Indexed In

- Open J Gate

- Genamics JournalSeek

- SafetyLit

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- Publons

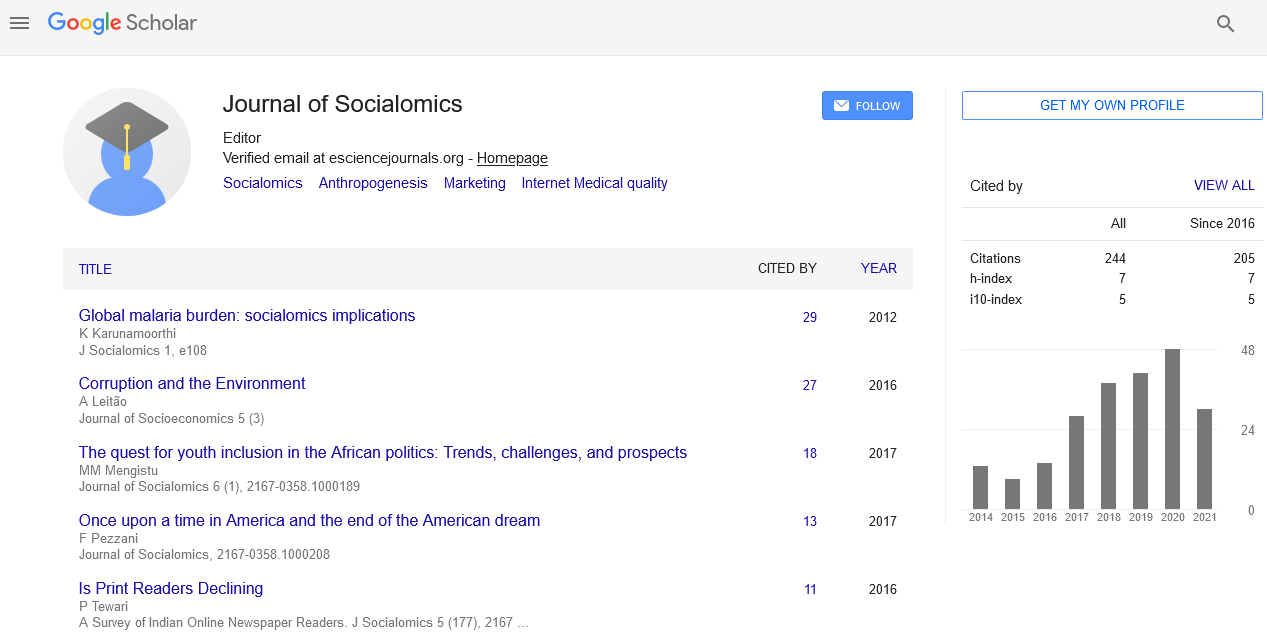

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Short Communication - (2025) Volume 14, Issue 1

The Role of Human Behavior in Economic Decision-Making

Giulia Bocci*Received: 24-Mar-2025, Manuscript No. JSC-25-29180; Editor assigned: 26-Mar-2025, Pre QC No. JSC-25-29180; Reviewed: 12-Mar-2025, QC No. JSC-25-29180; Revised: 19-Mar-2025, Manuscript No. JSC-25-29180; Published: 26-Mar-2025, DOI: 10.35248/2167-0358.25.14.257

Description

Behavioral economics is a field that blends insights from psychology and economics to better understand how people actually make decisions, especially under conditions of uncertainty and limited information. Unlike traditional economic theories that assume humans are perfectly rational agents who always act in their best interest, behavioral economics recognizes that real human behavior often deviates from this ideal due to cognitive biases, emotions, social influences, and heuristics. By studying these deviations, behavioral economics offers a more realistic and nuanced view of decision-making, with profound implications for public policy, business, finance and everyday life.

At its foundation, behavioral economics challenges the classical economic assumption of rationality. Traditional models assume individuals carefully weigh costs and benefits to maximize utility. However, numerous experiments and real-world observations show that people frequently make systematic errors and irrational choices. For example, people often overvalue immediate rewards compared to future benefits, a tendency known as present bias. This explains why many struggle to save for retirement or maintain healthy habits, despite understanding the long-term advantages. Loss aversion is another central principle, highlighting that people tend to feel the pain of losses more acutely than the pleasure of equivalent gains. This asymmetry helps explain behaviors such as reluctance to sell losing stocks or take risks to achieve gains but strong avoidance of potential losses. Loss aversion is closely related to prospect theory in which it highlights the importance of loss. Behavioral loss shows how the people evaluate potential outcomes relative to a reference point rather than in absolute terms. Prospect theory has become foundational in behavioral economics by illustrating that people value gains and losses differently, often leading to inconsistent risk preferences.

Behavioral economics also explores the role of framing effects, where the way information is presented influences decisions. For instance, people are more likely to choose a medical treatment described as having a 90% survival rate rather than one with a 10% mortality rate, even though the facts are identical. Such findings reveal that preferences are often malleable and context-dependent. Social factors play a crucial role in shaping economic behavior as well. People are influenced by fairness, reciprocity, trust, and social norms. Experiments like the ultimatum game demonstrate that individuals are willing to sacrifice personal gain to punish unfair offers, contradicting the purely self-interested rational agent model. Similarly, behavioral economics recognizes the importance of nudges subtle changes in the environment or choice architecture that steer people toward better decisions without restricting freedom. For example, automatically enrolling employees in retirement savings plans significantly increases participation rates, leveraging inertia and default bias.

In business and marketing, behavioral economics informs strategies to influence consumer behavior. Pricing tactics like decoy pricing, bundling, and anchoring take advantage of cognitive biases to boost sales. Marketers craft messages considering framing effects and social proof, understanding that consumers often rely on heuristics rather than detailed analysis when making purchases. Behavioral insights also shape product design, loyalty programs, and customer engagement.

Conclusion

Behavioral economics enriches our understanding of human decision-making by incorporating psychological realism into economic analysis. It reveals how cognitive biases, emotions, social influences, and heuristics shape choices, often leading to deviations from classical rational models. The field has practical applications across policy, business, finance, and everyday life, offering tools to design better interventions, products, and systems that account for actual human behavior. As it matures, behavioral economics will continue to bridge the gap between theory and reality, fostering more effective and humane economic frameworks.

References

- Gruppen LD, Mangrulkar RS, Kolars JC. The promise of competency-based education in the health professions for improving global health. Hum Resour Health. 2012;10:1-7.

[Crossref] [Google Scholar] [PubMed]

- Roediger III HL, Karpicke JD. Test-enhanced learning: Taking memory tests improves long-term retention. Psychol Sci. 2006;17(3):249-55.

[Crossref] [Google Scholar] [PubMed]

- Xu L, Duan P, Padua SA, Li C. The impact of self-regulated learning strategies on academic performance for online learning during COVID-19. Front Psychol. 2022;13:1047680.

[Crossref] [Google Scholar] [PubMed]

- Charokar K, Dulloo P. Self-directed learning theory to practice: A footstep towards the path of being a life-long learne. J Adv Med Educ Prof. 2022;10(3):135.

[Crossref] [Google Scholar] [PubMed]

- Hofer BK. Dimensionality and disciplinary differences in personal epistemology. Contemp Educ Psychol. 2000;25(4):378-405.

[Crossref] [Google Scholar] [PubMed]

- Singh P, Lu Z, Sengupta M. Variation in adult day services center participant characteristics by center ownership: United States. National Center for Health Statistics. 2022.

- Werner RM, Konetzka RT. Trends in post–acute care use among Medicare beneficiaries: 2000 to 2015. Jama. 2018;319(15):1616-1617.

- Azar KM, Shen Z, Romanelli RJ, Lockhart SH, Smits K, Robinson S, et al. Disparities in outcomes among COVID-19 patients in a large health care system in California: Study estimates the COVID-19 infection fatality rate at the US county level. Health Aff. 2020;39(7):1253-1262.

- Bekhet AK, Zauszniewski JA. Chronic conditions in elders in assisted living facilities: Associations with daily functioning, self-assessed health, and depressive symptoms. Arch Psychiatr Nurs. 2014;28(6):399-404.

- Rubano MD, Kieffer EF, Larson E. Infection prevention and control in nursing homes during COVID-19: an environmental scan. Geriatr Nurs. 2022;43:51-57.

Citation: Bocci G (2025). The Role of Human Behavior in Economic Decision-Making. J Socialomics. 14:257.

Copyright: © 2025 Bocci G. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution and reproduction in any medium, provided the original author and source are credited.