Indexed In

- Open J Gate

- RefSeek

- Hamdard University

- EBSCO A-Z

- Scholarsteer

- Publons

- Euro Pub

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Research Article - (2023) Volume 11, Issue 3

Inflation in Somalia Causes and Consequences

Abdirahman Jimale Adan*, Abdiaziz Ahmed Ibrahim and Jamaal Mohamud HusseinReceived: 20-Jan-2023, Manuscript No. IJAR-23-19632 ; Editor assigned: 23-Jan-2023, Pre QC No. IJAR-23-19632 (PQ); Reviewed: 06-Feb-2023, QC No. IJAR-23-19632 ; Revised: 07-Mar-2023, Manuscript No. IJAR-23-19632 (R); Published: 14-Mar-2023, DOI: 10.35248/2472-114X.23.11.332

Abstract

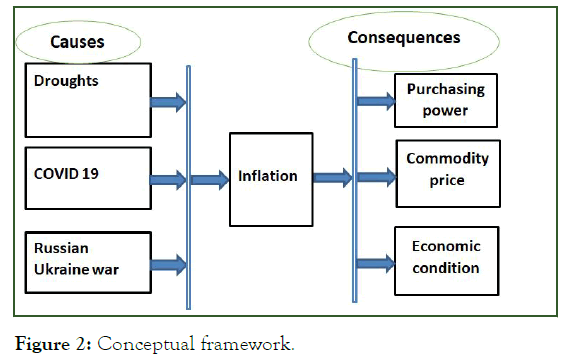

The first purpose of this research is to examine factors that cause inflation in Somalia in 2022. The causes include droughts in the country, COVID-19 and Russian Ukraine war. The second purpose is to analyze the effect of inflation on households’ standard of living. In order to assess the causes and consequences of inflation on Somali economy, the researcher adopted an analytical descriptive approach. To collect primary data questionnaire is conducted with different groups of people (e.g. merchants, household, and bankers). The research reveals that droughts in the country, COVID-19 and Russian Ukraine war contributed to the increase of inflation in Somalia, and also concluded that inflation has a negative impact on many aspects of Somali economy the most important of which is its impact on purchasing power, commodity price and economic condition of the households and hampering the business activity of Somali people by creating uncertainty among savers and investors. The researcher recommended that the government should work hardly to prevent stop the continuous rise of rates of inflation in Somalia by introducing economic policies that aim at increasing the productivity, inducing public saving, as well as providing the necessary basic needs to those affected by droughts.

Keywords

Inflation; Power purchasing; Commodity price; Economic conditions; COVID-19

Introduction

Inflation is one of the most important macroeconomic variables and the most feared by the economic actors, including the government, because it can bring bad influence on the structure of production costs and the level of welfare. And the wider effects such as instability, economic growth, the declining of competitiveness, the interest rate, uneven income distribution and unemployment is increasing. Some of the countries that have experienced hyperinflation showed that poor inflation would lead to social and political instability, and did not create the economic growth [1].

In Somalia, the inflation rate measures a broad rise or fall in prices that consumers pay for a standard basket of goods. The most important categories in the Somali consumer price index are food and non-alcoholic beverages (46% of the total weight) and housing, water, electricity and gas (23%), followed by clothing and footwear (5%), health (5%), transport (4%), furnishing, households and maintenance (3%), communication (3%), tobacco and narcotics (1%), and recreation and culture (1%) [2].

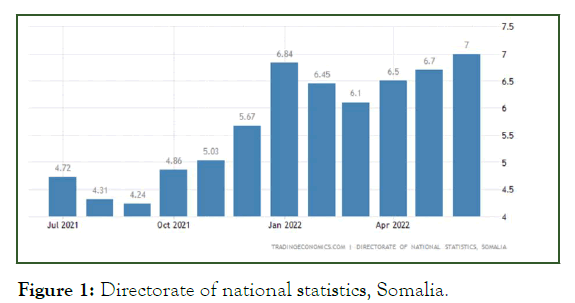

The annual inflation rate in Somalia rose to 6.98% in June of 2022, from 6.67% in the previous month. It was the highest inflation rate since December 2005, amid acceleration in prices of food and non-alcoholic beverages (16.86% vs. 14.74%) in May. Meanwhile inflation eased for transport (1.03% vs. 1.35%); and housing and utilities (1.34% vs. 3.81%). On a monthly basis, consumer prices fell by 0.06% after declining 1.47% in the preceding month (Figure 1).

Figure 1: Directorate of national statistics, Somalia.

The COVID-19 pandemic has highlighted the interrelationships between disease emergence and spread, different actors and segments of the agrifood system, and the multifaceted effects of the crisis [3]. These complexities require policy responses grounded in solid evidence and supported by systemic research. Increased constraints on fiscal resources-in part a consequence of the continuing crisis-demand that such policies be informed, smart, and effective, contributing to agrifood system resilience and protecting the most vulnerable. Responses must be coordinated, linking health, environmental, social, and financial objectives, and their implementation should minimize unintended harms. In addition to emergency response measures such as income support programs, policies focused on the most vulnerable groups must target their basic needs, including sanitation and nutrition, to improve their ability to cope [4].

Since the rates of inflation is very high but its causes and consequences are not defined. For that reason, this study will investigate the challenge facing household livelihood, factors which caused the inflations and gab which needs to be solved in the study [5].

Objectives of the study

This article investigates two main objectives, the main factors contribute to the inflation in Somalia and the effect of inflation on Somali economy [6].

The specific objectives of this study are to,

• Estimate how droughts effected the inflation in Somalia during 2022.

• Evaluate how COVID-19 effected the inflation in Somalia during 2022.

• Analyze how Russian Ukraine war effected the inflation in Somalia during 2022.

• Analyze the effect of inflation on purchasing power. In Somalia 2022.

• Know the effect of inflation on commodity price in Somalia 2022.

• Find out the effect of inflation on economic condition in Somalia 2022.

• Conceptual framework (Figure 2).

Figure 2: Conceptual framework.

Materials and Methods

Articles review

This paper analyzes the macroeconomic effects of the COVID-19 epidemic on Euro Area (EA) GDP and inflation, using a stylized New Keynesian model. COVID-19 is interpreted as a combination of aggregate demand and aggregate supply disturbances. Offsetting aggregate demand and supply changes are shown to account for the stability of EA inflation, in the face of COVID-19. The evidence presented here indicates that COVID-19 induced aggregate demand and supply shifts were persistent [7]. An aggregate supply contraction is identified as the dominant force driving the sharp fall of EA GDP in 2020.

This paper analyzes the evolution and drivers of inflation during the pandemic and the likely trajectory of inflation in the near term using an event study of inflation around global recessions and a Factor Augmented Vector Auto Regression (FAVAR) model. The paper report three main results. First, the decline in global inflation during the 2020 global recession was the most muted and shortest-lived of any of the five global recessions over the past 50 years and the increase in inflation since May 2020 has been the fastest. Second, the decline in global inflation from January-May 2020 was four-fifths driven by the collapse in global demand and another one-fifth driven by plunging oil prices, with some offsetting inflationary pressures from supply disruptions. The subsequent surge in inflation has been mostly driven by a sharp increase in global demand [8]. Third, both model based forecasts and current inflation expectations point to an increase in inflation for 2021 of just over 1 percentage point. For virtually all advanced economies and one-half of inflation targeting Emerging Market and Developing Economies (EMDEs), an increase of this magnitude would leave inflation within target ranges. If the increase is temporary and inflation expectations remain well anchored, it may not warrant a monetary policy response. If, however, inflation expectations risk becoming unanchored, EMDE central banks may be compelled to tighten monetary policy before the recovery is fully entrenched.

This paper gives a comprehensive assessment of drought economic impacts provides critical information to rational decisions supporting drought mitigation policies and programs. The objective of this paper is to increase the understanding of the full scope of drought economic impacts and the associated quantitative assessment methodologies. To accomplish this, the paper reviews the literature of drought economic impact studies in both agricultural and non-agricultural sectors, summarizes the methods and data employed, compares the various results, and investigates the problems and limitations of previous studies. The paper concludes with a discussion of the challenges and directions of future improvement on drought economic impact assessment.

The motivation of the study was to understand the severity of drought on agriculture as well the impact on the whole economy (to quantify the economy wide effects/losses emanating from the drought). To quantify these effects a single country Computable General Equilibrium (CGE) model was used. Four scenarios were developed: Impact of field crops losses; impact of livestock losses; impact of aggregated agriculture losses; and impact of aggregated agriculture losses plus drought relief. The analysis shows that all scenarios led to a negative impact on GDP, employment and exports while the drought relief was found to have saved some jobs, albeit not significantly.

This study was carried out using secondary data to review food price crisis and food insecurity in Kenya. Food prices have been increasing in Kenya since 2006 to date. Prices of staple foods such as maize, wheat and milk among others have been rising progressively diminishing access to food for the poorer sections of the population leading to food insecurity in many households.

Underlying causes of food price crisis and food insecurity include both demand side and supply side factors. Demand side factors include: Rapid population growth, rapid urbanization, low income, poverty and increasing demand for food products for biofuel production in developed nations. Supply side factors include: Declining agricultural productivity, high input prices, and decline in world food stocks, underinvestment in rural infrastructure, climate change and climate variability, underinvestment in agriculture, poor markets and market access by small holder farmers.

The impacts of food price crisis manifest as high food prices, political instability, food insecurity, increasing poverty, and declining agricultural productivity. Both short term and long term policies have been enacted by the government and other stakeholders to address the problem. Short term coping strategies include provisions of emergency food assistance by the government and donors, adoption of food policy nets (food subsidies, cash transfers, food for work and school feeding programs), adjustment of trade and tax measures, enhancement of agricultural production by providing agricultural input subsidies and administered prices for producers. Long term policy measures include investment in agricultural research and extension, investment in rural infrastructure (irrigation, marketing infrastructure etc.), investment in financial services and agro-processing. The study concluded that food price crisis and food insecurity are a reality in Kenya and necessary interventions are required to deal with it Emongor, et al.

This article shows that both the Russian war in Ukraine and the subsequent trade restrictions have become a powerful trigger, significantly increasing the level of inflation and exacerbating the existing issues of economies. As a result, the confrontation between the West and Russia has greatly escalated, which will have a long term, large scale negative impact on most European companies and economies. There could also be a lasting restructuring of world trade. The article notes that not only the end date of the war in Ukraine may be important for business and economies, but also which of the trade and financial restrictions can be lifted from Russia, and when. The article also makes recommendations that may help company leaders plan, in a timelier and more accurate fashion, the changes necessary to maintain company sustainability.

This study has the objective to analyze the effect that occurs between Indonesian Bank (BI) rate, foreign exchange rates, money supply, oil price and gold prices on Inflation, its impact on Human Development Index (HDI) and poverty in Indonesia for the period 1997 up to 2016.

This study used secondary data with purposive sampling method. Methods of data analysis using multiple regression analysis, model 1: Results of this study indicate that there are significant variables simultaneously at BI rate, foreign exchange rates, money supply, oil price and gold prices to the level of inflation in Indonesia.

The results also showed variable BI rate, money supply, and oil price and gold prices partial effect on the level of inflation positively and significantly, while the exchange rate variable does not affect the rate of inflation.

The results determinant coefficient of 0.9497means the ability of independent variables to explain the dependent variable of 94.97%, while the remaining 5,03% is influenced by other variables and are not included in this study. Model 2: Inflation on HDI is significant and positive and model 3: Inflation on poverty is significant and positive.

Research methodology

The researcher adopted an analytical descriptive approach for the second objective; and depicted regression models for the first objective. Primary data was used through questionnaire conducted with different groups of people (e.g. merchants, household, and bankers, teachers, etc).

The target population of the study will be 120 as case study resident in Mogadishu, Somalia without concerning their position, experience, education and gender etc.

Results and Discussion

Findings of research objective one

For the effectiveness of this study, both descriptive and analytical techniques were employed. For the analysis of the time series data, certain statistical techniques were employed. This includes multiple regression analysis of a single equation model based on method of Ordinary Least Squares (OLS) (Table 1).

Model summary

| R | Change statistics | |||||

|---|---|---|---|---|---|---|

| R square change | F change | df1 | df2 | Sig. F change | Durbin-Watson | |

| 1 | 0.081 | 54.855 | 3 | 119 | 0 | 1.102 |

| a. Predictors: (Constant), droughts, COVID 19, Russian Ukraine war. b. Dependent variable: Inflation |

||||||

Table 1: Shows the model summary.

As shown in the previous slide, the coefficient of determination R-squared (R2) is 0.801. This result implies that on the average about 80.1% of variations in inflation in Somalia within the period under review is systematically explained by changes in these explanatory variables. Thus, about 19.9% variations in inflation in Somalia remain unexplained by these explanatory variables. The unexplained variations are attributed to other external factors not included in the model.

The Durbin-Watson (DW) value of 1.102 suggests that there is no presence of autocorrelation. The null hypothesis of this study is stated that the model is not significant (Table 2). The decision rule follows that if the computed F-value is greater than the tabulated F-value, we reject the null hypothesis, otherwise accept. Since our computed F-statistics (54.855 is greater than the F-tabulated value (2.96) at 5% levels, therefore, we reject the null hypothesis. Thus, we conclude that the model is statistically significant and reliable.

| Model | Standardized coefficients | T | Sig. |

|---|---|---|---|

| Beta | |||

| (Constant) | 9.843 | 0 | |

| Droughts | 0.542 | 6.387 | 0 |

| COVID-19 | 0.222 | 2.403 | 0.021 |

| Russian-Ukraine war | 0.359 | 3.363 | 0.002 |

Table 2: Regression analyze.

Table summarized those results obtained from regression analysis and it revealed that, droughts, COVID-19 and Russian- Ukraine war have positive and significant relationship on inflation in Somalia.

However, the t-statistics value when compared with the tabulated t-value at 5%, shows that the coefficients of droughts, COVID-19 and Russian-Ukraine was significant in explaining upward variations in the inflation (Tables 3-5).

Findings of research question two

| No. variables | Mean | Interpretation |

| Power of purchasing | ||

| Power of purchasing differentiates among the income of household | 3.33 | Very high |

| Power purchasing of household depends on the currency fluctuation in the market | 3.14 | High |

| Power purchasing indicates the consumption growth and of household | 3 | High |

| Purchasing power should be possible to purchase the same basket of goods and services anywhere in the Mogadishu | 2.85 | High |

| Grand mean | 3.08 | High |

Results indicate that the extent of differentiates among the income of household is generally high and this is indicated by the overall mean (overall mean=3.08), this implies differentiates among the income of household in Somalia.

Table 3: Power purchasing.

| No. commodity price | Mean | Interpretation |

| Commodities price in the market are important to the household s’ economy | 3.24 | Very high |

| As the world becomes increasingly connected by technology, the international commodities market is also growing in volume and value | 3.17 | Very high |

| Exchange rate movements as a tool for predicting commodity price movements and utilize the house hold | 2.93 | High |

| When market participants foresee a commodity price shock, their expectations will be priced Into the current exchange rate, because of its anticipated impact on future exchange rate values | 2.97 | High |

| Grand mean | 3.08 | High |

Results indicate that the extent of commodity price in the market is important to the household s’ economy and generally high, this is indicated by the overall mean (overall mean=3.24), this implies importance of household s’ economy in Somalia.

Table 4: Commodity price.

| No. economic condition | Mean | Interpretation |

| A good economic condition of house hold improves the style of household | 3.38 | Very high |

| A good economic condition of household increases social cultures decreases unemployment rate | 2.85 | High |

| A good economic condition shows on political stability in the county and helps the household | 2.85 | High |

| Lack of well economic conditions cause instability, unemployment and anarchy | 3.21 | Very high |

| Grand mean | 3.09 | High |

Results indicate that the extent of a good economic condition of house hold improves the style of household and generally high, this is indicated by the overall mean (overall mean=3.24), this implies importance of a good economic condition of house hold improves the style of household in Somalia.

Table 5: Economic condition.

Conclusion

This study investigated the causes of inflation and its influence of household livelihood in Somalia.

The results obtained in this study showed that droughts, COVID-19 and Russian Ukraine war were most factors contributed to the increase the level of inflation in Somalia, and also concluded that inflation has a negative impact on many aspects of Somali economy, which means an increase in the inflation results in a decrease in power of purchasing and high price of commodity and violation the economic condition of households.

Recommendations

The researcher recommended that the government should work hardly to prevent and stop the continuous rise of rates of inflation in Somalia by introducing economic policies that aim at increasing the productivity, inducing public saving, as well as providing the necessary basic needs to those affected by droughts.

References

- Franses PH, Janssens E. Inflation in Africa, 1960-2015. J Int Financial Mark Inst Money. 2018;57:261-292.

- Kurtulus EN. Exploring the paradoxical consequences of state collapse: The cases of Somalia 1991-2006 and Lebanon 1975-82. Third World Q. 2012;33(7):1285-1303.

- Kollmann R. Effects of COVID-19 on Euro area GDP and inflation: Demand vs. supply disturbances. Int Econ Econ Policy. 2021;18:475-492.

- Rose AK, Spiegel MM. Cross-country causes and consequences of the 2008 crisis: Early warning. Jpn World Econ. 2012;24(1):1-6.

- Ntombela S, Nyhodo B, Ngqangweni S, Phahlane H, Lubinga M. Economy-wide effects of drought on South African agriculture: A Computable General Equilibrium (CGE) analysis. J Dev Agric Econ. 2017;9(3):46-56.

- Daar OB, Gele AA. Tuberculosis in a weak health system, conflict and fragile zone: The monetary value of human lives lost associated with deaths of persons older than 14 years in Somalia. Int J Health Plann Manage. 2023;38(1):53-68.

[Crossref] [Google Scholar] [PubMed]

- Mubarak JA. The “hidden hand” behind the resilience of the stateless economy of Somalia. World Dev. 1997;25(12):2027-2041.

- Yolanda Y. Analysis of factors affecting inflation and its impact on human development index and poverty in Indonesia. Eur Res Stud. 2017;20(4B):38-56.

Citation: Adan AJ, Ibrahim AA, Hussein JM (2023) Inflation in Somalia Causes and Consequences. Int J Account Res. 11:332.

Copyright: © 2023 Adan AJ, et al. This is an open access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.