Indexed In

- Open J Gate

- Genamics JournalSeek

- Academic Keys

- ResearchBible

- Cosmos IF

- Access to Global Online Research in Agriculture (AGORA)

- Electronic Journals Library

- RefSeek

- Directory of Research Journal Indexing (DRJI)

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- Scholarsteer

- SWB online catalog

- Virtual Library of Biology (vifabio)

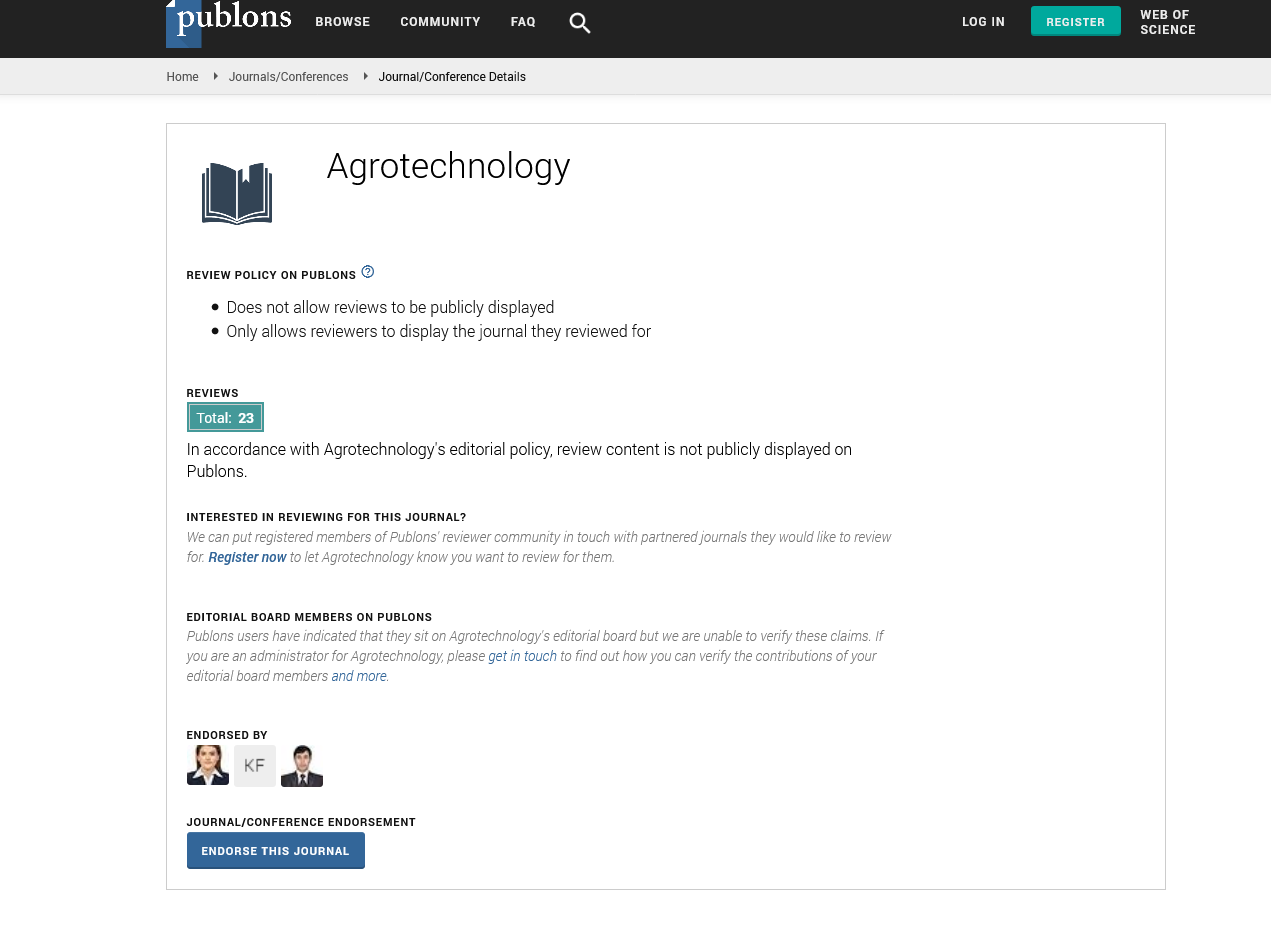

- Publons

- Geneva Foundation for Medical Education and Research

- Euro Pub

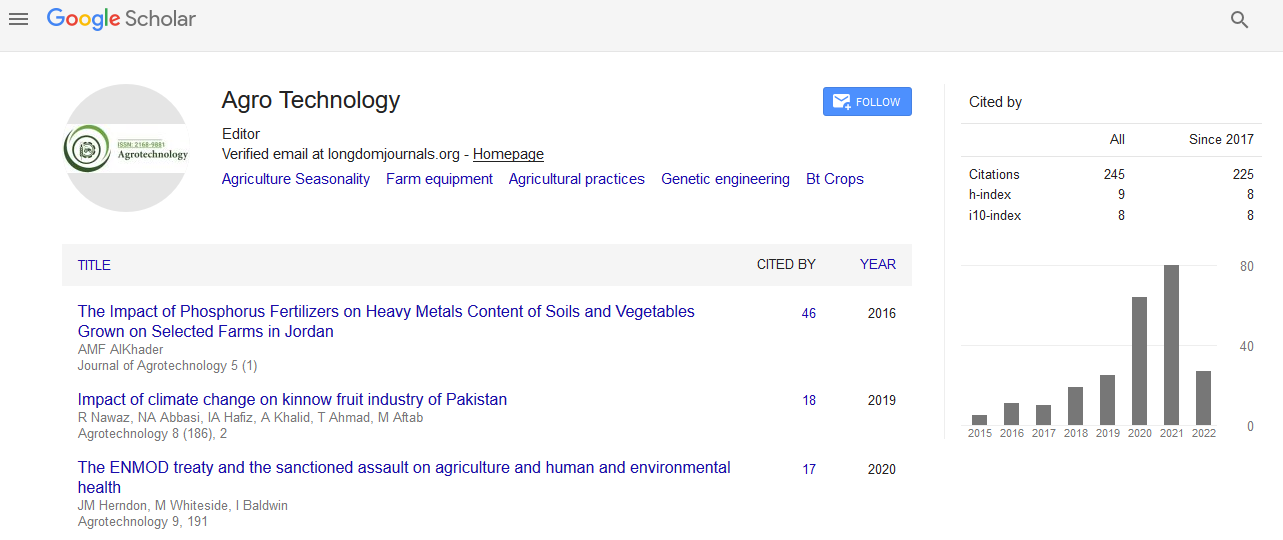

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Abstract

Study on the Volatility Spillover Effect and Nonlinear Dynamic Evolution Mechanism of Economic Policy Uncertainty and Asset Prices-An Analysis of Futures Prices of Oil and Grease Agricultural Products Based on the VAR BEKK-GARCH-VS Model

Xiulian Zhou* and Qiankun Jiang

In this paper, we take the role path of economic policy uncertainty, securities market and futures market and construct VAR-BEKK-GARCH-VS model to explore the volatility spillover effect and nonlinear dynamic evolution of economic policy uncertainty and asset prices, and the empirical analysis results show that the oil and grease futures price and financial market have significant risk spillover effect and asymmetry and usually the oil and grease futures price is the risk transmitter of this volatility spillover; from the static spillover effect, the degree of influence of oil and grease futures price fluctuations on China's agricultural products market is the strongest; in the dynamic spillover effect, the oil and grease futures price under the impact of extreme events has significant time-varying characteristics and asymmetry, and the dependence on the fluctuation of China's futures prices is strong. Based on this, policy makers should adopt policy guidance and market subsidies, improve the futures reserve and insurance system for oil and grease agricultural products, and establish risk monitoring and early warning mechanisms to effectively prevent systemic risks.

Published Date: 2025-05-19; Received Date: 2024-05-29