Indexed In

- Open J Gate

- RefSeek

- Hamdard University

- EBSCO A-Z

- Scholarsteer

- Publons

- Euro Pub

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Research Article - (2021) Volume 9, Issue 10

IMPACT OF CORPORATE SOCIAL RESPONSIBILITY ON FINANCIAL PERFORMANCE OF SELECTED LISTED OIL AND GAS FIRMS IN NIGERIA

KFA Ibrahim1* and ADEMU, Sylvester Onyekachi22Department of Accounting, University of Abuja, Nigeria

Received: 23-Jan-2021 Published: 22-Jul-2021

Abstract

This study investigated the impact of corporate social responsibility (CSR) on financial performance of selected listed oil and gas firms in Nigeria. Ex post facto research design was adopted. The sample size of seven (7) oil and gas firms was derived from the population of the listed twelve (12) oil and gas companies in Nigeria. Judgmental approach was employed during the sampling process. The study used secondary data sourced from the annual reports of the listed oil and gas firms in Nigeria Stock Exchange fact books of official lists covering a ten-year period (2010-2019). The study employed Multiple Regression Model as the technique of data analysis with the aid of STATA 13.0 statistical software. Analysis of findings revealed that CSR charitable donation expenditure significantly affects financial performance of oil and gas firms in Nigeria. It was discovered that CSR expenditure on education has significant impact on financial performance of oil and gas firms in Nigeria. The study also revealed that there is significant relationship between CSR societal expenditure and financial performance of oil and gas firms in Nigeria. However, CSR health expenditure does not significantly affect the financial performance of oil and gas firms. CSR environmental expenditure shows significant impact on financial performance of oil and gas firms in Nigeria. The study also reveals that there is significant relationship between CSR sports expenditure and financial performance of oil and gas firms in Nigeria. In line with the findings, the study recommends that the oil and gas firms should boost their CSR charitable donation and CSR on health expenditures and monitor them closely since they reveal negative impact. The study also recommends that CSR expenditure on education, CSR societal expenditure, CSR environmental and CSR sport expenditures should be upheld and sustained since they reveal significant positive impact on financial performance of oil and gas firms in Nigeria.

Keywords

Corporate Social Responsibility, Financial Performance and listed Oil and Gas Firms

Introduction

Oil and natural gas firms are major industries in the energy market and play an influential role in the global economy as the world's primary fuel sources. The industry is often divided into three segments: upstream, the business of oil and gas exploration and production which must take place in an environment and affect it positively and/or negatively; midstream, transportation; storage; and downstream, which includes refining and marketing of oil and gas [1]. The major aims of these activities are profit and wealth maximization, but this will be wrong if only shareholders are considered without the environments and other stakeholders.

The question is, should a firm use its resources to provide for the community what the elected government should primarily do? There are two divergent views on this. One view is that governments should be held responsible for the provision of amenities to their communities since the primary function of a responsible government is to do just that [2,3]. Another view is that a company cannot turn blind eyes to those bottle necks within surroundings she functions, and failure to address those issues might even lead to a possible collapse of the company. They also hold that the reputation of a socially responsible company will draw as well as maintain workers, leading to minimized labour in and out going, increased productivity as well as ultimately, better financial performance [2,3].

Insomuch this generation’s social and economic surroundings matters relating to communal obligation alongside maintenance are thriving significantly, most peculiarly in this economic world, economic missions and objectives seem more than close to individuals with surroundings from the societies and environs where their economic operations are carried out. Since period within one year profit is achievable, inability in furnishing business transaction reports with regards to the period above one year as far as human and surroundings endanger perpetuity, firms should be responsibility [4].

Companies therefore differ in their approaches to CSR. A company may choose to provide social infrastructure such as community hospital, schools, pipe-borne water, and scholarship to locals, pollution control or environmental remediation. Others only believe in provision of excellent working environment for their employees, production of good products, work safety etc. All these involve additional expenditure to the various companies that want to be socially responsible [2,3].

Presently, every commodity has a close substitute in most of the transactional meeting points and shops. Pursuant to this, clients are impliedly regarded as monarchs, rulers and dictators in the economy. Because businesses in this generation have experienced lots of rivalry, the subsistent triumphs of business corporations today depend on their corporate social responsibility performances [5]. To be active with business location rivalry, establishments presently embrace CSR so they can achieve economic benefit, in addition to increased success [6,7].

Statement of the problem

Three schools of thought emerged as a result of investigating impact of CSR on company’s financial performance: the first school of thought opined that CSR has positive result on company’s financial success [8-13] and counselled investment on the CSR activities as a result of CSR improves the worth of corporations. The second set opined that CSR has negative result on firm’s financial performance [14]. Whereas the results of the third cluster is neutral and inconclusive [15-18].

Samira et al. opined that CSR has become a tool utilized in the hand of commercial establishments to escape compulsory levy on the ground of disbursing lower to levy as tariff is free of CSR activities organization derive pleasure [19]. Several opponents as stated by Carpenter et al. (2010) and cited in Osemene did opine that CSR by its modus operandi by certain companies is ordinary insincere cover up [20]. Majority just trust that CSR struggles are just ordinary politics by corporations to drive corporation products. Several Nigerians are blind to CSR; thus, whenever a company does one thing “purportedly large” for public sake, such a corporation and their administration are hailed for being helpful and charitable [20].

One different issue is, what variable(s) ought to really be a usually accepted proxy for company social responsibility of oil and gas firms?. In line with Wang et al. as cited in Lyubenova [21,22]. ‘exercising CSR activities is not an unvaried method adopted in a very uniform manner by all firms, since the incentives, motivations and methods among firms might dissent considerably.

A lot of studies relating to CSR with the resultant influence on firms’ financial boost was conducted at several other sectors including corporations, however only a few has been conducted on listed oil and gas sector particularly in Nigeria. And this very vital sector needs such much attention [1].

Another area that needs improvement and filling of gap in the literature is the aggregated method and technique that many research students and scholars used for CSR. It is academically necessary to use disaggregated technique in order to classify the dimensions of CSR as demonstrated by Iqbal et al. ; Malik and Nadeem ;Khan and Tariq; Al Qaisi [23-26]. what specific expenses headings and kinds really frame CSR expenditures and not simply CSR as Madichie et al.; Ohaka and Ogaluzor [18,27] did. This study was so conducted purposely to clear such persistent literary lacuna exploitation on listed oil and gas corporations in Nigeria and creating contribution to existing information by examining if there is any positive impact of CSR pertaining to financial performance of quoted oil and gas firms in Nigeria. It is in view of this that the research interest was stimulated.

Objectives of the Study

The overall aim of the study is to examine the Corporate Social responsibility (CSR) practice in relation to its impact on financial performance of selected listed oil and gas firms in Nigeria.

The specific objectives are:

i. To determine the effect of CSR Charitable Donation Expenditure of quoted oil and gas firms on their financial performance;

ii. To examine the impact of CSR Expenditure on Education of quoted oil and gas firms on their financial performance;

iii. To assess the relationship between CSR Societal Expenditure of quoted oil and gas firms and their financial performance;

iv. To investigate the extent to which CSR Health Expenditure affects financial performance of quoted oil and gas firms in Nigeria;

v. To determine the effect of Corporate CSR Environmental Expenditure of quoted oil and gas firms on their financial performance;

vi. To examine the impact of CSR Sports Expenditure of quoted oil and gas firms on their financial performance.

Research Hypotheses

The following research hypotheses were formulated in null form:

Ho1: CSR Charitable Donation Expenditure does not significantly affect the financial performance of oil and gas firms in Nigeria.

Ho2: There is no significant relationship between CSR Expenditure on Education and financial performance of oil and gas firms in Nigeria .

Ho3: There is no significant relationship between CSR Societal Expenditure and financial performance of oil and gas firms in Nigeria

Ho4: CSR Health Expenditure does not significantly affect the financial performance of oil and gas firms in Nigeria.

Ho5: CSR Environmental Expenditure does not have significant effect on financial performance of oil and gas firms in Nigeria.

Ho6: There is no significant relationship between CSR Sports Expenditure and financial performance of oil and gas firms in Nigeria.

Literature Review and Theoretical Framework

Concept of Corporate Social Responsibility

According to Mallouh and Tahtamouni [28], when a company is no longer operationally myopic on its charitable obligations to such vicinity where it operationalizes and esteems the wellbeing of its immediate surroundings where itself is the citizen and plays a role of a responsible citizenry, it becomes a step further to boost their financial wellbeing. CSR can be looked at as a deliberate action to both internal and external stakeholders which go beyond the purview of Law Amodu, Carroll [29,30]. stated that in general, CSR specifically might have showcased its comprehension to mean strategies with implementation that businesses introduced to ensure people’s, corporation investors, other than business owners, are protected and considered in the way they strategized and operationalize

Forms of CSR in Oil and Gas Firms in Nigeria

Corporate Social Responsibility Charitable Donation Expenditure (CSRCDE): This is a present presented by an organization or a person for benevolent reasons and for the good of the humanity which could be in sort of money provision, services, clothing, toys, food, vehicle etc. Donations likewise comprise emergency reprieve and improvement provision or health needs like donation of blood and transplant [31]. Donation may be financial (currency assistances) or non-financial like food stuff, apparel, houses, relief material etc. [27].

Corporate Social Responsibility Expenditure on Education (CSREDE): This is an expenditure on education or for academic purposes which include but not limited to studentship awards, young people’s improvement exercise and the provision of learning amenities, donation of houses and equipment to improve the coaching with educational setting, purchase of stationeries, donation of school bus, building of classroom blocks, donation of computers to schools, award of scholarships to indigent pupils and students from poor homes and intelligent children as an encouragement, building and donating staff quarters to teachers [16,31,32].

Corporate Social Responsibility Societal Expenditure (CSRSE): This refers to the diverse spending including reward remunerated to workers as they define the expenses incurred towards the public. Categories of diverse costs comprise of gift, public and community (people), rural development, investing in females through giving occupational teaching, occupation and health care spending [33]. According to [34], contribution to societal welfare has to do with security with work of the needy, aids, public benefit provision, etc. According to Mentor (2016), a firm’s pull as an outlay is also reliant on the societal influence of manual labour/employing practices, integrity and popularity matters, multiplicity, social privileges, consumer safety, bodily wellbeing, etc. A firm should make a mindful attempt to improve the public. Firms can achieve through engaging in a support or giving a proportion of profits to community developments.

Corporate Social Responsibility Health Expenditure (CSRHE): This depicts the degree at which the oil and gas firms are spending in the aspect of health on both their employees and for community (stakeholders). A separate amount of money is usually being set aside majorly to carter for the health need of the needy within the society [23]. Workers in the oil and gas firms enjoy these medical facilities. . CSR regarding the healthcare is a means of maintaining a sizeable degree of dynamism and reducing the conveyance contamination and pollutions in the surroundings [23].

Corporate Social Responsibility Environmental Expenditure (CSREE): This refers to the costs incurred by oil and gas firms with the aim of safeguarding their surroundings where operations take place. Such expenses are on preservation of natural resources, discarding of manufacturing wastes by using safe means, prevention of noise and air pollution [28]. According to Cho et al. environmental expenditure has to do with environmental investment, pollution performance, etc [34].

Corporate Social Responsibility Sports Expenditure (CSRSPE): According to to Jajić & Jajić (n.d), ‘sticking to the opinion that, there exists a thing that is more than profit, “the business unceasingly support mutual schemes and gifted persons in the educational arenas, sports, science, technical know-how, well-being, culture and arts’ More so, to give immense consideration to the mutual popular sports, such as football and basketball, momentous backing is directed towards encouraging development of sports associations related to sports which the government often times gives little or entirely no attention to, like judo, wrestling, karate, biking, skiing, gymnastics and other forms of sports that can bring people like physically challenged youths together [35].

Concept of Financial Performance: Naz et al. defined financial performance as measurement of a firm’s financial wealth for a given time lag. In another view, it can be seen as a financial action which is used to generate higher sales, profitability and value of a business unit for its vary owners also known as the shareholders by striking a balance between a firm’s current with non-current assets, funding, equity, incomes and expenditures [36]. Fatihudin et al. defined the term “Financial performance” as the “attainment of a corporation’s financial performance for a given period of time covering when finances are being collected and allocated measured by capital adequacy, solvency, liquidity, efficiency, profitability and leverage” [37].

Measurement of Financial Performance:

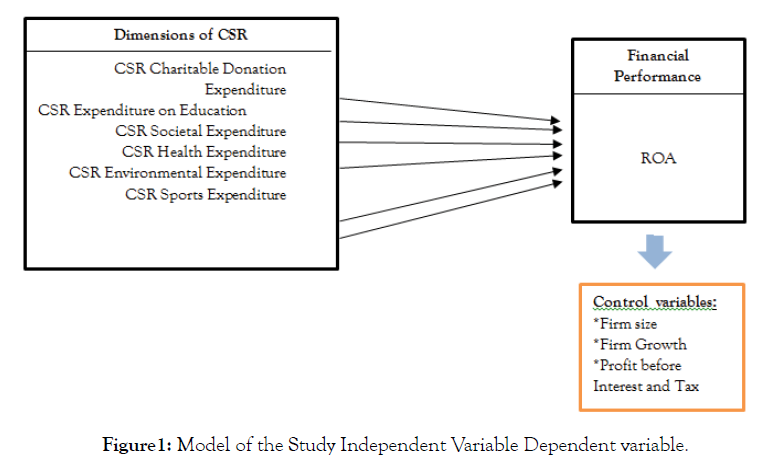

Return on Asset (ROA): According to Uwoma and David, ROA can be defined as a fiscal proportion showing a fraction of company’s receivables in relation to its general resources. ROA reveals a certain level to which management uses its assets and make returns. Rosikah et al. opine that ROA is used to evaluate a firm’s ability and potential to creating returns through the usage of totality of owned assets by a corporation in time to come [38]. See return on asset as the measurement of organizational performance, which informs investor on how viable a corporation utilizes its assets to make returns. Also, that a greater return on asset denotes higher level of management performance (Figure 1).

Figure 1: Model of the Study Independent Variable Dependent variable.

Theoretical Framework

Social Contract Theory: According to Omran and Ramdhony (2015), the historical precedence of this theory started in Hobbes (1946), Rousseau (1968) and Locke (1986). Donaldson (1982) sights the corporation and societal association in the theoretical point of view. His opinion is that there is an unspoken social agreement that exists among corporation with the people and community. License to operate with regards to this theory originates from standpoint that all firms require implicit and explicit authorization from regimes, societies in relation to other interested parties to participate in [21].

Stakeholders Theory: The leading scholars of stakeholder theory among others are stakeholder theory proposes that a firm’s aim is creation of stakeholder’s value to the best of its ability. Since Stakeholder theorists view the corporation as a collection of internal and external groups (e.g. shareholders, employees, customers, suppliers, creditors, and neighbouring communities)- that is, “stakeholders,”which was originally defined as those who are affected by and/or can affect the achievement of the firm’s objectives (Freeman, 1984), stakeholder theory is the underpinning theory for this research work.

Empirical Review: Iqbal et al. studied the impact of CSR among Islamic and Conventional Banking system in enhancing by means of EPS, ROE and ROA. An empirical analysis was conducted with respect to twelve-monthly accounts of four banks for the two years from 2010-201. To confirm the association amidst EPS, ROA, ROE and CSR, regression models were utilised. The outcomes reveal absence of CSR in Pakistan and reveals that a positive association exists among profitability proxies and CSR implementations [23].

Al Qaisi conducted a study which aims in investigating the impact of dimensions of CSR (environmental, community service and human resources) on financial performance of firms listed on Amman Stock Exchange (ASE). The study used a total sample of (15) Jordanian companies quoted on ASE for the period of 2012–2016. Simple and multiple linear regression techniques were utilized in analysing the extracted data from annual reports. The end results of the findings show that dimensions of CSR have impact on financial performance measured by ROA of firms quoted on ASE [26].

Adewoye et al. carried out a research on CSR and Performance of Oil and Gas Industry in Nigeria. Ex-post facto research design was adopted, Breusch Pagan Lagrangian Multiplier (LM) and Hausman tests were adopted in estimating the model, while fixed effect panel exploration was utilized to analyse the data. The outcomes discovered that individual effects of environmental ,ethical, and societal social responsibilities are mixed on performance, the result indicating that there was a significant association amongst CSR and performance of oil and gas firms in Nigeria. The study therefore recommends that the companies should look into the expenditure items of their corporate social responsibilities.

Akubo et al. studied impact of CSR on financial performance of Deposit Money Banks (DMBs) in Nigeria with the period ranging from 2013 to 2017 [39]. The CSR was proxied with health and sports expenditures while performance was proxied with profitability as Profit After Taxes (PAT). The data used were secondary data which were run in E-Views 9 to produce regression output. The results show that expenditure on health (CSRHE) has positive and insignificant impact on profitability while that of sports (CSRSE) shows a significant positive impact on PAT of DMBs in Nigeria from 2013 to 2017.

Nuzula investigated effect of environmental cost on financial performances of some sampled Japanese Chemical industries during 2012-2015 [40]. The study covers a sampled of 27 companies out of the 81 total population. Data used were taken from the company’s individual websites. Environmental cost being the independent variable was explained by aggregate of environmental costs expended by these firms as seen in their yearly sustainability reports. Five dependent surrogates were used namely ROA, PER, NPM, ROE and Tobin’s Q. Regression analysis was run to check whether environmental costs have an effect on the five dependent surrogates. The outcomes showed that environmental expenditure affected ROA adversely, with no effect on ROE; negatively affecting NPM; and having no impact on PER.

They conducted a study on Environmental responsibility reporting and financial Performance of quoted oil and gas companies in Nigeria. Their research made use of secondary data as extracted from the yearly reports and account of the 13 oil and gas firms listed on the floor of the NSE for the years 2012-2017. OLS regression method was utilized as the method of data exploration. The outcome shows that a positively significant relationship exists amid financial performance with environmental responsibility reporting in the oil and gas sector of Nigeria. Results of the findings likewise discloses that firms operating in the oil and gas sector report very minute information about the impact of their operations on the environment although over the years there seems to be little improvement on that. The study further recommends that relevant authorities in the country should come up with good regulatory policies that will help in guiding and regulating the oil and gas sector and putting measures to ensure compliance with order.

Ashraf et al. researched on ‘Corporate Social Responsibility Impact on Financial Performance of Islamic and Conventional Banks: Evidence from Asian Countries’. The secondary data sourced from individual banks yearly financial reports were utilized. Correlation and regression techniques were utilized in evaluating the data. The regression and Robust analysis results showed that an overall positively significant association exist among CSR and financial performance. It was further examined that not only do banks recompense for CSR, their clienteles also do participate in the bank day to day activities [25].

They conducted an investigation on the effect of environmental cost on organizational performance of Nigerian Brewery Plc [41]. The data utilized for the investigation were collected from the yearly report and accounts of Nigerian Brewery Plc on Donations (DN), Medical Expenses (ME) and on the Return on Asset (ROA) from 2011-2015. Hypotheses were stated and multiple regressions utilized for interpretation. The study revealed that both donations and medical expenses reveal a negative impact correspondingly with ROA. Recruitment, Trainings and Canteen Expenses (TRC) and the ROA revealed a positive impact on Nigerian brewery Plc.

Gaps in the Literature: Owing to the past studies, there arose three groups of scholars with three diverse results (positive, negative, mixed and neutral) impact of CSR on firms’ financial performance. Also, there are no generally accepted variables to proxy CSR. The use of CSR as aggregated method instead of categorisation of the CSR expenditures into variable headings which this study has used.

Methodology

Research Design

The study adopted ex-post facto research design because the secondary data already existed.

Population of the study and Sampling Design: The population of this study constitutes of the twelve (12) listed oil and gas firms on the Nigeria Stock Exchange as at 31st December, 2019. The sample size of seven (7) was chosen from oil and gas firms which CSR reportings are in disaggregated form. Also, some listed oil and gas firms did not quantify (in figures) their CSR report in the audited annual reports and accounts if at all they are practicing CSR which led to selection of seven (7) oil and gas firms (Eterna, Forte Oil, 11plc (Mobil), Mrs Oil, Oando, Seplat and Total Nig. Plc.) which data are available on disaggregated basis.

Methods of Data Collection

The study employed secondary data which were collected from the financial statements and annual reports of the sampled listed oil and gas firms listed on the NSE as at December 31st, 2019.

Techniques of data analysis

The study used several statistical methods for analysing data. These are descriptive which are minimum, maximum, mean standard deviation, skewness, and kurtosis. Correlation matrix, multiple regression and test for multicollinearity using variance inflation factor (VIF) were also conducted. The analysis was conducted with the aid of STATA 13 Software package.

Model Specification and Variable Measurement

Model Specification: The modified model of Al Qaisi (2019) is stated below:

ROA= f(CSRCDE,CSREDE, CSRSE, CSRHE, CSREE, CSRSPE, FZ, FG, PBIT) (1)

ROA=α+β1CSRCDEit+β2CSREDEit+β3CSRSEit+β4CSRHEit+β5CS REEit+β6CSRSPEit+β7FZit+β8FGit+β9PBITit+eit (2)

Where:

CSR= Corporate Social Responsibility,

CSRCDE= CSR Charitable Donation Expenditure

CSREDE= CSR Education Expenditure,

CSRSE= CSR Societal Expenditure

CSRHE= CSR Health Expenditure ,

CSREE= CSR Environmental Expenditure

CSRSPE= CSR Sports Expenditure,

FZ= Firm Size,

FG= Firm Growth,

PBIT= Profit before Interest and Tax

e= Error term (representing the combined effect of omitted variables),

f= functional relationship

β= Coefficient of the independent variables,

α = a constant,

it = Dated panel data

Discussion of Findings

Regression Results: One of the limitations of the correlation matrix in data analysis is that it reveals the path of the association among surrogates but it does not show the power or strength of the association [2,3]. Hence, regression analysis is academically preferable (Table 1).

| Roa | Coef. | Std. Err. | T-value | P> | t | | [95% Conf. | Interval] |

|---|---|---|---|---|---|---|

| Csrcde | -0.3381 | 0.0641 | -5.27 | 0 | -0.4664 | -0.2097 |

| Csrede | 0.4107 | 0.0617 | 6.65 | 0 | 0.2872 | 0.5342 |

| Csrse | 0.3282 | 0.0673 | 4.88 | 0 | 0.1935 | 0.4629 |

| Csrhe | -1.1088 | 1.0714 | -1.03 | 0.305 | -3.252 | 1.0344 |

| Csree | -0.2154 | 0.0879 | -2.45 | 0.017 | -0.3912 | -0.0395 |

| Csrspe | 0.3922 | 0.1964 | 2 | 0.05 | -0.0007 | 0.7853 |

| Fz | -2.6843 | 0.9959 | -2.7 | 0.009 | -4.6765 | -0.692 |

| Fg | 0.0461 | 0.1431 | 0.32 | 0.748 | -0.2401 | 0.3325 |

| Pbit | -0.1345 | 0.2746 | -0.49 | 0.626 | -0.6839 | 0.4148 |

| Cons | 105.647 | 13.174 | 8.02 | 0 | 79.2949 | 131.9991 |

Table 1: Multiple Regression Results.

From the Table 4.4.1 above, the variable CSR charitable donation expenditure (CSRCDE) shows significant (0.000) at 5% level with negative coefficient value of-.3381 and negative T-value of -5.27. Also, CSR expenditure on education (CSREDE) is significant (0.000) at 5% level with positive coefficient value of 0.4108 and positive T-value of 6.65. CSR societal expenditure (CSRSE) is also significant (0.000) at 5% level with positive coefficient value of 0.3282 and positive T-value of 4.88. While CSR environmental expenditure (CSREE) is significant (0.017)at 5% level, but with negative coefficient value of -0.2154 and negative T-value of -2.45; CSR sports expenditure (CSRSPE) is significant (0.050) at 5% level with positive coefficient value of 0.3923 and positive T-value of 2.00.

CSR health expenditure (CSRHE) is the only variable that is not significant (0.305) going by the rule that any p-value above 0.05 (i.e.5%) is insignificant [26]. CSRHE shows a negative coefficient of -1.0715 and a negative T-value of -1.03.

The variable CSRCDE shows significant (0.000) at 5% level with negative coefficient value of-.3381 and negative T-value of -5.27. Also, CSREDE is significant (0.000) at 5% level with positive coefficient value of 0.4108 and positive T-value of 6.65. CSRSE is also significant (0.000) at 5% level with positive coefficient value of 0.3282 and positive T-value of 4.88. While CSREE is significant (0.017) at 5% level, but with negative coefficient value of -0.2154 and negative T-value of -2.45; CSRSPE is significant (0.050) at 5% level with positive coefficient value of 0.3923 and positive T-value of 2.00.

CSRHE is the only variable that is not significant (0.305) going by the rule that any p-value above 0.05 (i.e.5%) is insignificant [26]. CSRHE shows a negative coefficient of -1.0715 and a negative T-value of -1.03.

Test of Hypotheses

The table tests the six (6) null hypotheses formulated for this study. It is to test which variables have significant relationship with financial of the oil and gas firms and which one(s) prove otherwise (Table 2).

| Hypothesis | Coef. | T-value | P-value | Decision |

|---|---|---|---|---|

| Ho1:CSRCDE does not significantly affect the financial performance of oil and gas firms in Nigeria | -0.3381 | -5.27 | 0 | Reject |

| Ho2:There is no significant relationship between CSREDE and financial performance of oil and gas firms in Nigeria | 0.4107 | 6.65 | 0 | Reject |

| Ho3:There is no significant relationship between CSRSE and financial performance of oil and gas firms in Nigeria | 0.3282 | 4.88 | 0 | Reject |

| Ho4: CSRHE does not significantly affect financial performance of oil and gas firms in Nigeria | -1.1088 | -1.03 | 0.305 | Accept |

| Ho5: CSREE does not have significant effect on financial performance of oil and gas firms in Nigeria | -0.2154 | -2.45 | 0.017 | Reject |

| Ho6:There is no significant relationship between CSRSPE and financial performance of oil and gas firms in Nigeria | 0.3922 | 2 | 0.05 | Reject |

Table 2: Test of Hypotheses.

The results from the table above 4.5.1 prove that five(5) out of the six (6) null hypotheses formulated for this study are rejected, while only is one (1) is accepted. It therefore means that five (5) independent variables revealed significant impact on financial performance of oil and gas firms in Nigeria while only one depicts insignificant impact. The rule of thumb for the test above is that where p-value is less than 5% (0.05) the null hypothesis should be rejected. And if the p-value is greater than 5% (0.05) the null hypothesis should be accepted [26]. as in the case of null hypothesis number four (Ho4) above (CSRHE) with p-value of 0.305 (Table 3).

| Model | R2 | Adj. R2 | Prob > F | F-Change |

|---|---|---|---|---|

| 1 | 0.8072 | 0.7783 | 0 | 27.91 |

Table 3: Model Summary.

Model Summary

From the table above, the coefficient of determination (R2) reveals the extent to which the independent variables explain the dependent variable. It is therefore evidenced that the degree to which variations in dependent variable can be explained by independent variables is 80.72%. As for the F-Statistics change, it has the value 27.91 while p-value=0.0000 which shows that the whole model is fit for analysis.

Discussion of the Findings

Relying on the result of the multiple regression on table 4.1, the empirical regression model:

ROA = α + βCSRCDEit + β2CSREDEit+ β3CSRSEit + β4CSRHEit +β5CSREEit+ β6CSRSPEit +β7FZit +β8FGit +β9PBITit +et (3)

It is substituted as below:

ROAit =105.647it -0.3381CSRCDEit + 0.4108CSREDEit +0.3282CSRSEit -1.1088CSRHEit -0.2154CSREEit +0.3923CSRSPEit -2.6843FZit +0.0462FGit -0.1346PBITit+eit

From the model, five (5) independent variables are significant, out of which three of the independent variables CSREDE, CSRSE and CSRSPE showed a positive significant impact on ROA. While two others, CSRCDE and CSREE show significant but negative impact, all at 5% level. The remaining independent variable, CSRHE indicates insignificant and negative impact on ROA.

From the estimated regression model therefore, the variables with positive coefficients implies that for every increase in one unit of the variables, the dependent variable ROA will increase by the coefficient values of the variables (in this case, CSREDE, CSRSE and CSRSPE).

The negative coefficient value interpretation is the opposite of what is obtainable when positive value is obtained (i.e. decrease), which has do with CSRCDE, CSREE and CSRHE.

Hence, if an additional one Naira (N1) is expended on CSRCDE, it could lead to decrease in ROA by N0.3381. In the case of CSREDE, it means that any additional one Naira expended on it, could lead to an increment in ROA by N0.4108. The next variable in the model, CSRSE with positive coefficient implies increment in value by N0.3282 for every one naira spent it. As for CSRHE with negative coefficient, each N1 spent on it will lead to reduction of N1.1088. Also, CSREE indicates negative coefficient which implies that for every N1 expenditure incurred on it, there will be reduction in ROA by N0.2154. The sixth (6th) independent variable CSRSPE with a positive coefficient value of 0.3923 which means that for every N1 spent on sports, it could lead to an increment in ROA by N0.3923.

Summary of the Findings

The results of the CSR charitable donation expenditure corroborate the findings of Agbo et al; Ashraf, et al. Who found that there is negative impact of CSR charitable donation expenditure on financial performance and that overall findings of theirs showed that there are positive and significant results, but contradict the result of Iqbal et al. Whose results found positive impact of CSR charitable donation expenditure on company financial performance [41,25,23].

The results of the CSR expenditure on education corroborate the findings of Iqbal et al. and Ashraf et al. who found positive impact of CSR expenditure on education on company financial performance [23,25].

Furthermore, CSR societal expenditure results corroborate Adewoye et al. Whose study indicates that there is a significant positive relationship between CSR societal social responsibilities and performance of oil and gas companies in Nigeria.

As for CSR health expenditure, it is in tandem with Agbo et al. whose study revealed that medical expenses reveal a negative impact correspondingly with ROA and in variance with Akubo et al. whose results show that CSR expenditure on health has positive and insignificant impact on profitability of firms [41,39].

Also, the results of CSR environmental expenditure support the work of Nuzula which reveals negative impact, it contradicts the works of. Who found positive impact of CSR environmental expenditure on company financial performance [40,26].

Corporate social responsibility sports expenditure result supports the findings of Akubo et al. whose study found significant positive impact of CSR sports expenditure on financial performance of firms [39].

Conclusion and Recommendations

The study concludes that CSR plays a significant role on the financial performance of oil and gas firms in Nigeria. Following the findings, summary and conclusion, the study therefore makes the following recommendations:

1. The oil and gas firms should boost their expenditure on CSR Charitable donation expenditure (CSRCDE) and monitor it closely.

2. The management of oil and gas firms should continue to uphold CSR Expenditure on Education (CSREDE) because it has a positively significant impact on their financial performance.

3. The oil and gas firms should sustain CSR Societal Expenditure (CSRSE) because it has a positively significant impact on their financial performance.

4. CSR Health Expenditure (CSRHE) should be held in high esteem owing to the fact that a healthy nation is always a wealthy nation. The expenditure on heath of the citizenry especially the community and the environment has ability to earn a participating firm reputation over the other that does not embark on CSR.

5. CSR Environmental Expenditure (CSREE) should be encouraged in the sense that CSR is a short term investment that has long term benefit.

6. The oil and gas firms should be consistent in CSR Sport Expenditure (CSRSPE) as it is evidenced that it has significant positive impact on their financial performance

REFERENCES

- VassiliouMS.Historical dictionary of the petroleum industry. 2018.

- Kajola SO, Anene EC, Desu AA . Corporate social responsibility and financial performance of the Nigerian listed firms. Int J Sustain Dev. 2017;2(1):71–82.

- Kajola SO, Adedeji SB, Olabisi J, Babatolu AT. Effect of credit risk management on financial performance of Nigerian listed deposit money banks. Scholedge Int J Bus Policy Gov.2018; 5 (6):1-4.

- Boafo ND, Kokuma DA. The impact of corporate social responsibility on organisational performance : a case study of vodafone Ghana limited. Eur J Manag. 2015;3(5): 26–37.

- Barnabas G. Effects of corporate social responsibility on organizational performance : a study of Nigeria’s Telecommunication Industry. 2017; 5(5):55–63.

- Giannarakis G, Konteo G, Zafeiriou E, Partalidou X. The impact of corporate social responsibility on financial performance. Investment Management andFinancial Innovations. Manag Financial Innov.2016;13(3).

- NyongesaWR. Corporate social responsibility and financial performance : the case of safaricom ltd.2017; 6(6).

- Abilasha N, Tyagi PM. Impact of CSR on financial performance of top 10 performing CSR companies in India. IOSR J Econo Fin. 2019;10(2):01-08.

- Alozie J, , Chigozie E. Corporate social responsibility and profitability of Nigerian banks : Implications For Service Delivery. IOSR-JBM 2017; 19(11), 64–75.

- Anas M A, Ratna S, Ahmad H A. Corporate social responsibility and firm financial performance by the Jordanian Telecommunication Firms. Int J Res. 2018; 6(3).

- Tapang A T, Bassey B E. Effect of corporate social responsibility performance on stakeholder’s perception of telecommunication companies in Nigeria (a study of Mtn , Globalcom & Etisalat).2017;19(6).

- Bora SY, Mukhtar A S. The Effect of corporate social responsibility on financial performance : the evidence from the banking industry in emerging economies. J Bus Stud Q. 2017; 9 (1).

- Firli A, ,Akbar N. Does corporate social responsibility solve ROA problem in Indonesia telecommunication industry ? Am J Econ. 2016; 6(2).

- Raji S, Adekoya A, Mbashiru F,& Adebayo I. (2017). Corporate social responsibility and firms' performance in Nigeria. J Emerg Trends Econ Manag Sci. 2017; 8(6):276-283.

- Galant A,Cadez S.Corporate Social Responsibility and financial performance relationship: a review Of measurement approaches. ECONRES EKONISTRAZ.2017;30:(1):676693

- Tijani AA, Adeoye A O,Alaka NS. Effects of corporate social responsibility on banks financial performance in Nigeria : A Study of United Bank of Africa. Int J Bus Emerg.2017;4(6):136-147.

- Wissink R.B.A A test of the virtuous cycle of corporate social responsibility. Testing the relation between corporate social performance and corporate financial performance. Master Thesis.2012.

- Madichie CN, Nwekwo M N,& Nnad C S O. Effect of corporate social responsibility on financial performance of selected oil and gas firms in Nigeria. Eur. J Manag Bus Econ. 2018;10 (21).

- Samira IR, Noor NB, & Masudul H.Impact of CSR on firm’s financial performance: a study on some selected agribusiness industries of Bangladesh. Am J Econ Finance Manag.2018;4 (3):74-85.

- OsemeneO F.Corporate social responsibility practices in mobile tele communications industry in Nigeria. Eur J Manag Bus Econ. 2012; 4 (8).

- Mwangangi SA . Effect of corporate social responsibility on performance of manufacturing firms in Kenya. Unpublished Ph.D thesis. Jomo Kenyatta University of Agriculture and Technology.2018.

- Lyubenova M L . Determinants of corporate social responsibility disclosure: empirical evidence from Bulgaria, s1497197 MSc Business Administration. Track: Financial Management University of Twente.2019.

- Iqbal N, Ahmad N, & Kanwal M. Impact of corporate social responsibility on profitability of Islamic and conventional financial institutions. Applied mathematics in engineering, management and technology. Int J Emerg Mark. 2013;1(2).

- Malik MS, & Nadeem M.Impact of corporate social responsibility on the financial performance of banks in Pakistan. Int lett Soc humanist Sci.2014; 21: 9-19.

- Ashraf M, Khan B,Tariq B.Corporate Social Responsibility Impact on Financial Performance of Bank ’ s : Evidence from Asian Countries. Int J Acad Res Bus Soc Sci 2017; 7(4).

- Al Qaisi F. Corporate social responsibility effect on firm’s financial performance in Jordan. Int J Monetary Eco Financ 2019 ;12 (4):325–342.

- Ohaka J, Ogaluzor O I. Corporate social responsibility accounting and the effect of corporate social responsibility accounting and the effect of donations on profitability of oil and gas companies in Nigeria.2018.

- Mallouh A A, Tahtamouni A. The impact of social responsibility disclosure on the liquidity of the Jordanian industrial corporations Alaa Abu Mallouh Asem Tahtamouni. Int J Manag Financ Acc 2018; 10(3).

- Amodu N A. A conceptual framework for effective corporate social responsibility for companies in the Nigerian extractive industry. Ph.D. thesis submitted to school of postgraduate studies university of Lagos, Nigeria. 2017.

- 30.Carroll AB. Carroll’s pyramid of CSR: taking another look. Int J Corp Soc Responsib. 2016 ;1(1).

- Madugba JU, Okafor MC. Impact of corporate social responsibility on financial performance: Evidence from listed banks in Nigeria. Expert J Finac. 2016; 4(1): 1-9.

- Ezeji CE and Okonkwo ON. Corporate social responsibility: a study of oil transnational corporations in Nigeria. J Bus Law Res. 2016; 4(2):1-9.

- Mandal K, Banerjee S. Is ‘Societal expenditure’ an alternative route to business success? an empirical study. J Adv Manag Sc 2015;3(1).

- Cho S J, Chung C Y, Young J. Study on the relationship between CSR and financial performance. Sustainability (Switzerland). 2019; 11(2).

- Jajić B, Jajić J. Corporate social responsibility and sport. University of educons, Serbia.JEL classification: L83, M14.

- Naz F,IjazF, & Naqvi F. Financial performance of firms: evidence from Pakistan Cement Industry. J Teach Edu. 2016;05(01).

- Fatihudin D,Jusni, Mochklas M. How measuring financial performance. Int J Civ Eng 2018;9(6).

- Rosikah, Prananingrum DK, MuthalibDA, Muh I.A & Rohansyah, M. (2018). Effects of return on asset , return on equity , earning per share on corporate value. Int J Eng Sci. (IJES), 2018;7(3).

- Akubo D, Ekpah F, Ochepa AA,Ochidi Z, & Elaigwu BE .Impact of corporate social responsibility on financial performance of selected deposit money banks in Nigeria. 2018.

- Nuzula NF. Does environmental cost affect Japanese firms’ performance? Int. J. Prof. Bus. Rev. 2019; 4 (1):14–21. DOI - 10.26668/business review/2019.v4i1.105.

- Agbo B. O, Ohaegbu O.K, & Akubuilo F. The effect of environmental cost on financial performance of Nigerian Brewery. Eur J Manag Bus Econ. 2017; 9 (17).

Citation: Ibrahim KFA, Onyekachi S (2021) Impact of Corporate Social Responsibility on Financial Performance of Selected Listed Oil and Gas Firms in Nigeria. Int J Account Res 9:226. doi: 10.35248/2472-114X.21.9.226

Copyright: © 2021 Ibrahim KFA, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.