Indexed In

- Open J Gate

- Genamics JournalSeek

- SafetyLit

- RefSeek

- Hamdard University

- EBSCO A-Z

- OCLC- WorldCat

- Publons

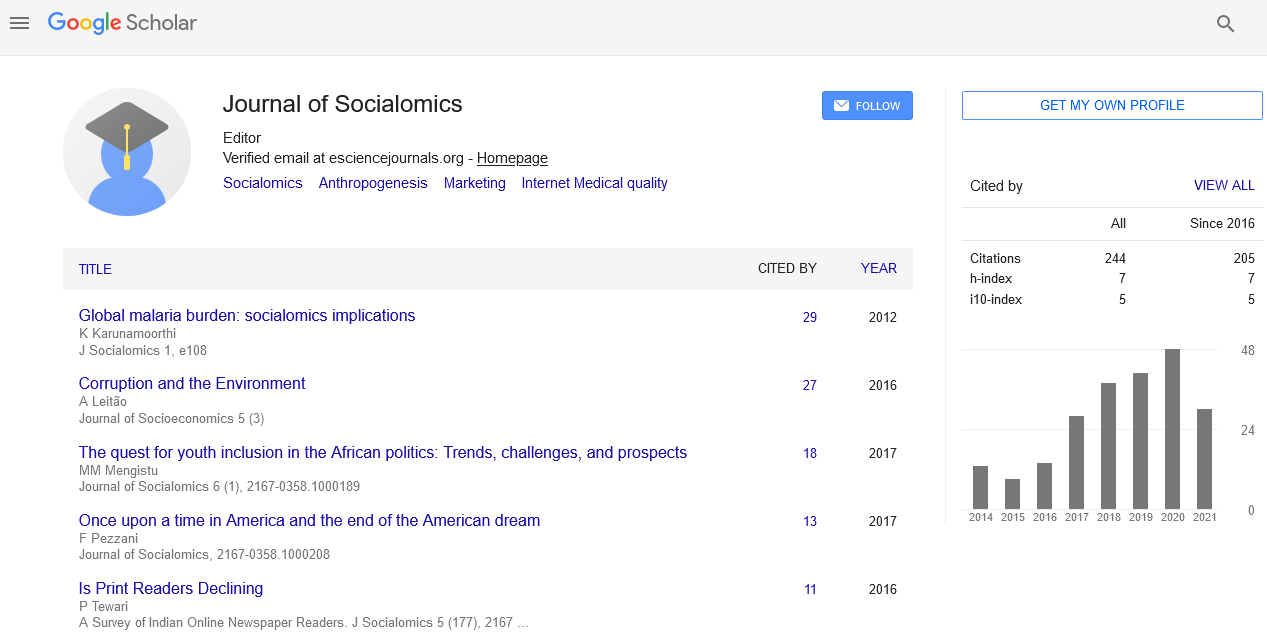

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Perspective - (2024) Volume 13, Issue 1

Strategic Distribution of Indivisible Properties for Maximum Social Welfare

Guicheng Zheng*Received: 01-Jan-2024, Manuscript No. JSC-24-24869; Editor assigned: 04-Jan-2024, Pre QC No. JSC-24-24869 (PQ); Reviewed: 18-Jan-2024, QC No. JSC-24-24869; Revised: 25-Jan-2024, Manuscript No. JSC-24-24869 (R); Published: 01-Feb-2024, DOI: 10.35248/2167-0358.24.13.220

Description

The distribution of indivisible goods poses a challenging problem in various domains, such as resource distribution, auction design, and even in the context of fair division. In recent years, there has been a growing interest in optimizing social welfare in such allocations, with the Nash product emerging as a powerful tool for achieving efficient outcomes. In this article, we will explore the concept of maximizing Nash product social welfare in the allocation of indivisible goods and its implications on achieving fair and equitable distributions. The Nash product, named after the Nobel laureate John Nash, is a mathematical concept often used in game theory to analyze and predict the outcomes of strategic interactions among multiple players. In the context of allocating indivisible goods, the Nash product serves as a measure of the joint benefit that a group of individuals can achieve through a given allocation. It takes into account the utility or satisfaction of each individual and multiplies these values together, emphasizing the collaborative aspect of the allocation. Distributing indivisible goods is a complex problem, especially when the goods cannot be divided among the participants. Traditional allocation mechanisms, such as auctions or negotiations, may not always lead to socially optimal outcomes. The challenge lies in devising a method that maximizes the overall satisfaction or welfare of the group while respecting individual preferences and constraints.

Maximizing product social welfare

To maximize the Nash product social welfare in allocating indivisible goods, it is essential to consider the preferences and valuations of each participant. One approach involves designing mechanisms that encourage truthful revelation of preferences, as integrity is essential for achieving efficient allocations. Mechanism design, a field at the intersection of economics and computer science, provides tools and frameworks for creating incentivecompatible mechanisms that lead to truthful reporting. The Vickrey Clarke Groves mechanism incentivizes participants to truthfully report their valuations for the goods, as the outcome is determined based on these reports. By using payment schemes that align with individual valuations, the VCG mechanism ensures that participants have no incentive to misrepresent their preferences, ultimately leading to a socially optimal outcome.

Implications for fairness and equity

Maximizing Nash product social welfare in allocating indivisible goods has significant implications for fairness and equity. The Nash product inherently considers the joint welfare of all participants, emphasizing cooperation and collaboration. In contrast to other allocation methods that may focus solely on individual maximization, the Nash product encourages participants to consider the overall well-being of the group. Moreover, by employing mechanisms like VCG that promote truthfulness, the allocation process becomes more transparent and fair. Participants are not only motivated to be truthful but can also trust that the mechanism will prioritize the collective welfare. This can help address concerns about potential manipulations or strategic behavior that might arise in the absence of well-designed mechanisms.

Real-world applications

The concept of maximizing Nash product social welfare finds applications in various real-world scenarios. For example, in the allocation of public resources, such as radio frequencies or airport slots, optimizing social welfare is crucial for the efficient use of these limited resources. Similarly, in the context of fair division of estates or assets during inheritance, maximizing Nash product social welfare can lead to outcomes that are perceived as more equitable by the involved parties. Furthermore, in the age of digital platforms and online marketplaces, where indivisible goods are often virtual assets or digital services, the principles of maximizing Nash product social welfare can guide the development of algorithms for fair and efficient resource allocation.

While maximizing Nash product social welfare provides a potential framework for indivisible goods allocation, challenges remain. The computational complexity of designing mechanisms that optimize the Nash product is a significant hurdle, particularly as the number of participants and goods increases. Researchers are actively exploring ways to address these computational challenges and develop scalable solutions for realworld applications. Additionally, the incorporation of considerations such as privacy concerns, dynamic preferences, and diverse valuations further complicates the allocation problem. Future study may focus on extending the current frameworks to accommodate these complexities and develop mechanisms that are strong and adaptable to a wide range of scenarios. Maximizing Nash product social welfare in allocating indivisible goods represents a powerful and principled approach to achieving efficient and equitable outcomes. By leveraging concepts from game theory and mechanism design, researchers and practitioners can design allocation mechanisms that encourage truthfulness and prioritize the collective welfare of participants. As we continue to face challenges in allocating limited resources and goods, the principles of maximizing Nash product social welfare offer a potential avenue for creating fair and optimal solutions in diverse fields.

Citation: Zheng G (2024) Strategic Distribution of Indivisible Properties for Maximum Social Welfare. J Socialomics. 13:220.

Copyright: © 2024 Zheng G. This is an open access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.