Indexed In

- Open J Gate

- RefSeek

- Hamdard University

- EBSCO A-Z

- Scholarsteer

- Publons

- Euro Pub

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Research Article - (2024) Volume 12, Issue 1

Determinants of Tax Administration among Category âAâ and âBâ Tax Payers in Bench Sheko Zone, South West Ethiopia Peopleâs Region

Endale Emiru1* and Netsanet Gizaw22Department of Economics, Mizan- Tepi University, Mizan Teferi, Ethiopia

Received: 22-Dec-2022, Manuscript No. IJAR-22-19433; Editor assigned: 26-Dec-2022, Pre QC No. IJAR-22-19433 (PQ); Reviewed: 09-Jan-2023, QC No. IJAR-22-19433; Revised: 27-Dec-2023, Manuscript No. IJAR-22-19433 (R); Published: 03-Jan-2024, DOI: 10.35248/2472-114X.24.12.374

Abstract

Tax is compulsory levy imposed on property by government to provide security and create conditions for well-being of society and it is a key player in every economy of the world today. In most developing economies taxation goes hand in hand with growth of their economy as it is vital to provide services for long-term investments in public goods. Understanding determinants of tax administration is essential to design suitable tax policy to improve its performance. This study was done with the objective to examine determinants of tax administration among category “A” and “B” tax payers in Bench Sheko zone. To meet its objective, the study used cross sectional data that were collected from 288 sample tax payers while the non-response rate was 2.7%. The sample respondents were selected using stratified random sampling proportionally. Besides, for the purpose of triangulation of the data 7 KII were carried out with employees of tax offices both in woreda and town administration. Descriptive statistics and binary logistic regression method were applied for analysis of collected data. The finding of the study revealed that out of 8 explanatory variables included in the mode; Education Level of tax payers (EDUL), Complexity of Tax System (CTS), Audit Effectiveness (AUDE), Fairness of tax (FAR), Service Delivery of tax authorities (SD) were found statistically significant at less 5% in determining performance of tax administration in the study area. Thus, providing apt and adequate education to taxpayers, prompting fairness of tax in the study area, ensuring audit effectiveness, improving quality of service delivery, and easing tax system for payments by capacity building had been suggested for tax authority and when this is done, it will lead to boost performance of tax administration in the study area there by improving the overall quality of tax administration.

Keywords

Tax administration; Tax payers; Bench Sheko zone; Tax authority; Complexity of tax

Introduction

Development of any country depends on the volume of revenue generated and applied by the government on public for the benefits of that society. Hence, no economy can grow without adequate resources for funding infrastructural development and provision of power and public utilities and other related services. That is why it is said that taxes and tax systems are the fundamental components to build nations, and this is particularly true in the case of developing or transitional nations like Ethiopia.

Developing countries are in difficulty to collect their tax efficiently, because of many serious problems they face. As a result these countries are in trouble to provide basic social services emanating from taxation. To reap the proceeds from taxation, administrative aspect of tax system must be given attention because how well tax administration system performs depends on how well it achieves goals for which it should be held accountable [1]. An efficient tax administration system would enhance high level of taxpayer voluntary compliance, which in turn would result in high collection potential of tax revenue.

Ethiopian tax administration proclamation number 983/2016, article 37(c) states that country is directly responsible for tax collections. Officials or employees of authority appointed under the Ethiopian revenue and custom authority establishment proclamation and any delegation of powers or duties to officer under article 8(3) with responsibility for administration and enforcement of tax laws [2].

Materials and Methods

Statement of the problem

It is fact that a properly designed and administered taxation system is very vigorous in generating revenue as well as increasing tax base to the government of any country in the world. Yet one of the more puzzling problems for policy makers in most developing and transition economies is encouraging high levels of tax compliance. With increasing task of the government, the role of taxation in economic development has become more significant and thus, the fundamental principle of tax is the mobilization of economic resources [3]. Tax revenue can be used to maintain and expand adequate system of social services, limiting of unnecessary national consumption of luxury goods, maintain economic stability and rising funds for capital formation among others.

Ethiopian tax is not only meant to raise revenue for current expenditures, but aims at directing economic agents to the development goals foreseen by the government through the incentive schemes embedded within the prevailing tax laws. The regular operation of tax authority body has the positive impacts on the effectiveness of tax revenue collected and the detection of fraud that made by taxpayer to evade the tax. Improving the tax administration system also enhances the revenue of the government and lowers the costs of administration without any adverse effect on economic environment. The key problems are tax payer and tax authority which is lack of tax awareness. As factors like behavioural, cultural factor, lack of integrity among employee of tax authority and unwillingness to take awareness creation training affect tax systems [4-8]. Implying that tax authority has an obligation to create awareness properly, and they are confused of it Mesele, et al.

Most studies made regarding taxation are focused on the effect of corruption, governance, tax evasion, tax system and tax administration on tax revenue generation in developed and developing nations of the world. The findings of such researches may not applicable in our country Ethiopia in general and Bench Sheko particularly. These are because of different factors like economic, social and political factors. Our country’s economic backbone is agriculture, as result tax revenue generated from such economy is not like industrialized one.

As the researcher’s knowledge is concerned, there is no independent study carried out on similar topics especially in category “A” and “B” in the current study area. Determinants of tax administration among category “A” and “B” “tax payers” in Bench Sheko zone together with the knowledge and existing literature gap motivated the need to conduct this study [9].

Research questions

• What are the socioeconomic determinants of tax administration in Bench Sheko zone?

• What are institutional related determinants of tax administration in Bench Sheko zone?

• What the perception of tax payer’s looks regarding penalty and fairness in the study area.

Objectives of the study

The major objective of this study was to examine determinants of tax administration among category “A” and “B” tax payers in Bench Sheko zone, South West Ethiopia. By having specific objective of:

• To examine socioeconomic determinants of tax administration in Bench Sheko zone.

• To evaluate institutional factors that affect tax administration in Bench Sheko zone.

• To evaluate tax payer’s perception regarding to penalty and fairness in the study area.

Review of related literature

Tadesse, et al. factors influencing taxpayer's compliance with the tax system in Mekelle city. By using nine variables were tested using ordered logistic regression, namely the probability of being audited, perception of government spending, perception of equity and fairness, penalties, financial constraints, changes to current government policy, roles of referent groups, roles of the tax authority and tax knowledge [10]. The findings indicated that tax compliance was influenced by the probability of being audited, financial constraints and changes on current government policy.

Afework, et al. conducted research on factors affect fairness of taxation on category “B” tax payers in case of Dawuro zone, Tercha city, south nation and nationalities people of Ethiopia [11]. The survey result indicated majority of respondents agreed that exchange with government, horizontal fairness and time related fairness as relatively fairer in current tax system. But general fairness, vertical fairness, administrative fairness, selfinterest or personal fairness, tax knowledge and tax complexity are negatively perceived by majority of tax payers and reflect negative effect on tax fairness.

Niway, et al. conducted study on determinants of voluntary tax compliance behavior in self-assessment system evidence from south nation nationalities people regional state, Ethiopia. The result of this study revealed that tax knowledge, simplicity of tax returns and administration, perception on fairness and equity, perception on government spending, probability of auditing, and the influence of referral group were determinant factors that influence voluntary compliance behavior of tax payers in self-assessment system. Daniel, et al. conducted research on entitle as factors affecting voluntary compliance of category “C” taxpayer's attitude of Arbaminch, SNNPR, Ethiopia [12]. And they concluded that the survey data has showed that majority of the taxpayers know why they pay taxes but they have no detail knowledge about taxation.

Mesele, et al. problems towards taxation associated with tax payers and revenue authority in case of Dessie town was facing tax payers were tax fairness and equity, organizational strength of the tax authority, awareness level of the taxpayers, cultural factors and provision of social services by the government. Daba, et al. conducted research on factors affecting rental income tax payer’s compliance with tax system: In case of Hawassa city administration, SNNPR, Ethiopia. The finding revealed that certain factors were found to be the major determinants of nonresidential house rental income tax payer's voluntary compliance.

Yonas, et al. conducted on assessment of tax payer’s attitude in case of Gedeo zone, southern Ethiopia. The author used descriptive statistics design. And the researcher concluded that taxpayers perceive that they are paying tax just because their citizenship responsibility, majority of them feels that they are paying fair taxes, they also believe that there is no significant magnitude of treatment variation among tax payers done by tax officials.

Manchilot, et al. studies on the determinants of tax compliance in case of Gondar city by including the factor like social, psychological, economic, demographic and institutional factors that have an impact on compliance behavior of taxpayers in category “A” and “B”. The study used to ordered logit model and select the respondent by simple random sampling. Finally he concluded that the simplicity of tax system, probabilities of detection and organizational strength of tax authorities had significant determinants on tax compliance in Gondar city [13].

Research methodology

The research design selected for this study was a cross-sectional survey design. And research considered both descriptive and analytical aspects. Both primary and secondary data were used to achieve the objectives of the study. Primary data was collected from sample selected on category “A and B” tax payers in Bench Sheko zone and key informants. The questionnaire comprised of both closed and open ended questions. From primary method of data collection researchers used unstructured interview, indepth interview of each town tax authority [14]. Secondary data were obtained from review of related literature, document and annual tax report in Bench Sheko revenue authority, taxation books, and internet.

According to Bench Sheko zone tax and revenue authority report during the last June 2012 E.C (2020/21) the total number of category “A and B” tax payers in the zone are 1284 i total. From these figure, about 795 are category “A” while the remaining 489 are category “B” tax payers. Hence, the target population considered for this study was 1,284 tax payers.

The selections of respondents from sample population for questionnaires were based on stratified random sampling. Stratified random sampling was used as the total population of the study is heterogeneous. This method involves the division of a population into smaller groups known as strata which can be formed based on members' shared attributes.

In order to make representative samples, first the list of all tax payers under category “A” and “B” were used. The total tax payers under category “A” and “B” in Bench Sheko Zone are 1284. Out of which 795 are category “A” and the rest 489 are category “B”. Even if six woreda and two town administration in the zone, there is no category “A” and “B” in Sizi town administration and Gidi Bench woreda. This because of, both are newly incorporated town administration and woreda administration respectively [15].

Therefore, the sample was taken only from the rest of woreda and Mizan town administration.

Where,

s=required sample size.

The table value of chi-square for 1 degree of freedom at the desired confidence level (3.841).

N=the population size=1,284

P=population proportion (assumed to be 50 since this would provide maximum sample size).

d=the degree of accuracy expressed as a proportion (.05).

=295.83~296.

From this sample proportion of category “A” that were considered for this study was 296 × 795/1284=183 and for category “B” 113 sample respondents were considered. After making proportion the sample for each category, the category proportionated to each woreda and town administration accordingly [16]. To triangulate the information that was obtained from sample respondents, Key Informant Interview (KII) was carried out in woreda with large number of tax paying sample respondents of both categories (Table 1).

| Woreda/town administration | Population for each category | Proportionated sample to each category | Sample from each woreda/administration (category A and B) | Key informants | ||

|---|---|---|---|---|---|---|

| “A” | “B” | “A” | “B” | |||

| Mizan Aman | 451 | 372 | 451/795 × 183=14 | 372/489 × 113=86 | 190 | 2 |

| Semen Bench | 37 | 4 | 37/795 × 183=8 | 4/489 × 113=1 | 9 | 1 |

| Shey Bench | 24 | 19 | 24/795 × 183=6 | 19/489 × 113=4 | 10 | 1 |

| Sheko | 130 | 31 | 130/795 × 183=30 | 31/489 × 113=7 | 37 | 1 |

| Debub Bench | 119 | 32 | 119/795 × 183=27 | 32/489 × 113=8 | 35 | 1 |

| Gurafarda | 34 | 31 | 34/795 × 183=8 | 31/489 × 113=7 | 15 | 1 |

| Sub total | 795 | 489 | 183 | 113 | 296 | 7 |

| Total | 1284 | 296 | 303 | |||

Table 1: Stratified sample.

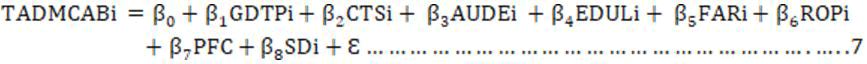

Econometric model specifications

For this study logistic regression was used to overcome the limitation of linear probability as the outcome for linear probability model might be less than zero and greater than one (Table 2). Further the analyses were carried out by using statistical software program STATA version 14. Finally, to estimate the impact of the explanatory variables, the following logistic regression model is specified for the current study which is just a slight modification of equation 6 and by including specified control variables as;

| # Name | Symbol | Nature of variables | Measurements | Expected sign |

|---|---|---|---|---|

| Tax administration on category “A” and “B” | TADMCAB | Dummy/ dichotomous | 0=if tax administration is good, and 1 otherwise | |

| 1. Gender of tax payers | GTP | Dummy | 0=if female, 1 otherwise | -/+ |

| 2. Education level of tax payer | EDUL | Categorical | 3=no education,2=elementary (1-8), 1=secondary (9-12), 0=college diploma above | + |

| 3. Complexity of tax system | CTS | Dummy | 0=if not complex, 1=otherwise | - |

| 4. Audit effectiveness | AUDE | Dummy | 0=if tax audit is effective, 1=otherwise | + |

| 5. Fairness of tax | FAR | Dummy | 0=if tax is fair, 1=otherwise | + |

| 6. Response to offense and penalties | ROP | Dummy | 0=if no, 1=otherwise | + |

| 7. Personal financial constraints | PFC | Dummy | 0=if no constraint, 1=otherwise | + |

| 8. Service delivery of tax | SD | Categorical | 0=if very good, 1=good 2=fair and 3=poor | + |

Table 2: Variables used in the model ad their expected sign.

Results and Discussion

Socio demographic characteristics of sample respondents

Before discussing the data related to the major items, summary of socio demographic characteristics of the respondents was presented below. Description of the socio–demographic characteristics of the respondents gives some basic information about gender, age, marital status, education level, categories of tax payers and type of business activities [17]. As sociodemographic characteristics of the respondents have their own implication and relation with tax administration in the study area and it has its own implication for performance of tax administration.

Gender of the respondent: The study revealed that out of 288 sample respondents, 193 (67.01%) of them were male tax payers and 95 (32.99%) of them were female tax payers (Table 3). The number suggests that males are more engaged in business activity in the study area as compared to their counterparts [18].

| Male | Female | Total | |

|---|---|---|---|

| Gender of the respondent | 193 | 95 | 288 |

| 67.01% | 32.99% | 100% |

Source: Own survey result, 2022.

Table 3: Gender of the respondents.

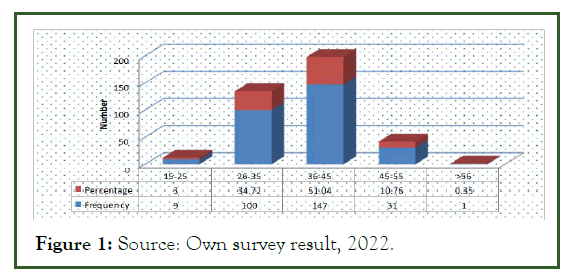

Age of the respondents: The study revealed that majority (147) respondents were in age category of 36-45 years which is about 51.04 percent, and about 34.72% (100) of the respondents were in age category of 26-35. This implies that most tax payers in the study area were within the age limit of 26-45 years. Age category of the respondents has been summarized by using Figure 1.

Figure 1: Source: Own survey result, 2022.

Marital status of respondents: Table 4 indicates that out of 288 respondents, 65 (22.57%) percent were unmarried, 206 (71.53%) percent were married, 14 (4.86%) were divorced, and 3 (1.04%) percent were widowed. This indicates that the majorities of the respondents were married tax payers.

| Unmarried | Married | Divorced | Windowed | Total | |

|---|---|---|---|---|---|

| Frequency | 65 | 206 | 14 | 3 | 288 |

| Percentage | 22.57% | 71.53% | 4.86% | 1.04% | 100% |

Source: Own survey result, 2022

Table 4: Marital status of the respondents.

Education level of the respondents: The study revealed that out of 288 sample respondents, 31 (10.76%) respondents were having education level of college Diploma and above, 132 (45.83%) respondents were having secondary education, 104 (36.11%) of the respondents were with primary education, and 21 (7.29%) respondents have no formal education [19]. The number shows that respondents with secondary education followed by respondents with primary education (Table 5).

| Education level of the respondents | ||

| Frequency | Percentage | |

|---|---|---|

| No formal education | 21 | 7.29 |

| Elementary (1-8) | 104 | 36.11 |

| Secondary education (9-12) | 132 | 45.83 |

| College diploma and above | 31 | 10.76 |

| Total | 288 | 100 |

Source: Own survey result, 2022

Table 5: Education level of the respondents.

Category of tax payers: The study revealed that out of 288 sample respondents, 178 (61.81%) of them were category “A” tax payers, while the remaining 110 (38.19%) were category” tax payers (Table 6).

| Category of tax payer’s | Frequency | Percent |

|---|---|---|

| Category “A” | 178 | 61.81% |

| Category “B” | 110 | 38.19% |

| Total | 288 | 100% |

Source: Own survey result, 2022

Table 6: Category of tax payers.

Type of business activities respondents engaged in: The study revealed that out of 288 sample respondents, 101 (35.07%) respondents were engaged in rendering services, 153 (53.13%) respondents were engaged in merchandising (trade) business, and 34 (11.81%) respondents were engaged in small manufacturing (Table 7). The number shows that majority of tax payers were engaged in merchandising business followed by service business.

| Type of business activities | Frequency | Percentage |

|---|---|---|

| Service business | 101 | 35.07 |

| Merchandising business | 153 | 53.13 |

| Small manufacturing business | 34 | 11.8 |

| Total | 288 | 100 |

Source: Own survey result, 2022

Table 7: Type of business activities respondents engaged in.

Results of key informant interview regarding tax administration: To triangulate the data, the researchers used purposely selected key informants interview to gather qualitative data from tax office employees. One key informant was contacted from five woreda tax office each, while two key informants were interviewed from Mizan Aman town administration revenue office. Totally seven (7) KII were made for this study. The procedure that was used for this study with regard to tax administration is purposely contacting those individuals who are willing to give information on participants consent. The interview question provided to each interviewee and result was as follows.

What factors determines tax administration with regard to institution? The problem that faces tax office regarding tax payer is that they didn’t accept rules of tax office as tax payers consider tax imposed only on them without enforcing other tax payer. The reason is that taxpayers think unequal treatment. Also the interviewee raise issue related to tax administrator “when employees tried to work, they didn’t obey rule and regulation”. However, their intention is not to evade tax but discouraged by illegal traders. Those engaging in business activities without trade license are increasing due to socio political instability of the area. They know why they pay tax but their voluntary compliance affected by other noncompliance. In this area illegal trade is rapidly increasing due to socio political instability and those operating business in Guraferda and Sheko. Consequently, those who want to evade tax used this as opportunity [20].

The other challenges that faced according to the interview result summary lack of enough skilled man power. There is no customer officer who follows up customer satisfaction. There is double task for each employee in the office. For instance, in some woreda an individual employee works on double position as tax officer and tax collector and assessor officer. The frequent change of tax policy and regulation also affect their assessment and collection procedure, this confused not only tax payer but also employee of the tax office. Other thing is less communication among department of tax office and less skilled man power to provide training for tax payers. Employees who worked in tax audit were less committed to serve clients.

As institutional difficulty, the interviewee raised “lack of skilled human power assigned for tax collection and administrating. And lack of sustainable logistic service to address all tax payers. For instance to give training it requires costs. Our tax office has only one desktop computer serving the whole staff. Imagine how it becomes difficult to manage and operate to serve the customer”. Finally he added issue is that budget allocation problems. “To follow up the taxpayer regularly even if it is difficult home to home, it requires costs. To provide training for them requires great effort. So as to come up with smooth follow up the tax payer there is shortage of budget. When the tax office call them to training it also requires budget to cover their minimum costs even if it didn’t replace their costs associated with taking the training”.

What do you think about factors that affect administration related with tax payers? Not only the institutional problems but also taxpayer’s aspects, which have been challenging the administration is their unwillingness to use receipt for Value Added Tax (VAT) and Turn Over Tax (TOT) for category A and B tax payers respectively. The interviewee revealed that “taxpayers consider as if they use the receipt for sale the amount of tax increase. Tax payer’s viewed holding receipt and using VAT and TOT required high tax amount to be paid. The other things, they less aware about using the turnover tax to sale product or service. Initially they resisted to use the TOT by assuming it requires high tax. But now when they compares with category “c” tax payers, not as much as they expected, which means less tax compared to other category”.

According to another interview “to collect the tax it requires additional costs. The taxpayers themselves didn’t voluntarily compliant bases on the schedule given for them. As the time period reached for payment, it requires mobilization of tax payers to collect. The mobilization itself requires extra costs for tax office which leads the tax administration in to inefficiency by irrelevant costs incurred for transport, time, and resource. So their unwillingness to compliant according to time set is one problem. However, majority of them unintentionally become non-compliant. They forgot the schedule for their time period. Those forget the schedule were those having less educational back ground. If it is intentionally, there are punishments”. Generally, the tax office has no budget allocate for such purpose. The above interview result shows challenges that face the tax administration of both categories “A” and “B” institutionally and taxpayer related issue. So, the result is consistent with the finding in the regression and descriptive parts.

Econometric analysis

Determinants of tax administration in the study area: The general objective of this study was to examine determinants of tax administration among category “A and B” tax payers in Bench Sheko zone, South West Ethiopia Thus, to perform this task, binary logistic regression model was used as econometric model. But, before applying logistic regression for analysis, taking model diagnostic test becomes necessary. The model diagnostic test was performed to insure that the model fits well. The model diagnostic test can be done by running OLS regression model. The rationale behind conducting diagnostic test is to check whether the model is correctly specified or not, to check the correlation between explanatory variables exist or not, and helpful in checking the overall significance of the model.

Accordingly, inclusion and exclusion of irrelevant and relevant variables respectively were tested by OV tests (Omitted Variable) and the result shows misspecification is not the problem for this model. VIF test was used to check the problem of multicollinarity and the result shows multicollinarity is not the problem and the Variance Inflation Factor (VIF) test confirmed non-existence of multicollinarity among variables in the model (VIF=1.10). The nonexistence of heteroskedasticity problem was tested by using Breusch-Pagan test. Goodness of fit test was checked by computing Hosmer-Lemeshow goodness of fit. Hosmer–Lemeshow goodness of fit test result shows that the model was fit. After model diagnostic, logit model was used for analysis in which the dependent variable (TADMNCAB) was a binary response variable taking value of 0 and 1, for good and its counterparts respectively. The independent variable used in the model contains dummy and categorical.

Performing all the stated procedures above, the logistic regression model was run. A total of 8 explanatory were used to explain the dependent variable. From 8 explanatory variables used for analysis, 5 variables were found significant at less than 5% probability level. However, the result from logit model, whether it is coefficient report or odds ratio; it shows only direction of the effect of the explanatory variable on the dependent variable, but not the magnitude. Unlike slope coefficient measures directly the change in probability of an event occurring as the result of a unit change in the value of a repressor in the LPM; in logistic regression model, the slope coefficient of a variable gives the change in the log of the odds associated with a unit change in that variable, ceteris paribus.

Therefore, with the binary logistic regression coefficient or odds ratio, we don’t have a sense of magnitude. Consequently, to show the magnitude of the explanatory variables effect on dependent variables, it is essential to calculate the marginal effect (dy/dx) of explanatory variable on dependent variable after running logistic regression. According to Greene, et al; and Gujarati, et al. the calculated marginal effect shows expected change in the probability of particular choice being made with respect to a unit change in an explanatory variable, ceteris variable, ceteris paribus. The regression output of Logit model is presented in Table 8.

| Variables | Coefficient | Standard error | Z | P>|z| | Marginal effect (dy/dx) |

|---|---|---|---|---|---|

| GTP | -0.1794 | 0.3825 | -0.4 | 0.639 | -0.0431 |

| EDUL | 0.5346 | 0.2171 | 2.46 | 0.014 | 0.1292** |

| CTS | 1.6959 | 0.3608 | 4.7 | 0 | 0.3942* |

| AUDE | 1.2365 | 0.3319 | 3.72 | 0 | 0.2949* |

| FAR | 1.5056 | 0.3513 | 4.29 | 0 | 0.3463* |

| ROP | 0.2346 | 0.3642 | 0.64 | 0.519 | 0.0564 |

| PFC | -0.3461 | 0.6585 | -0.97 | 0.334 | -0.0836 |

| SD | 0.8129 | 0.2255 | 3.6 | 0 | 0.1964* |

| Constant | -4.0702 | 0.6215 | -6.55 | 0 | - |

- Number of obs. 288

- Log likelihood= -118.5537

- LR Chi square (8)=158.12

- Prob>Chi square=0.0000

- Pseudo R2=0.4001

- VIF=1.25

- * Shows significant at 1%

- ** Shows significant at 5%

Table 8: Logit model estimates for tax administration in Bench Sheko zone.

Education level of tax payers’ (EDU): Education level of tax payer is one of the important factors that determine tax administration made by tax authority. For stance, when tax payers know his/her obligation with regard to timely paying of tax obligation, reporting of complete and accurate information and awareness about return of taxation to the economy as whole. Tax payers with better level of education is expected to have better awareness about the overall tax system and make tax administration possible with least cost as compared to tax payers with no education at all. The result shows that the probability of tax administration to be good by about 12.92% when education level of tax payers increases by one year. This positive relationship between education level and good tax administration might be because of better knowledge (skill) attained from formal education enables tax payers to fit themselves with the existing tax laws and regulation making administration easy for tax authority. This result is in line with the work of Daba, et al. Mustafa, et al. that tax payers with higher level of education is good for tax authority to administer its tax payers in easy way.

Tax System Complexity (CTS): In this study, complexity of tax system as per the perception of particular tax payer is assumed to be one of the determinants of tax administration in the study area. Similar to prior expectation, the finding of this study generated that probability of tax administration to be poor when the existing tax system is complex (not clear) for taxpayers. If tax system is complex to tax payers, computing their tax liabilities, understanding the procedure of tax might be difficult to prepare their income statement which again reduces the quality of services being delivered by tax authority and hence tax administration. Hence, in this study tax system complexity for ith tax payers could generate the probability of poor tax administration. The finding of this study is consistent with available study such as McKerchar, et al.; Richardson, et al.; Christian, et al. confirmed that complexity of tax system for taxpayers would have tendency to deteriorate probability of tax administration system.

Tax Audit Effectiveness (AUDE): In this study, tax audit effectiveness as per the perception of tax payers is assumed to be one of the determinants of tax administration in the study area. Tax audit is assumed to be effective when it detects misstatements (understatement of revenue and overstatement of expense) as evaluated by the perception of tax payers. If tax audit of revenue authority is effective in the perception of tax payers it could again lead to properly administered tax system. The finding of this study is consistent with the finding of Daba, et al; Dinku, et al. that audit effectiveness in revenue authority could increase probability of tax administration to be good.

Fairness of tax (FAR): In this study, fairness of tax as per the perception of tax payers who are engaged in similar business activity is assumed to be one of the determinants of tax administration in Bench Sheko zone. For this variable, the question provided for tax payers was weather tax payers pay similar amount as compared to the business stands with similar position. The marginal effect from the logistic regression result was 0.3463 and statistically significant at 1%. The result implies that the probability of tax administration to be good is about 34.63% when existing tax payment system is fair and its reverse could be true when existing tax is not fair. The result further suggests that when existing tax is fair in the opinion of taxpayers, it could likely contribute positively to tax administration. Hence, in this study ensuring tax fairness could significantly increase the probability of tax administration to be good. The finding of this study is consistent with the work of Siahaan, et al; Mohd, et al. confirmed that enhancing tax fairness by revenue authority could increase probability of tax administration to be good in the study area.

Service Delivery of tax authority (SD): For this study service delivery of tax authority as per the perception of tax payers is assumed to be one of the determinants of tax administration in Bench Sheko zone. The result indicates that probability of tax administration to be good is about 19.64% when existing service delivery of tax authority is very good. The result further suggests that when service delivery of tax authority is very good in the opinion of taxpayers, it could likely contribute positively to tax administration. Hence, in this study delivering effective tax service at the right time and place to bests of tax authority could significantly increase the probability of tax administration to be good. This finding is consistent with the work of Kirchler, et al; Lemessa, et al. who previously confirmed that enhancing service quality by revenue authority can improve tax administration.

Conclusion

Tax is compulsory levy imposed on property by government to provide security and create conditions for well-being of society and it is a key player in every economy of the world today. Tax has the impact of reducing undesirable products, promoting investment and development and reducing regional inequality, establishes economy, reduces imbalance between rich and poor. This goal can be achieved when it has good tax structure, clear rules and regulations, competent tax expert's compliance taxpayers and effective and efficient tax administration system. In most developing economies taxation goes hand in hand with growth of their economy as it is vital to provide services for longterm investments in public goods. However, these countries are in difficulty to collect tax efficiently because of their serious problems; consequently they are in trouble to provide basic social services emanating from tax revenue.

To acquire proceeds from tax, attention need to be given for administrative aspect of tax because how well tax administration depends on how well it achieves goals. The determinants of tax administration among category “A” and “B” tax payer's in the study area is part of determinants of tax by the same category in Ethiopia in one way or another, as tax payers in this study area are functions of national tax payers. Hence, investigating determinants of tax administration among category “A” and “B” tax payers has great inference to improve the existing tax administration as these categories of tax payers contribute lion share to gross government tax revenue in Ethiopia. Since identifying determinants of tax administrative is essential to design suitable tax policy, this study was done with the objective to examine determinants of tax administration among category “A” and “B” tax payers in Bench Sheko zone, South West Ethiopia.

Out of eight explanatory variables, five were statistically significant in determining tax administration in the study area. Accordingly, factors determining tax administration in the study area were; education level, tax system complexity, and tax audit effectiveness, fairness of tax, and service delivery of tax authority. Tax payers with better formal education have better awareness about tax system and make tax administration possible with less cost as compared to those with no formal education. This positive link between education level and better tax administration might be because formal education enables tax payers to fit with tax laws and regulation making tax administration easy for tax authority as theory stipulates.

With regard to tax system complexity, when tax system is complex for taxpayer’s tax administration will become poor. If tax system is complex to tax payers, computing their tax liabilities, understanding procedure of tax might be difficult to prepare their income statement which again reduces the quality of services being delivered by tax authority and hence tax administration.

Recommendations

Based on the finding of the study, the following policy recommendations has been drawn for immediate improvement to be made with regard to determinants of tax administration among category “A” and “B” tax payers in Bench Sheko zone, South West Ethiopia.

• Providing appropriate and adequate formal education to taxpayers to tax payers will make them to understand the existing tax systems in a better way, this again will lead tax administration to be good. This positive link between education level of tax payers and better tax administration might be because formal education enables tax payers to fit with tax laws and regulation making tax administration easy for tax authority as theory stipulates.

• Prompting fairness of tax in the study area is good to ensure better tax administration. As the finding of this study raveled that tax administration is determined by fairness of tax as per payer’s perception, this could again has impetus for the improving of tax administration.

• Improving quality of service delivery by tax authority was found imperative so as to improve tax administration in the study area. Service deliveries of tax authority to taxpayers were found to determine probability of tax administration to be good or bad. When service delivery of tax is good in opinion of taxpayers, it could contribute positively to tax administration and this can increase probability of tax administration to be good.

• As institutional determinants of tax administration in the study area, local government need to consider determinants like credit tax audit effectiveness, access to training (s) so as to improve tax administration among category “A” and “B” taxpayers. Ensuring tax audit effectiveness by revenue authority in the perception of tax payers it could lead to properly administered tax system.

• Easing tax system for payments by capacity building had been suggested for tax authority and when this is done, it will lead to boost performance of tax administration in the study area there by improving the overall quality of tax administration.

References

- Mebratu AA. Impact of tax audit on improving taxpayers compliance: Empirical evidence from Ethiopian revenue authority at federal level. Int J Account Res. 2016;2(12):1-9.

- Mu R, Fentaw NM, Zhang L. The impacts of value-added tax audit on tax revenue performance: The mediating role of electronics tax system, evidence from the amhara region, Ethiopia. Sustainability. 2022;14(10):6105.

- Yoshida S. The struggle against social discrimination: Petitions by the Manjo in the Kafa and Sheka zones of southwest Ethiopia. Nilo-Ethiopian Studies. 2013;2013(18):1-9.

- Christian ML, Chukwuma EE, Asian A. Tax system in Nigeria: Challenges and the way forward. Res J Finance Account. 2012;3(5):9-15.

- Dinku T, Alamirew A. External factors affecting voluntary taxpayer’s compliance: The case of Amhara regional state revenue authorities. J Bus Finance Affa. 2018;7(322):2167-0234.

- Huseynov F, Klamm BK. Tax avoidance, tax management and corporate social responsibility. J Corp Finance. 2012;18(4):804-827.

- McKerchar M. The impact of income tax complexity on practitioners in Australia. Australian Tax Forum. 2005;20(4):529.

- Cao C, Li X, Xia C. The complicit role of local government authorities in corporate bribery: Evidence from a tax collection reform in China. China Econ Rev. 2021;65:101578.

- Siebers H. Struggles for recognition: The politics of racioethnic identity among Dutch national tax administrators. Scand J Manag. 200;25(1):73-84.

- Kogler C, Muehlbacher S, Kirchler E. Testing the “slippery slope framework” among self-employed taxpayers. Econ Gov. 2015;16:125-142.

- Mustafa F, Zainol A, Saad N. Effect of political factors on tax noncompliance behavior among libyan self-employed taxpayers. Acad Account Financial Stud J. 2018;22(4):1-9.

- Richardson G. Determinants of tax evasion: A cross-country investigation. J Int Account Audit Tax. 2006;15(2):150-169.

- Siahaan OP. The influence of tax fairness and communication on voluntary compliance: Trust as an intervening variable. Int J Bus Soc Sci. 2012;3(21):191-198.

- Tadesse G, Gotiom A. Factors influencing taxpayers compliance with the tax system in case of Mekelle city. eJournal Tax Res. 2014;12(2):433-452.

- Chung J, Trivedi VU. The effect of friendly persuasion and gender on tax comliance behavior. J Bus Ethics. 2003;47:133-145.

- Iraman E, Ono Y, Kakinaka M. Tax compliance and social desirability bias of taxpayers: Experimental evidence from Indonesia. J Public Policy. 2022;42(1):92-109.

- Minnick K, Noga T. Do corporate governance characteristics influence tax management?. J Corp Finance. 2010;16(5):703-718.

- Hasseldine J, Hite P, James S, Toumi M. Persuasive communications: Tax compliance enforcement strategies for sole proprietors. Contemp Account Res. 2007;24(1):171-194.

- Martinez-Vazquez J, Timofeev A. Choosing between centralized and decentralized models of tax administration. Int J Public Adm. 2010;33(12-13):601-619.

- Alm J, Torgler B. Do ethics matter? Tax compliance and morality. J Bus Ethics. 2011;101:635-651.

Citation: Emiru E, Gizaw N (2024) Determinants of Tax Administration among Category â??Aâ? and â??Bâ? Tax Payers in Bench Sheko Zone, South West Ethiopia Peopleâ??s Region. Int J Account Res. 12:374.

Copyright: © 2024 Emiru E, et al. This is an open access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.