurement or when there is no time or resources for quantifying components concerned. The approach can vary since the evaluation is based on the judgment of the evaluator. Similarly, the scores in this case are also given in the range of 0 to 100 [7].

Several techniques are applicable in obtaining the final results from the MCA. There are simple and complex techniques used in conducting a MCA. They are based on the purpose and objectives of the analysis. The technique applied in this study was the linear additive model where each score given is multiplied for the criterion weight. These values are then summed up to obtain overall weighted scores together for each option [7] as shown in below equation 1.

The various parameters that influence biogas adoption, output, and plant size selection have been established. Substrate availability, income, environmental awareness, and local political governance are among the factors [8].

The aim of the MCA in this study is to identify which of the technologies could suit better the characteristics of the pineapple wastes generated from Del Monte Kenya Ltd. This is helpful in defining the model for the techno-economic analysis. Technologies evaluated in this study included; tubular, fixed dome and floating drum digesters and the criteria evaluated were; investment cost, structure and lifespan.

The investment costs: The investment costs are the initial total costs required to implement the biogas energy plant. The investment costs include the digester, pipes and other structures needed for biogas production. For this study the value of land was not factored in, assuming that the structure could be installed within the existing factory. The variables such as materials, the capacity of the digester and training of the personnel are different for each specific case. For this study, the technologies below are listed from the lowest to the highest investment cost [9]:

1. Tubular digester

2. Fixed dome digester

3. Floating drum digester

Direct rating was used for scoring this criterion. The highest score is given to lowest investment cost technology (Tubular digester) and the lower score to the highest investment cost technology (Floating drum digester). The score of the other technology is obtained by the interpolation of the line graph obtained from the first two.

Structure of biogas: The physical structure of biogas digester should provide a good anaerobic condition inside the digester for the development of the microorganisms [10]. Considering the nature of pineapple waste at Del Monte Kenya and climatic conditions, the digester’s structure should also provide a good insulation system. The weather conditions in Thika and its surrounding are extreme and temperatures fluctuate throughout the year. The average annual highest temperature in Thika is 27.8°C (82.0°F). The average annual lowest temperature in Thika is 12.1°C (53.8°F), and July is the coldest day on average. Therefore, based on this reason, the structure of the digester should be able to keep a constant the temperature inside the digester. This is crucial because temperature affects the level of activity of the microorganisms as well as their growth and thus the biogas production.

Again direct rating technique was applied to give scores in this criterion. The digester with a robust structure that could better adapt to the cold weather of Thika is given the highest score. The other scores are given according to the level of structural strength and sensitivity to low temperatures.

Lifespan of digester: The lifespan of the digester indicates the period (years) available for using the technology before it is necessary to replace it by a new unit. This criterion is important because it is necessary to ensure the heat generation and therefore it is preferred to have a long lifespan to avoid long time disruptions in the heat supply. The lifespan of the technologies is also related to its maintenance. Periodic preventive maintenance is necessary in order to have a good performance for biogas production.

To provide the scores of this performance, the idea of a value function in which the two extreme values correspond to the values 0 and 100 was applied [7].

Plant capacity: The capacity of a biogas energy plant is the maximum total volume of gas and the slurry that it can accommodate. The total volume of the plant is the sum of two components; the digester volume and the gas storage volume. This is measured in m³.

The digester volume is the maximum amount of slurry that the plant can hold, while the gas storage volume is the amount of gas it can hold when full of slurry.

Economic analysis

Preliminary economic study was conducted to evaluate the feasibility of setting up a bio-digester to treat pineapple wastes from DMKL. The Rehau home gas system in JKUAT was fed with pineapple waste co-digested with livestock waste which acted as the inoculants. The aim of the produced biogas is to replace the heavy fuel oils used in the production line. This is to reduce the cost of energy and carbon emissions. Biogas production rate is estimated based on the experiments carried out for economic evaluation as reported on Table 2.

| Parameters | Values |

|---|---|

| Amount of pineapple fruits processed | 108,528 tons/year |

| Amount of pineapple wastes generated annually (23% of pineapple fruits) | 24,961 tons/year |

| Quantity of biogas derived from experiments | 7.41 m³/ton/day |

| Methane content in the biogas | 65.40% |

| Amount of Methane produced | 4.85 m³/ton/day |

| Total amount of methane produced from pineapple wastes | 121,060 m³/year |

Table 2: Estimated biogas production.

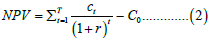

Net Present Value (NPV)

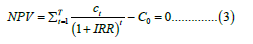

The Net Present Value (NPV) is the method used to determine the viability of the project. This method expresses the difference between the present values of cash inflows and outflows for a given period of time. According to Dominika et al., NPV evaluates the present rate of the total investment cost, taking into consideration the changes in the value of capital for a given period of time [11]. Therefore, with the value of the NPV obtained, one can evaluate the profitability and viability of the project. A positive value of NPV implies that the project is profitable and a negative value shows that it is not. The NPV is calculated from the equation 2 below:

Where;

T=number of time periods [years]

Ct=cash flow in year t [USD]

C0=total initial investment [USD]

r=discount rate [%]

t=time period [year]

According to the Central Bank of Kenya as on 29th September, 2022, the discount rate was 8.25%. This is the discount rate set for this study and the number of periods considered to be 20 years based on technology selected [12].

Internal Rate of Return (IRR)

IRR is a discount rate that makes the Net Present Value (NPV) equal to zero. Thus, the IRR is the case where the present value of the costs and the present value of the benefits are the same [12]. If the value of IRR obtained is higher than the discounted rate, then the investment is profitable and should be carried on whereas, if IRR is lower than discount rate the investment should not be conducted.

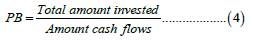

Payback Period (PB)

Payback Period (PB) is the number of years required to recover the initial money invested in the project. The project is more desirable when the payback period is shorter. PB can be calculated by equation 4 below:

Data sources

Experimental data: The fresh pineapple waste (less than one day old) was collected in plastic buckets and transported on the same day by road to the experimental site in Jomo Kenyatta University of Agriculture and Technology. The experimental parameters were optimized using Box Behnken Design (BBD). The optimal content of methane in biogas from the experiments was determined to be 65.4%. Since the biogas produced was aimed at replacing the heavy fuel oils for direct heating, the determination of its calorific value was crucial. The heating value of biogas was obtained to be 23,544 KJ/m³.

According to Shannon, the actual calorific value (KJ/m³) of biogas produced is determined by equation 5 [13];

Where;

Hac=actual calorific value of biogas produced in KJ/m³;

VCH4/Vtot=methane proportion in biogas,%;

CH4,act=actual biogas density (kg/m³); where; biogas density at STP is assumed as O.72 kg/m³.

Thus the,

Hu=calorific value of biogas at standard condition, kJ/ kg (assumed as 50000 kJ/kg or 36000 J/m³)

Data collected from Del Monte Kenya Ltd: Waste generation from the cannery is based on the shift operations. Depending on the demands, 3 shifts of 8 hours each are possible. The tons of pineapple fruits in production vary depending on weather, season or demand by customers. The amount of waste generation depends on the total amount of pineapple fruits processed in a particular shift/day. When all conditions are considered constant, the value of waste generated is equivalent to 23% of the total tons of fruits processed. Using a summary of data for the year 2021, it was determined that the total tons of fruits processed was 108,528 which implies that annual wastes generated was 24,961 tons.

Currently, the factory has been selling these wastes to locals as animal feed at a cost of $20 per ton, generating a net income of approximately $400,000 per year. Part of the wastes are decomposed and used as manure in pineapple farms.

The raw data collected from DMKL revealed that the factory utilizes approximately 4,909,535 Liters of oil annually, based on 2021 data. This oil is bought at approximately $0.662/Litre.

Meaning, annual energy cost on production line;

= 0.662 × 4, 909, 535

= $ 3,250,112.17

Results and Discussion

Anaerobic digestion technology selected

Selection of the AD technology to treat wastes from DMKL was based on the Multi-criteria analysis method described. The various technologies under consideration were the fixed dome, floating drum and flexible tubes digesters. The general characteristics of the pineapple wastes from DMKL were taken into consideration while evaluating these digesters. The chosen technology should be optimum for working at fluctuating temperatures around Thika town and be able to cover all the waste generated from the cannery of DMKL.

Four criteria were selected for the analysis: Investment cost, lifespan, structure and capacity. The scores in this study were given in the range of 0 to 100 which was based on literature and the author's judgement. The lowest performance was given a score of 0 and 100 to the highest one.

This generates a linear graph with the vertical axis representing the score and the horizontal axis the value of the option for the criteria. In this way, the scores for the other values can be directly read from the graph in the vertical axis.

The weighing was done by equally distributing 100 points between the criteria. Each criterion was assigned 25 points of the 100 (i.e. 0.25). The best technology from the MCA results shows that the fixed dome digester scored the highest points and thus the better technology for treating pineapple wastes from DKL. The scores are summarized in Table 3 below.

| Criteria | Investment cost | Structure | Lifespan | Capacity | Total score |

|---|---|---|---|---|---|

| Digester | |||||

| Tubular | 100 | 0 | 0 | 0 | 25 |

| Fixed dome | 66 | 100 | 100 | 100 | 91.5 |

| Floating drum | 0 | 66 | 88 | 100 | 63.5 |

Table 3: Performance matrix of the digester’s MCA.

The facts supporting this selection include the digester’s underground construction that saves space and protects the digesters from temperature fluctuations [14]. Thus the technology will favour the field conditions around DMKL throughout the year. The structure of a fixed dome digester also has minimum obstructions from external activities within the plant.

Based on previous studies, this digester can last more than 20 years, which is a greater lifespan as compared to tubular type and floating drum type of digesters [12,15]. The fixed dome digester’s volume of up to 120 m³ will adequately accommodate pineapple wastes generated on a daily basis.

Economic analysis

Investment costs: The data used for techno-economic analysis in this study were based on technology selected. Therefore, the investment cost represents the total amount of money invested in a fixed dome biogas plant. The lifespan is considered as 20 years which is the average lifetime of this digester as presented by previous studies [12,15].

The cost of land will not be included in the investment cost since there is enough space within the factory for setting up the system. The values used here are taken from different literature sources as well as experts consultations.

The project capital cost for the technology includes equipment purchase, fabrication and installations, labour, insurance, duties and taxes and miscellaneous costs for a total of USD 4,487,055 as detailed in Table 4.

| Description of item | Cost(USD) |

|---|---|

| Main equipment cost(mixing tank, digester, methane reactor, biofilter, burners) | 2,595,000 |

| Bio-gas Plant gas scrubbers filtration, compressor, desulphurizing units storage vessels/cylinders fabrication and civil works etc. | 800,500 |

| Piping, instrumentation and control | 40,000 |

| Equipment installation (Labour) | 1,035,000 |

| Management costs, insurance and other misc. costs | 8,555 |

| Duties and taxes | 8,000 |

| Total project capital cost | 4,487,055 |

Table 4: DMKL proposed biogas plant -project capital costs.

The operational and maintenance costs include wages, salaries, overheads, maintenance and administrative expenses etc. USD 159,141 per annum as detailed in Table 5. The maintenance costs of a biogas plant are assumed to be 2% of the total cost of investment [16].

| Description of item | Cost(USD) |

|---|---|

| Operational Labour (3 persons) | 25,200 |

| Maintenance of plant | 89,741 |

| Administrative expenses | 44,200 |

| Total O and M cost | 159,141 |

Table 5: Annual operational and maintenance (O and M) costs.

Incomes: The incomes will be generated from heat benefits, fertilizers production and carbon credits. It is assumed that the amount of waste to be treated is 23% of the total amount of fresh fruits harvested from the farm to be processed in every production shift. The operational hours of the biogas plant are assumed to be equivalent to canary operational time which is approximately 3069 operational hours yearly.

From the experiments carried, the calorific value of the biogas was obtained as 23,544 KJ/m³ with methane content of 65.4% which is nearly the same with findings of Jena et al. but higher than those of Mukawa et al.[17,18]. Biogas will be utilized for direct heating to replace heavy fuel oils thus will be able to save $3,250,112 used to import oils annually.

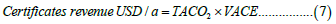

Carbon credits are calculated as avoided emissions of producing heat energy by biogas instead of using fossil fuels. These are presented in form of the possible revenues that can be generated by using renewable sources of energy. According to Salomon et al. calculations of the carbon credit monetary value are obtainable from equations 6 and 7 [19].

Where;

TACO2=Total avoided CO2 in ton CO2eq/year

TGE=Total amount of generated electricity in MWh/year

CIF=Carbon intensity factor in ton CO2eq/MWh

VCAE=Value of the certificates of avoided emissions in USD/ton CO2eq

In this case study, the proposed biogas energy plant for DMKL will utilize pineapple wastes from canary in generating biogas that would replace the current use of heavy fuel oils in the production line. In this study, the proposed biogas energy plant was projected to produce 24,961 tons of pineapple waste input annually. These have the potential of generating 121,060 m³/year of methane as presented in Table 2. The biogas generated had calorific value of 23.5 MJ/m³, and which has been reported that 1 m³ of biogas corresponds to 0.5 litres-0.6 litres of diesel fuel or about 6 kWh [20,21]. This translates to a net income of $161,252 per year from biogas.

The plant will also benefit from the production of bio-fertilizers (digestate) which can be applied back to pineapple plantation or be sold to local farmers. Bio-fertilizer produced from anaerobic digestion has the potential to improve crop production and productivity for sustainable agriculture at a low cost [22]. This technology can produce approximately 1,573 tons of dry biofertilizer per year based on the annual waste generation. Considering the current Kenya market price of $28.5 per 50 kg bag of fertilizer, then a net income of $896,610 per year is obtainable.

The possible income from carbon credit was estimated based on equations 6 and 7 and using the data collected from the factory. The CO2 emission from the burning of oil is 2.52 kg CO2 per litre (which is equivalent to 3.15 kg CO2 per kg, and 0.245 kg per kWh) [23]. According to Wang et al. about $20 can be earned for every avoided ton of CO2 avoided per year [24]. Based on data collected from DMKL an average income of $247,440 can be achieved through carbon offsets.

The NPV, IRR and payback period were evaluated to determine the profitability of the investment. Table 6 shows the results of economic analysis. It shows a positive value of NPV implying that the project is economically visible.

| Present | 1 | 2 | 5 | 10 | 15 | 20 | ||

|---|---|---|---|---|---|---|---|---|

| InvestmentInitial investment cost | ||||||||

| Cash flow | -4,487,055 | - | - | - | - | - | - | |

| Expenses | ||||||||

| Labor cost | -25,200 | -25,200 | -25,200 | -25,200 | -25,200 | -25,200 | ||

| Periodic Maintenance | -89,741 | -89,741 | -89,741 | -89,741 | -89,741 | -89,741 | ||

| Administrative | -44,200 | -44,200 | -44,200 | -44,200 | -44,200 | -44,200 | ||

| Incomes | ||||||||

| Heat benefit | 161,252 | 161,252 | 161,252 | 161,252 | 161,252 | 161,252 | ||

| Biofertilizers benefit | 896,610 | 896,610 | 896,610 | 896,610 | 896,610 | 896,610 | ||

| Carbon credits | 247,440 | 247,440 | 247,440 | 247,440 | 247,440 | 247,440 | ||

| Salvage | - | - | - | - | - | 897,411 | ||

| Total cash flow | 1,146,161 | 1,146,161 | 1,146,161 | 1,146,161 | 1,146,161 | 1,146,161 | ||

| Cumulative cash flow | -4,487,055 | -3,340,894 | -3,340,894 | -3,340,894 | -3,340,894 | -3,340,894 | -3,340,894 | |

| Net Present Value(NPV) | 1939019 | |||||||

| Internal Rate of Return (IRR) | 16% | |||||||

| Payback period (years) | 4 | |||||||

Table 6: Economic results of the study based on NPV model.

Based on the results, positive NPV indicates that setting up the biogas plant at DMKL to treat pineapple waste is feasible. A negative value could imply that the investment should be disregarded. The value obtained shows that the installation of the biogas energy plant is financially viable. This is in agreement with Maher [25]. On the other hand, Internal Rate of Return (IRR) was evaluated as another determinant of profitability. In this evaluation the NPV is greater than zero and the IRR (16%) is greater than the discount rate (8.25%), the realization of the project is profitable to embark on. This implies that the installation of the biogas plant will add value. Therefore, the study concludes that NPV and IRR make this possible regarding the benefits of the project. At this point, the internal rate of return of 16% calculated was said to be the rate at which the NPV was generated. Notably, the rate of return on investment is estimated to be 4 years. In a case where the IRR is less than the discount rate, then the essence of the project is defeated/ destroyed and should not be embarked on. Comparing these results with the current sales of the wastes to the locals as animal feed, the net income of $1,146,161 per year from this investment is much better than the $400,000 per year from sales of wastes.

Conclusion

The organic waste generated from DMKL was estimated to be 24,961 tons per year. The technology selected for treating this amount of pineapple waste was the fixed dome type of digester. This technology better suits the nature of wastes generated in comparison to the other small-scale biogas technologies evaluated when analyzing the investment cost, lifespan, structure and the capacity. The technology selected aided in evaluating the net present value, internal rate of return and payback period. The calculated NPV of $1,939,019 and IRR of 16% proved that the investment is financially feasible. In addition, biogas obtained with calorific value of 23,544 KJ/m3 can replace heavy fuel oils in the production line.

The study revealed that DMKL would benefit from this investment through heat benefits, Biofertilizers and carbon credits. Environmental benefits from the biogas plant would also be realized based on the avoided emissions. This could lead DMKL to be an active contribution for the mitigation of climate change.

References

- Kola W, Sikalieh D. The influence of organizational culture on change management in the energy sector. Population. 2015; 46:050-302.

- Welfle A, Chingaira S, Kassenov A. Decarbonising Kenya's domestic and industry Sectors through bioenergy: An assessment of biomass resource potential and GHG performances. Biomass Bioenergy. 2020; 142:105757.

- Laichena JK, Wafula JC. Biogas technology for rural households in Kenya. OPEC review. 1997; 21(3):223-244.

- KIGO BW. Renewable energy as a catalyst to reduction in carbon emissions and sustainable development in Kenya. 2011

- Fox ML, Liebenthal R, editors. Attacking Africa's poverty: Experience from the ground. World Bank Publications; 2006.

- Ndungu S. A report on conventional pineapple production in Kenya. Prepared for Swedish Society for Nature Conservation (SSNC), Sweden. 2014.

- Dodgson JS, Spackman M, Pearman A, Phillips LD. Multi-criteria analysis: A manual. 2009.

- Yang X, Liu Y, Thrän D, Bezama A, Wang M. Effects of the German Renewable Energy Sources Act and environmental, social and economic factors on biogas plant adoption and agricultural land use change. Energy Sustain. Soc. 2021; 11(1):1-22.

- Kulkarni I, Zang JW, Leandro WM, Parikh P, Adler I, Da Fonseca-Zang WA, et al. Closed-loop biodigesters on small-scale farms in low-and middle-income countries: A review. Water. 2021; 13(19):2744.

- Lam J, Heegde F, Teune B. Domestic biogas compact course. Technology and Mass-Dissemination Experiences from Asia. 2010.

- Ogrodowczyk D, Olejnik TP, Kaźmierczak M, Brzeziński S. Economic analysis for biogas plant working at sugar factory. (2016).

- Wang CB, Zhang LX. Life cycle assessment of carbon emission from a household biogas digester: Implications for policy. Procedia Environ Sci. 2012; 13:778-789.

- Shannon, R. Biogas conference proceedings. 2000.

- Cheng S, Li Z, Mang HP, Neupane K, Wauthelet M, Huba EM. Application of fault tree approach for technical assessment of small-sized biogas systems in Nepal. Appl Energy. 2014; 113:1372-1381.

- Nzila C, Dewulf J, Spanjers H, Tuigong D, Kiriamiti H, Van Langenhove H. Multi criteria sustainability assessment of biogas production in Kenya. Appl Energy. 2012; 93:496-506.

- Behzadi A, Houshfar E, Gholamian E, Ashjaee M, Habibollahzade A. Multi-criteria optimization and comparative performance analysis of a power plant fed by municipal solid waste using a gasifier or digester. Energy Convers Manag. 2018; 171:863-878.

- Jena SP, Mishra S, Acharya SK, Mishra SK. An experimental approach to produce biogas from semi dried banana leaves. Sustain Energy Technol Assess. 2017; 19:173-178.

- Mukawa J, Pająk T, Rzepecki T, Banaś M. Energy potential of biogas from sewage sludge after thermal hydrolysis and digestion. Energies. 2022; 15(14):5255.

- Salomon KR, Lora EE, Rocha MH, Almazán OO, Olmo D. Cost calculations for biogas from vinasse biodigestion and its energy utilization. Sugar industry. 2011; 136(4):217-223.

- Kabeyi MJ, Oludolapo AO. Development of a biogas plant with electricity generation, heating and fertilizer recovery systems. In2nd African International Conference on Industrial Engineering and Operations Management, IEOM Society International 2020 (pp. 5-7).

- Rohstoffe eV FN. Biogas Basisdaten Deutschland–Stand: Oktober 2008. 7p. Very short but comprehensive overview of the biogas situation in Germany.

- Hua, Wei. "Manure application increased crop yields by promoting nitrogen use efficiency in the soils of 40-year soybean-maize rotation." Sci. Rep. 2020; 1-10.

- Grizane T, Jurgelane-Kaldava I. Tourist transportation generated Carbon Dioxide (CO2) emissions in Latvia. Rigas Tehniskas Universitates Zinatniskie Raksti. 2019; 23(3):274-292.

- Wang Y, Corson C. The making of a ‘charismatic’ carbon credit: Clean cookstoves and ‘uncooperative’ women in Western Kenya. Environ Plan A. 2015; 47(10):2064-2079.

- Maher AM. Techno-economic assessment of biogas energy from animal wastes in central areas of Palestine: Bethlehem perspective. Int J Energy App and Tech. 2018; 5(3):119-126.

Citation: Otieno EO, Kiplimo R, Mutwiwa UN (2023) Economic Analysis of Biogas Production from Pineapple Waste as Alternative Source of Energy in a Pineapple Processing Plant, Case of Del Monte Kenya Limited. Int J Waste Resour. 13:551.

Copyright: © 2023 Otieno EO, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.