Indexed In

- Open J Gate

- RefSeek

- Hamdard University

- EBSCO A-Z

- Scholarsteer

- Publons

- Euro Pub

- Google Scholar

Useful Links

Share This Page

Journal Flyer

Open Access Journals

- Agri and Aquaculture

- Biochemistry

- Bioinformatics & Systems Biology

- Business & Management

- Chemistry

- Clinical Sciences

- Engineering

- Food & Nutrition

- General Science

- Genetics & Molecular Biology

- Immunology & Microbiology

- Medical Sciences

- Neuroscience & Psychology

- Nursing & Health Care

- Pharmaceutical Sciences

Review Article - (2024) Volume 12, Issue 1

Determinants of Loan Repayment Performance of Smallholder Farmers: Empirical Evidence from Southern Zone of Tigray, Ethiopia

Hailekiros Nigus Adhana1*, Hadush Redae Kahisu2 and Salih Suleman Fetiwi12Department of Economics, Raya University, Tigray, Ethiopia

Received: 30-May-2023, Manuscript No. IJAR-23-21532; Editor assigned: 01-Jun-2023, Pre QC No. IJAR-23-21532 (PQ); Reviewed: 15-Jun-2023, QC No. IJAR-23-21532; Revised: 27-Dec-2023, Manuscript No. IJAR-23-21532 (R); Published: 03-Jan-2024, DOI: 10.35248/2472-114X.24.12.376

Abstract

This study sought to examine the determinants of smallholder farmers’ loan repayment performance in southern Tigray using binomial logistic regression analysis. Both quantitative and qualitative data were collected from a crosssection of 362 randomly selected smallholder farmers, from which 17.40% of them were found to be defaulters while the remaining 82.60% were non-defaulters. In this explanatory study, loan repayment performance was modeled as a function of age, gender, marital status, education level, number of dependents, distance to microfinance, saving behavior, loan reputation, loan timeliness, loan size, loan diversion tendency, training, other loans, repayment period suitability, and perception on prevalent political instability. Out of the fifteen variables used in the analysis only eight variables; namely, the number of dependents in household, saving behavior, loan reputation, loan timeliness, loan diversion, loan usage training, repayment period suitability, and perception of the prevalent political turmoil were found to have significant bearing on the repayment performance of the smallholder farmers. It can, therefore, be concluded that voluntary saving behavior of borrowers, better credit experience of borrowers, non-diverting loan utilization practices of borrowers, improved loan usage trainings by microfinanciers, suitable repayment arrangements, and stable political environment are the major contributors to enhanced loan repayment performance of borrowers. Hence, based on the results of this study, it is recommended that the microfinance institutions, borrowing households, and concerned governmental bodies should join hands together to improve loan repayment performance in the industry.

Keywords

Loan repayment; Determinants; Microfinance; Logistic regression; Tigray

Introduction

Due to factors such as lack of collateralizable assets, relatively high transaction and monitoring costs, no steady employment and verifiable credit history, and lower literacy levels, lower income groups are not eligible to receive credit facilities of commercial banks. They simply survive off little money generated through micro businesses and informal activities that can comprise of mini-food processing ventures, small scale farms, services provisions, and various crafting activities. In fact, such activities, collectively called micro and small enterprises, are recognized as major contributors of gross domestic product, usually in terms of employment opportunities and income generations. Therefore, in contrast to formal banks which provide loans to relatively better-off members of the society on the basis of collateral, microfinance institutions are established to provide loan and other services to the poor and lower-income persons so as to help them alleviate poverty and become selfemployed by making their business activities. Those microfinance institutions are expanding their services through different product offerings such as micro-savings, flexible loan repayment, and insurance Sengupta, et al., and it is not surprising that the word microfinance still lacks a formal definition as the field has continuously undergone far-reaching transformations [1-5].

Despite this absence of formal definition, the term “microfinance” is generally used to refer those financial institutions that are committed to assist typically poor households and small enterprises in gaining access to financial service. Those institutions have been playing a vital role as a socio-economic and financial mechanism for poverty alleviation, promoting entrepreneurial undertakings, and lifting the profile of disadvantaged people. As stated by Nawai, et al., microfinance has been especially effective and beneficial in bringing products such as savings, insurance, and credit to the un-served and under-served societies of developing and transitional economies.

In recognition to the multifaceted economic roles of microfinance institutions and with a desire to assure the sustainability of those institutions, several studies such as Munene, et al.; Nawai, et al.; Oladeebo et al.; and Godquin, et al., have been conducted to investigate the determinants of borrowers of microfinance institutions’ loan repayment performance. A few researches including Abreham, et al.; Jemal, et al.; Fikirte, et al.; Assfaw, et al.; Girma, et al.; and Mikir, et al., have also been conducted to investigate the determinants of loan repayment performance in Ethiopian context. Nevertheless, the findings in the literature lacks consistence Nawai, et al., and therefore the issue of what really determines borrowers’ loan repayment performance still remains hot research topic [6-8].

Microfinance institutions have experienced a sharp increase in number and embraced miraculous innovations in their core activities. Despite its recent advent, the microfinance industry in Ethiopia has equally shown remarkable growth in terms of outreach, particularly in the number of clients. The performance of microfinances has, nonetheless, been debated extensively in the empirical literature focusing on the methods that microfinance institutions use to improve borrower’s payback behavior. Some beneficiaries of the microfinance institutions, especially when they are public organizations, regard the loans obtained as their own fair share of the “national cake” and thus fail to repay the loan promptly. Consequently, microfinances are facing financial constraints to sustain loan provision to the poor due to problems in loan repayment performance. If borrowers do not repay, the liquidity position of the microfinances will be endangered as no enough fund is maintained. When there is a loss in the liquidity of the microfinance institutions, due to high levels of non-repayment, the cyclical flow of funds between the microfinance and the borrowers will be interrupted. In other words, if the microfinance institutions are not performing well because of the default problem, borrowers will not have access to loan and the ultimate result would be suffering from poverty, which drags the development mobilization of the country [9,10].

In order for microfinance institutions to be effective in reducing loan defaults or improve repayment performance, they should be able to find a way of identifying the determinants of loan repayments. In an effort to understand the determinants of loan repayment performance, several preliminary studies Drake, et al.; Lensink, et al.; Godquin, et al.; Oladeebo, et al.; Wafula, et al.; and Kebede, et al., and others have been conducted on the area of loan repayment performance of microfinance institutions. But, as Tundui, et al., asserted, the results in the literature are quite mixed, they lack consistency regarding the determinants of loan repayment performance. Apart from this, the available researches on developing nations are dominantly from Asian developmental states and only scanty of studies are available from African nations, let alone Ethiopia. The gap in literature availability coupled with the afro-mentioned inconsistency in findings, revealed a need for more researches. Besides, to the best knowledge and access of the researchers the financial arena in the study area, southern zone of Tigray, remained untouched to date. To this end, this study attempted to examine the determinants of loan repayment performances of smallholder farmers in southern zone of Tigray, Ethiopia [11,12].

Literature Review

The concepts of microfinance and loan default

According to Gonzalez, et al., microfinance is defined as the provision of financial services to low-income clients, including consumers and the self-employed, who traditionally lack access to banking and related services. Robinson, et al., also distinguishes microfinance as a development approach that provides financial as well as social intermediation. The financial intermediation includes the provision of savings, credit and insurance services, while the social intermediation involves organizing citizens’ groups to voice their aspirations and raise concerns for consideration by policymakers and develop their self-confidence. Certainly, as pointed out by Zerai, et al., microfinance institutions in developing countries, emerge with the unique opportunity of serving the poor who do not have access to commercial banks [13].

Apart from this, the word microfinance and microcredit are mostly used interchangeably, hence turns out to be confusing for many. Yet, as described by Sinha, et al., microcredit is a component of microfinance that involves in the provision of credit facilities to the poorer members of societies, whereas microfinance involves additional non-credit financial services such as savings, insurance, pensions and payments services. Notwithstanding this, and in agreement with Emmanuel, et al., this study takes the term microfinance in the context of providing general financial services, specifically loans, to poor people who are unable to obtain financial services from the formal financial institutions. Besides, as contended by Welday, et al., the prime component of microfinance development strategy in Ethiopia was the establishment of sustainable microfinance institutions that could reach a large number of rural and urban poor. Therefore, the definition adopted from Emmanuel, et al., indeed sounds pertinent to Ethiopian microfinance institutions [14,15].

Microfinance institutions can positively contribute to the socioeconomic welfare of the society, only if their financial sustainability is ensured. Nevertheless, their financial sustainability is highly encumbered by the existence of default problems. Loan default is a situation when a borrower fails to make payment of his/her loan on the time specified in the lending agreement. As stated by Nawai, et al., loan default might be instigated by borrower’s characteristics, institutional characteristics, loan characteristics, or due to other uncontrollable factors, such as entrepreneurial failures or natural disasters. Loan default can also be caused by political factors. Therefore, in this study, these particular factors were examined for the extent to which they influence borrower’s loan repayment performance [16].

Determinants of loan repayment behavior

Zeller, et al., employed a Tobit model to analyze determinants of loan repayment performance in microenterprises in Madagascar. The result based on 146 sample groups showed that enterprises with higher levels of social cohesion had better repayment rate. The finding of this study also showed that it is the degree of variance of risk assets among members not the level of physical and human assets of the enterprises that contributes to better loan repayment. It, therefore, indicated that heterogeneity in asset holdings among members and related intra group diversification in on and off farm enterprises, enables members to pool risks so as to better secure repayment of the loan. Moreover, gains in the repayment rate due to risk pooling diminish at the margin because of increased costs of coordination, monitoring, and moral hazard that come with greater heterogeneity in groups. Bhatt, et al. surveyed 26 borrowers of 11 microcredit programs in the US and concluded that low transaction costs and high threat of sanction on loan default were positive contributors of repayment performance. Acquah, et al., surveyed determinants of loan repayment performance of 62 fishermen from Ghana. The study revealed that loan repayment increased with years of education, fishing income, years of fishing experience and amount of loan whilst the age and investment made negatively influenced the amount of loan repaid. The regression analysis asserted fishing income, loan and amount of investment made as significant predictors of the amount of loan repaid [17].

Nawai, et al., studied factors affecting repayment performance of 309 respondents and documented that age, gender, business experience, religious education, total household income, total sales, distance to the lender office, the formality of business, period of loan approval and loan monitoring were significant determinants of loan repayment performance. Yacob, et al., studied the socio-economic determinants of Eritrea’s saving and credit program from 140 sample beneficiaries. They have shown that age, gender, type of business and credit experience were found to be significant determinants. Age and type of business had a negative relationship with loan repayment, while gender and credit experience had a positive relationship with the loan repayment probability. Nawai, et al., studied the determinants of repayment performance of 401 respondents in Malaysian microfinance programs and found that gender, business experience, education level, distance, total loan and transaction cost had positive coefficient while, age, religious education level, total income, business sector, business status, year of establishment, business area, registration status, total sales, loan type, repayment schedule, repayment period and loan monitoring had negative coefficient in relationship between delinquent borrowers and good borrowers. However, only religious education level, distance, registration status, total sales, repayment schedule and loan monitoring were statistically significant.

Wafula, et al., conducted a study on loan repayment behavior of 590 microfinance clients of Nakuru county in Kenya and revealed that age, income level, and education level of borrowers had significant positive impacts on repayment results. A study by Murthy, et al. looked into the determinants of defaults on credit repayments among 120 sample borrowers of microfinance organizations in Shah Alamin area of Malaysia. Finding of this study have established that loan default was positively related with nature of business operation, while negatively related with age of borrowers, diversion of funds by borrowers and repayment schedule suitability. Enimu, et al., investigated loan repayment determinants of 300 microcredit group members and showed that age, household size, house income, educational level, the amount of credit received, length of stay in the locality, distance to the credit source, supervision and disbursement lag were significant determinants of loan repayment. Among those variables, only household size, disbursement lag, and the probability of being male were negatively related with loan repayment rate [18].

In his studies on the repayment of loans and their determinants in the financing of 319 sample micro and small enterprises in Ethiopia, Abreham, et al., discovered that having other sources of income, education and work experience in related economic activities before the loan were repayment enhancing factors, while diversion of loans, being male borrower, and extended loan repayment period were undermining factors of the loan recovery performance. A research undertaken by Jemal, et al., on some 203 sample borrowers in rural Ethiopia showed that the possession of property such as livestock and the education of the beneficiary of the loan reduce the risk of default on the loan. On the other side, households with bigger house holdings and greater dependency ratios and female headed house holdings were connected with a greater incidence of defaults on loans. The research also found that families with significant human capital and physical capital, and improved access to infrastructure, had better repayment performance. Another study by Fikirte, et al., analyzed data from 200 randomly selected borrowers of Addis credit and saving institution. This study has shown that age, education, income level, loan supervision, suitability of the repayment period, accessibility of other credit sources and livestock holdings were important and significant factors that improved the loan repayment performance of borrowers, while the diversion of loans, the celebration of social ceremonies, the size of the family and the size of the loan were discovered to have considerably increased the default of the loan. This research also discovered that being female and business experiences of the borrower were important in improving the efficiency of borrower's loan repayment.

Zelalem, et al., identified socio-economic and institutional factors influencing the loan repayment efficiency of 130 randomly selected smallholder farmers in Kalu district of South Wollo. A two-limit Tobit model showed that, among the variables used in the analysis, landholding size, livestock ownership, agricultural extension package experience, cultural festival expenditure, the source of credit used and the purpose of borrowing had statistically significant impact on the repayment performance of the sample households. In this study, only expenditure on social festivals had a negative and significant effect on loan recovery rate, while the remaining five variables had a significant and positive effect. Haile, et al., used a binary logit model to analyze the determinants of loan repayment performance of 120 borrowers in Harari microfinance and concluded that saving habit, loan size, borrowers’ perception on repayment period, source of income, availability of training, business experience, business type, family size, and purpose of saving were significant determinants of loan repayment performance. In this study, increased probability of default was associated with large family size, negative perception on repayment period, less training, low business experience, poor saving habit, and having only single income source.

Girma, et al., studied the determinants of loan repayment performance of 364 sample borrowers in Gedeo zone Ethiopia. Among the variables used in logit regression analysis of the study educational level, method of lending, nearness of borrower’s residence to the institutions, family size, and income from activities financed by loan and training were found to be significant determinants. Family size and individual lending method were negatively and significantly related with loan repayment while the other three variables were positively related. Another relevant study by Mikir, et al., studied the determinants of loan repayment performance of Omo microfinance institution using a binary logit model and found that education level, annual income and training were positively and significantly related with loan repayment performance, while loan size was negatively and significantly affecting loan repayment of borrowers.

Methodology

Description of study area

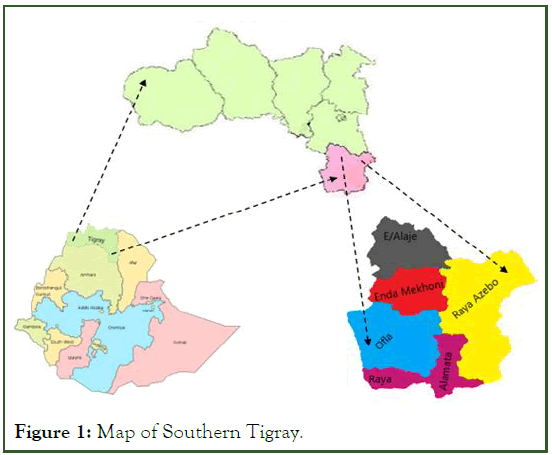

The Southern zone of Tigray is bordered on the South and West by the Amhara region, on the North by the South Eastern zone, and on the East by the Afar region. Towns and cities in the Southern zone include Maychew, Adishihu, Korem, Mekhoni and Alamata. Based on the 2007 Census, no census afterwards, conducted by the Central Statistical Agency of Ethiopia (CSA, this zone has a total population of 1,006,504, of whom 497,280 are men and 509,224 women 125,787 or 12.5% are urban inhabitants. Geographically it is shown as below Figure 1.

Figure 1: Map of Southern Tigray.

Research designs and approaches

The primary objective of this study was to examine statistically influential determinants of smallholder’s loan repayment performance. As such, explanatory research design, usually used in explaining the cause effect relationship between two variables, dependent and independent, was employed for the good purpose of this study. Alongside this, another research design called descriptive research design was used as ancillary design, to help describe the basic attributes and nature of the datasets used in this study. Besides, mixes of quantitative and qualitative research approaches were employed in this research, as the nature of the study calls for the adoption of quantifiable and non-quantifiable datasets.

Sampling design and sample size

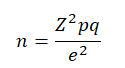

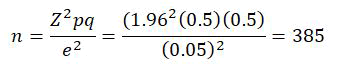

Multistage sampling was employed in this study. In the first step, taking convenience into account, Southern Tigray was purposively selected out of the seven zonal divisions of Tigray. Assuming large number of smallholder farmers and by taking into account the unavailability of complete sample frame, the following formula attributable to Cochran, et al. was employed to determine the required sample size for this study:

Where; n=Required sample size. Z=Coordinate value of normal distribution. p=Estimated proportion of an attribute present in a population. q=1-p, and e=Desired level of precision.

In most cases the p and q proportions are set at 0.5, for it supposedly allows for maximum variability, and e is often taken to be 5% in most statistical computations. By substituting those values in the above formula, therefore, the sample size was set to be about 385 as follow:

Given the financial nature of the data for this study, it was somehow difficult to get respondents’ consent to participate in the survey. To counteract this challenge, this study hence employed quota sampling in which smallholder farmers who were willing to genuinely provide the required information were selected from across the whole southern Tigray zone. By doing so a total of 385 questionnaires were distributed to participants, and only 362 usable questionnaires, representing a response rate of more than 94%, were filled and returned.

Data sources and collection techniques

The data for this study were obtained from both primary and secondary sources. The primary data were collected from 362 respondents by using a questionnaire form that contained both closed ended and open-ended question items. To overcome language barrier, the questionnaire was translated into Tigrinya, the respondent’s mother tongue language. In this regard, survey participants were asked to provide genuine response about their socio-economic, demographic, institutional, political, and loan repayment behaviors. Alongside this, secondary data were gathered from different source materials thorough document and internet websites reviews. This procedure has helped this study enormously in respect of literature review, variable selection, methodological adoptions, and finally as a basis in providing arguments for the study findings.

Study variables and related hypotheses

In this study, relevant variables were selected from the extant literature in the subject, and their respective expected effect on borrowers’ repayment performance is hypothesized in Table 1.

| Label | Variable name | Nature and measurement | Expected sign | Source |

|---|---|---|---|---|

| LnRep | Loan repayment | Dummy variable that took 0 for non-repayment and 1 for repayment. | Dependent variable | Mikir, et al. |

| Ag | Age | Continuous in nature expressed in terms of the number of years since the birth of respondents. | + | Nawai, et al.; Dula, et al.; Enimu, et al.; and Fikirte, et al. |

| Gnd | Gender | Dummy variable that took the value 1 if respondent was male and 0 otherwise. | - | Enimu, et al. |

| MarSt | Marital status | Categorical in nature that took 1 for single, 2 for married, 3 for divorced, and 4 for widowed. | +/- | Haile, et al. |

| EduL | Educational level | Ordinal in nature that took 1 for unschooled, 2 for elementary, 3 for high school, 4 for TVET and diploma, 5 for bachelor degree and above. | + | Girma, et al.; Osman, et al. |

| Depen | Dependents | Continuous variable expressed in terms of the number of dependents in family. | - | Jemal, et al.; Pasha, et al. |

| Dist | Distance | Continuous expressed in terms of the number of kilometers from borrowers’ residence to lenders office. | - | Nawai, et al.; Girma, et al.; and Osman, et al. |

| SavB | Saving behavior | Dummy variable that took 1 if the respondent is voluntary saving participants and 0 otherwise. | + | Haile, et al. |

| LnRpu | Loan reputation | Continuous variable expressed in terms of the number of previous borrowings borrowers had with the lender. | + | Mirpourian, et al.; Lensink, et al. |

| LnTm | Loan timeliness | Dummy variable that took 1 for timely loan release and 0 otherwise. | + | Pasha, et al.; Enimu, et al; Nawai, et al. |

| LnSz | Loan size | Continuous variable expressed in terms of the amount of loan granted to the borrower. | + | Jemal, et al.; Enimu, et al.; and Mikir, et al. |

| LnDiv | Loan diversion | Dummy variable that took the value 1 if loan was not diverted and 0 otherwise. | - | Dula, et al.; Pasha, et al. |

| Tr | Training | Dummy variable assigned with 1 if the respondent had received training and 0 otherwise. | + | Haile, et al.; Girma, et al. |

| ExtraLn | Extra loans | Dummy variable assigned with 1 if respondent had other outstanding loans and 0 otherwise. | - | Dula, et al. |

| RepSuit | Repayment suitability | Dummy variable assigned with 1 if the loan repayment period was suitable for the respondent and 0 otherwise. | + | Jemal, et al.; Dula, et al.; Pasha, et al. |

| PolPer | Political perception | Dummy variable assigned with the value of 1 if the respondent was percipient of the prevalent political situation as an opportunity to evade repayment and 0 otherwise. | - | Nawai, et al.; Stephen, et al. |

Table 1: Descriptions of study variables and their respective hypothesis.

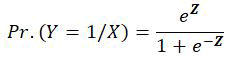

Econometric model specification

The primary aim of this study was to examine statistically significant determinants of borrowers’ loan repayment performance. For that purpose, the dichotomous dependent variable, loan repayment, was modeled as a function of fifteen explanatory variables nominated from an extensive review of articles on the subject matter. Loan repayment performance dichotomized into defaulters vs. non-defaulters was regressed on variables age, gender, marital status, educational level, number of dependents, distance, saving behavior, loan reputation, timeliness of loan release, loan size, training, other loans, repayment period suitability, and perception on prevailing political situation. If the dependent variable of a regression model is dichotomous, from econometric point of view, either logit or probit regression models should better be employed to counteract the limitations of the linear regression models. Besides, despite their much statistical similarity, logit model has got wider application in econometric analysis mainly owing to its technical simplicity involved in interpretation of statistical outputs. Therefore, the following logit model was developed for this study:

Where the Z exponent in the probabilistic model is determined by the following function:

Z=β0+β1Ag+β2Gnd+β3MarSt+β4EduL+β5Depen+β6Dist +β7SavB+β8LonRp+β9 LonTm+β10LonSz+β11LnDiv+β12Tr +β13ExtraLn+β14RepSuit+β15PolPer+ε

Where in this model:

• β0=Constant term and β1-β15 is model coefficients.

• Ag=Age of household heads.

• Gnd=Gender of borrowers.

• MarSt=Marital status of borrowers.

• EduL=Educational level of borrowers.

• Depen=Number of dependents in the borrowers’

family.

• Dist=Distance from borrowers’ home to lenders

office.

• SavB=Voluntary saving behavior of borrowers.

• LonRp=Loan reputation of borrowers with the

microfinance.

• LonTm=Timeliness of loan release by the

microfinance.

• LonSz=Loan size or amount of loan

granted.

• LnDiv=Loan diversion by borrowers.

• Tr=Training delivered to borrowers by the

microfinance.

• ExtraLn=Extra outstanding loans from other sources.

• RepSuit=Loan repayment period suitability for the

borrowers

• PolPer=Borrowers’ perception of prevailing political

environment

• ɛ= Error term of the model.

Results and Discussion

Descriptive statistics

In this study data was collected from a total of 362 households. A descriptive analysis for the categorical variables of those observations is presented in Table 2.

| Variable | Payer | Non-payer | Total |

|---|---|---|---|

| n (%) | n (%) | n (%) | |

| Gender | |||

| Female | 63 (21.07) | 21 (33.33) | 84 (23.20) |

| Male | 236 (78.93) | 42 (66.67) | 278 (76.80) |

| Marital status | |||

| Single | 34 (11.37) | 7 (11.11) | 41 (11.33) |

| Married | 214 (71.57) | 41 (65.08) | 255 (70.44) |

| Divorced | 46 (15.38) | 14 (22.22) | 60 (16.57) |

| Widowed | 5 (1.67) | 1 (1.59) | 6 (1.66) |

| Educational attainment | |||

| Illiterate | 90 (30.10) | 23 (36.51) | 113 (31.22) |

| Elementary | 84 (28.09) | 13 (20.64) | 97 (26.80) |

| High school | 81 (27.09) | 15 (23.81) | 96 (26.52) |

| Diploma and TVET | 17 (5.69) | 5 (7.94) | 22 (6.10) |

| Degree and above | 27 (9.03) | 7 (11.11) | 34 (9.40) |

| Saving | |||

| Saver | 289 (96.66) | 43 (68.25) | 332 (91.71) |

| Non-saver | 10 (3.34) | 20 (31.75) | 30 (8.29) |

| Loan timeliness | |||

| Timely | 264 (88.29) | 34 (53.97) | 298 (82.32) |

| Non-timely | 35 (11.71) | 29 (46.03) | 64 (17.68) |

| Loan diversion | |||

| Diverter | 40 (13.38) | 43 (68.25) | 83 (22.93) |

| Non-diverter | 259 (86.62) | 20 (31.75) | 279 (77.01) |

| Training | |||

| Trained | 275 (91.97) | 33 (52.38) | 308 (85.08) |

| Untrained | 24 (8.03) | 30 (47.62) | 54 (14.92) |

| Supervision | |||

| Supervised | 249 (83.28) | 40 (63.49) | 289 (79.83) |

| Unsupervised | 50 (16.72) | 23 (36.51) | 73 (20.17) |

| Repayment period | |||

| Suitable | 269 (89.97) | 39 (61.90) | 308 (85.08) |

| Unsuitable | 30 (10.03) | 24 (38.10) | 54 (14.92) |

| Political perception | |||

| Affects | 15 (5.02) | 25 (39.68) | 40 (11.05) |

| Doesn’t affect | 284 (94.98) | 38 (60.32) | 322 (88.95) |

Table 2: Descriptive analysis of categorical variable.

As shown in Table 2, among the total participants 17.40% were found to be defaulter while the remaining 82.60% were nondefaulters. On the basis of gender distribution, majority of the participants were male households (76.80%) and only 23.20% were female households. According to Folefack, et al., such large proportion of males to females in financial affairs may show the fact that male households are charged with high financial obligations in a family. In terms of marital status, 11.33% of the total were single, 70.44% were married, while the remaining 16.57% and 1.66% were married and divorced, respectively. This composition in marital status may help infer that majority of the borrowers in the microfinance industry are married households, which obviously can be due to the saying by Saravia-Matus, et al., that married households are dependable than unmarried households, and thus are believed to be more creditworthy. In terms of educational attainment, 31.22%, 26.80%, 26.52%, 6.10% and 9.40% of the 362 total respondents were illiterate, elementary, high school, TVET and diploma, and degree & above, respectively. In this regard, the majority (31.22%) of the respondents have no basic educational attainment, indicating that education in fact is a recent social system introduction to the area.

Among the total, 332 samples, representing 91.71% of the study population, were participants in voluntary saving, while the remaining 8.29% had no history of voluntary saving participation. 82.32% of the respondents responded that they were granted with the amount they requested from the microfinance on time, while the remaining 17.68% were not ordained to receive the amount on time. Among the survey participants, 22.93% have diverted their borrowing for unintended purposes, whereas the remaining 77.01% have appropriated it for what it was purposed. In terms of loan usage training, 85.08% of the sample borrowers had attended trainings on loan utilization while the remaining 14.92% didn’t receive any training. 79% of the total samples were supervised by the microfinance body to ensure their efficient utilization. But, almost more than 20% of the participants were not supervised. Correspondingly, 85.08% of the respondents indicated that the repayment period set by the microfinance institution was suitable while the 14.92% regarded the repayment period as unsuitable. Besides, participants were surveyed for their perception about the contribution of prevailing political turmoil on the probability of loan default and only 11.05% of them perceived the political crisis as good opportunity to result in loan write-off, while the majority (88.95%) considered the turmoil as non-contributing to loan default. Apart from the categorical variables five continuous variables were used in this study and their respective statistics is presented in Table 3 below:

| Variables | Payers | Non-payers | T-statistics | Over all | |||

|---|---|---|---|---|---|---|---|

| Mean | SD | Mean | SD | Mean | SD | ||

| Ag | 37.07023 | 9.111451 | 39.65079 | 11.17768 | 1.9596 | 37.51934 | 9.536686 |

| Dpnts | 2.056856 | 1.242472 | 3.063492 | 1.366335 | 5.7418** | 2.232044 | 1.319477 |

| Dst | 5288.629 | 5913.283 | 5706.349 | 5965.218 | 0.5088 | 5361.326 | 5916.178 |

| LoanRep | 2.076923 | 1.197356 | 1.68254 | 0.819626 | -2.4928** | 2.008287 | 1.149461 |

| LoanSz | 38496.66 | 48839.78 | 48746.03 | 102902.4 | 1.1997 | 40280.39 | 61666.71 |

Note: **5% level of significance

Table 3: Descriptive analysis of continuous variables.

As shown in Table 3 above, the average age for the overall participants was 37.51934, which almost deemed to corroborate with the 37.95 average age reported by Nyangaya, et al. As for Olowa, et al., age ranges of 30-50 years are considered as productive periods of life, and it is believed to be so in this study. In this regard, even though it is insignificant, the average age for payers (37.07023) was less than the 39.65079 average ages for non-payers. Besides, the samples had, on overage, dependents of 2 to 3 persons in their household. The average number of dependents for non-defaulters (2.06) was relatively lower than the 2.23 average numbers of dependents for defaulters. This difference in average number of dependents is statistically significant at 5% level of significance as shown in the t-test statistics. Large number of dependents may impede repayment as it could increase households’ economic burden. For the overall sample, the distance from borrower’s residence to the microfinance was, on average, about 5361.33 meters with standard deviation of 5916.178, representing the degree of scatteredness in households’ residence. On the basis of loan reputation, households have, on average, took loans twice before. In addition, the average loan size granted for the sample households was around birr 40,280.

Model diagnostic tests

To test for the model specification, a test called linktest has been performed. This linktest uses the linear predicted value (_hat) and linear predicted value squared (_hatsq) as predictors to rebuild the regression model. In order for a model to be considered well specified, the linear predicted value (_hat) should be statistically significant with P-value of less than 0.005 (P<0.005), at the 95% confidence interval, whereas the linear predicted value square (_hatsq) must be statistically insignificant with P-value of greater than 0.005 (P>0.005). Insignificant (_hatsq) is associated with insignificant linktest. In this study, as shown in Table 4, the model is considered well specified as it is found to have an insignificant linktest with p value of 0.000.

| Repayment | Coef. | Std. Err. | Z | P>|z| | (95% Conf. Interval) | |

|---|---|---|---|---|---|---|

| _hat | 0.963068 | 0.142437 | 6.76 | 0 | 0.683896 | 1.24224 |

| _hatsq | 0.01964 | 0.046925 | 0.42 | 0.676 | -0.07233 | 0.111612 |

| _cons | 0.043516 | 0.265449 | -0.16 | 0.87 | -0.56379 | 0.476754 |

Table 4: Results of model specification test.

As shown in Table 5, another diagnostic test, Hosmer, et al., test, was used to test for the model fit. A common practice in this test is to construct a contingency table of 2 by 10 sizes, by combining the patterns formed by the predictor variables of the model. Under Hosmer, et al., test, the larger the P-value from the cutoff point is the better fit the model is. Accordingly, in this study the p value is 0.5549, signifying the goodness of fit of the model.

| Numbers of observations | Number of groups | Hosmer-Lemeshow Chi-square | Prob >Chi-square |

|---|---|---|---|

| 362 | 10 | 6.83 | 0.5549 |

Table 5: Results of test for model fit.

The model was also tested for the possible presence of multicollinearity problem. But, the Variance Inflation Factor (VIF) for all study variables was far below the standard threshold value of 10, signifying that there was no serious multicollinearity problem.

Logistic regression analysis

To examine the significant determinants on this study, the dependent variable loan repayment performance was regressed on the independent variables age, gender, marital status, education level, dependents, distance, saving behavior, loan reputation, loan timeliness, loan size, loan diversion tendency, training, other loans, repayment period suitability, and perception on prevalent political instability.

On this regard, as shown in Table 6, the log likelihood Chisquare value of 178.73 was significant at 1%, implying that all the independent variables in this model, were better in explaining the variations in loan repayment performance than a model with no explanatory variable. From the logistic regression, seven of the fifteen explanatory variables were significant at 5% level of significance, and two other predictor variables were significant 1% level of significance. The statistics for number of dependents in household, loan reputation, loan timeliness, loan size, training, repayment period suitability, and political perception were significant at 5% significance, while saving behavior and loan diversion were significant at 1%. Interpretations of the logistic regression analysis for the significant determinants of loan repayment performance are given as follows.

Saving behavior: As shown in the logistic estimation table, households’ participation on voluntary saving was found to have positively significant effect on loan repayment performance at 1% level of significance. Those who participated on voluntary saving were found to have almost 14.10 times higher probability of paying their loan in time than those who didn’t ever venture to save voluntarily. Apparently, savers would tend to accumulate better wealth and will not face difficulties of repaying their borrowings. This finding is in agreement with. Hence, the findings, as regards to the variable saving behavior, fails to reject the hypothesis of this study, that postulated significant positive relationship between saving behavior and loan repayment performance among among the smallholder borrowers.

Loan diversion: From the logistic regression, it is evidential that loan diversion was significant at 1% level of significance and it negatively affects repayment performance of the borrowers. Committing borrowed funds into intended purposes magnifies the repayment performance of households by a factor of 10.74. Alternatively, borrowers who utilize microfinance loans for intended purposes would have 10.74 times higher probability of repaying loans in time than those who diverted their borrowings to social and domestic purposes. Financial loans are meant to be used profitably, but if they are misappropriated by users for unproductive expenditures, such as medical expenses and contingencies, house consumptions, social-ceremonies and etc., it is logical that repayment difficulties are inevitable. Altogether, this result is consistent with earlier findings such as Jemal, et al.; Dula, et al.; Abreham, et al.; and Mohamed, et al. substantiating that loan diversion affects loan repayment performance significantly and adversely. Therefore, the hypothesis pertaining loan diversion and loan repayment in this study is accepted.

Number of dependents in household: Number of dependents was found to have negative and significant effect on loan repayment status of borrowers at 5% significance level. As shown in odds ration column of Table 6, holding all other variables unchanged, a unit increase in number of dependent households decrease the probability of being non-defaulter by 68.17%. This is indeed true as higher number of dependents in household is likely to imposes substantial economic burden. The result of this study comes to be consistent with earlier studies of Kebede, et al.; Angaine, et al. Therefore, the hypothesis regarding the effect of number of dependent households on loan repayment performance is accepted.

| Number of obs=362 LR chi2(20)= 178.73 Prob>chi2=0.0000 Log likelihood=-77.961879 Pseudo R2=0.5341 |

|||||||

| Rpt | Coef. | Std. Err. | Z | P|z| | 95% Conf. Interval | Odds ratio | |

|---|---|---|---|---|---|---|---|

| Age | -0.00928 | 0.024511 | -0.38 | 0.705 | -0.05732 | 0.038756 | 0.990759 |

| Gender | 0.260313 | 0.511194 | 0.51 | 0.611 | -0.74161 | 1.262235 | 1.297336 |

| Marital status | |||||||

| Married | 0.446201 | 0.844511 | 0.53 | 0.597 | -1.20901 | 2.101412 | 1.562366 |

| Divorced | -0.13981 | 0.959597 | -0.15 | 0.884 | -2.02058 | 1.74097 | 0.869527 |

| Widowed | 1.557594 | 2.191643 | 0.71 | 0.477 | -2.73795 | 5.853136 | 4.747387 |

| Educational level | |||||||

| Elementary | 0.398297 | 0.637951 | 0.62 | 0.532 | -0.85206 | 1.648658 | 1.489286 |

| High school | 0.498656 | 0.647976 | 0.77 | 0.442 | -0.77135 | 1.768665 | 1.646506 |

| TVET and diploma | -1.19235 | 0.926 | -1.29 | 0.198 | -3.00728 | 0.622579 | 0.303508 |

| Degree and above | -0.31867 | 0.875209 | -0.36 | 0.716 | -2.03405 | 1.396708 | 0.727116 |

| Dependents | -.3831354** | 0.17797 | -2.15 | 0.031 | -0.73195 | -0.03432 | 0.681721 |

| Distance | -5.7E-05 | 3.57E-05 | -1.6 | 0.109 | -0.00013 | 1.28E-05 | 0.999943 |

| Saving behavior | 2.642928* | 0.699303 | 3.78 | 0 | 1.27232 | 4.013536 | 14.0543 |

| Loan reputation | .5747396** | 0.270977 | 2.12 | 0.034 | 0.043635 | 1.105845 | 1.776668 |

| Timeliness | 1.188565** | 0.526812 | 2.26 | 0.024 | 0.156033 | 2.221098 | 3.282369 |

| Loan size | -5.81E-06 | 2.96E-06 | -1.96 | 0.05 | -1.2E-05 | -7.82E-09 | 0.999994 |

| Loan diversion | 2.374349* | 0.465412 | 5.1 | 0 | 1.462158 | 3.28654 | 10.74402 |

| Training | 1.504133** | 0.606912 | 2.48 | 0.013 | 0.314608 | 2.693658 | 4.50025 |

| Supervision | -0.1909 | 0.568667 | -0.34 | 0.737 | -1.30547 | 0.923663 | 0.826211 |

| Repayment suitability | 1.327141** | 0.542528 | 2.45 | 0.014 | 0.263805 | 2.390477 | 3.77025 |

| Political perceptio | -1.512329** | 0.602695 | -2.51 | 0.012 | -2.69359 | -0.33107 | 0.220396 |

| _Constant | -4.67016 | 1.638028 | -2.85 | 0.004 | -7.88063 | -1.45968 | 0.009371 |

Note: *and **shows level of significance at 1% and 5%, respectively.

Table 6: Logistic regression results.

Loan reputation: As shown in Table 6, loan reputation turned out to have a positive and significant effect on loan repayment performance of borrowers at 5% level of significance. A unit increase in credit experience would result an increase in paying ability of a household by a factor of 1.78. This positive relationship between loan reputation and repayment performance can be explained in words of Lensink, et al., that as beneficiaries continue acquiring loans from dominant microcredit providers, they start to appreciate the role of microfinance loans for their entrepreneur undertakings and will work to improve their repayment performance so as to secure their financial access. In this regard, the hypothesized statement about the effect of loan reputation on loan repayment performance is accepted, and this finding supports earlier findings of Mirpourian, et al.; Lensink, et al.

Timeliness of loan release: This variable was also found to have a significant positive impact on loan repayment performance of borrowers, at 5% level of significance. As shown in Table 6, timely loan release by the lending institution can help enhance borrowers paying ability by a factor of 3.28. If requested loan is processed and released quickly, beneficiaries can effectively finance their affaires and start to earmark some money for repayments. But, if the loan release by a lending agent is delayed, household repayments are likely to be deferred as they need long loan tenure. This finding aligns with earlier studies of Tesfaye, et al.; Pasha, et al., and the hypothesis developed for this variable is validated by the findings.

Training: The other determinantal variable, at 5% level of significance, found to have significantly positive impact on loan repayment was Training on loan utilization. Loan beneficiaries who have attended loan usage training were found to have 4.5 times greater probability of paying loan on time than the nonattendants. This relationship emanates from the fact that if more training is given to borrowers, they will be able to understand the microfinance’s rules and regulation. This study corroborates with findings of Fikirte, et al.; Pasha, et al.; Tundui, et al.; and Mikir, et al., where training was found to be significant determinant of borrowers’ repayment status. Therefore, the hypothesis of this study regarding training and loan repayment is accepted.

Suitability of repayment period: In this study, suitability of repayment period was also found to have a significant and positive effect on loan repayment performance of borrowers. As shown in Table 6, if the repayment period is made to be suitable for the borrowers, their repayment performance can be increased by a factor of 3.77. The more suitable the repayment period is, the better households repayment status would be, and this finding is in line with studies of Kebede, et al.; Pasha, et al. As for Abreham, et al., this positive and significant relationship between loan repayment and loan suitability can be explained by the fact that if the lending institution’s repayment schedule is suitable for the borrowers, they tend to increase their belief and attuited towards the microfinance institution. Hence, the hypothesis concerning about loan repayment suitability is accepted.

Perception on political instability: Borrowers’ perception on the political environment was also found to have significant adverse influence on repayment performance of households at 5% significance level. From the regression output, it can be inferred that, borrowers that perceive the political upheaval as an opportunity to evade have 22% less probability of repaying their loans than those who don’t perceive that political environment as good opportunity to evade. Ethiopia as a nation has nowadays succumbed into deep political crisis and structural instability. And, at the face of this instability, it is high likely that, microfinance borrowers would consider the loans, as said by Oladeebo, et al., as their own fair share of the “national cake.” Thus, in this study households’ perception on current political upheavals was found to have significant negative effect on their repayment ability. The negative relationship between political perception and repayment performance nearly corresponds with that of Stephen, et al., except that the test statistics for their study was insignificant. Nevertheless, as Nawai, et al., commended, political environment is one among the sources of systematic risks [19,20].

Conclusion

The analytic results presented in chapter four have shown that voluntary saving behavior of borrowers, better credit experience of borrowers, non-diverting loan utilization practices of borrowers, improved loan usage trainings by microfinanciers, suitable repayment arrangements, and stable political environment are the major contributors to enhanced loan repayment performance of borrowers. While providing finance to discharge its social mission and promote entrepreneurial activities, microfinance institutions, as Goldberg, et al., stated, should assure their sustainability and growth. Hence, as long as their sustainability is concerned, they should strive towards minimizing loan defaults. The borrowers, in turn, should be cognizant that sustainable financial provision for their productive endeavors is dependent on their loan repayment performance. If they fail to satisfy their loan repayment agreements, it would mean trammeling their prospective financing options. Thus, both parts, the lending microfinance institutions and borrower household units, should maximize the loan repayment performance in the broader financial system. Based on findings of this research, the following recommendations are believed to be worth pursuing.

The microfinance institutions should train and inspire their clients to save and sustainably utilize loans on most productive means. Microfinance institutions should also arrange their repayments periods in ways deemed to be suitable to their clients. Arbitrarily arranged repayment periods is found to be the major cause of loan defaults and delinquencies in the surveyed microfinance, and as such improving that practice would mean tackling repayment problems in microfinancing industry. Besides, lending money to borrowers with established credit history is one contributor to enhanced repayment status. Hence, microfinance institutions should extend larger portions of their loan portfolios to their existing customers, while also employing rigorous credit policy on new borrowers.

Upon households’ failure to repay their loans on time, legal actions by lenders are inevitably ensued and these may cause bankruptcy to economic establishments and ruin marriage relationships. Numerous legal cases in marriage related issues are caused, among others, due to loan repayment failures. Overcoming loan repayment problems would help settle family life, and borrower households should live up to the contractual agreements with their lenders. This is achievable through having personal saving and productive loan utilization. Thus, smallholder farmers are advised to voluntarily save from their earnings, and borrow money only for productive endeavors. As far as concerned, policy makers and financial industry regulators should issue directives that help sustain financial provision while minimizing loan defaults? They should work towards enhancing households’ saving habits and frame improved credit screening and evaluation schemes, as it would mean a lot to the nation’s social welfare and economic wellbeing.

Future researchers should also investigate the determinants of households’ loan repayment performance in more in-depth analysis. Due to economic reasons and data accessibility, the scope of this study was delimited to only one microfinance borrowers from southern zone of Tigray. However, extending its scope beyond the zonal administration and inclusion of other extra microfinance institutions could have provided better deep findings on loan repayment issue. Therefore, extending the areal and circumstantial coverage of this study could be a prospective research project for upcoming researchers. Besides, examining the socio-economic consequences of loan defaults, by the households’ perspective, seems somewhat worth investigating research area, and thus, researchers are recommended to turn their attention towards that.

References

- Angaine F, Waari DN. Factors influencing loan repayment in microfinance institutions in Kenya. IOSR J Bus Manag. 2014;16(9):66-72.

- Asgedom AK, Desta TS, Bahita GH. Determinants of MFIs group loan repayment performance: A case of debit credit and saving institution, Mekelle, Ethiopia. J Pove, Invest Develop. 2015;10(1):1-22.

- Bhatt N, Tang SY. Determinants of repayment in microcredit: Evidence from programs in the United States. Int J Urban Reg Res 2002;26(2):360-376.

- Enimu S, Eyo EO, Ajah EA. Determinants of loan repayment among agricultural microcredit finance group members in Delta state, Nigeria. Financ Innov. 2017;3:1-2.

- Folefack AJ, Teguia JS. Factors influencing loan repayment by credit beneficiaries of microfinance institutions in the Far North region, Cameroon. Russ J Agric Soc Econ Sci. 2016;51(3):44-51.

- Jote GG. Determinants of loan repayment: the case of microfinance institutions in Gedeo zone, SNNPRS, Ethiopia. Univers J Account Finance. 2018;6(3):108-122.

- Godquin M. Microfinance repayment performance in Bangladesh: How to improve the allocation of loans by MFIs. World Dev. 2004;32(11):1909-1926.

- Firafis H. Determinants of loan repayment performance: Case study of Harari microfinance institutions. J Agric Ext Rural Dev. 2015;7(2):56-64.

- Hossain MK. Measuring the impact of BRAC microfinance operations: A case study of a village. Int Bus Res. 2012;5(4):112-123.

- Kebede M, Tegegn T, Tafese T. Factors affecting loan repayment performance of small scale enterprises financed by micro finance institutions: Study on private borrowers around Wolaita and Dawuro zone. Global J Manag Bus Res C Finan. 2016;16(7):54-63.

- Mead DC, Liedholm C. The dynamics of micro and small enterprises in developing countries. World Dev. 1998;26(1):61-74.

- Melese M, Asfaw M. Determinants of loan repayment performance of omo microfinance institution: In the case of Mizan Aman town, Southwest Ethiopia. Res J Bus Manag. 2019;14(1):7-14.

- Murthy U, Mariadas PA. An exploratory study on the factors contributing loan repayment default among the loan borrowers in micro finance institutions in Shah Alam, Selangor. Int J Bus Manag. 2017;12(12):242-250.

- Nawai NB, Shariff MN. Determinants of repayment performance in microfinance programs in Malaysia. Labuan Bulle Inter Bus Finance. 2013;11:14-29.

- Nawai N, Shariff MN. Determinants of repayment performance in microcredit programs: A review of literature. Int J Bus Soc Sci. 2010;1(2):152-161.

- Nawai N, Shariff MN. Factors affecting repayment performance in microfinance programs in Malaysia. Procedia Soc Behav Sci. 2012;62:806-811.

- Oladeebo JO, Oladeebo OE. Determinants of loan repayment among smallholder farmers in Ogbomoso agricultural zone of Oyo state, Nigeria. J Soc Sci. 2008;17(1):59-62.

- Olowa OW, Olowa O. Tobit Analysis of factors influencing loan repayment performance: A case study of Lift Above Poverty Organization (LAPO) Micro-credit agency in Nigeria. Appl Sci Rep. 2017;18(3).

- Pasha SA, Negese T. Performance of loan repayment determinants in Ethiopian micro finance-An analysis. Eurasian J Bus Econ. 2014;7(13):29-49.

- Tundui CS, Tundui H. Microcredit, micro enterprising and repayment Myth: The case of micro and small women business entrepreneurs in Tanzania. Am J Ind Bus Manag. 2013;2(1):20-30.

Citation: Adhana HN, Kahisu HR, Fetiwi SS (2024) Determinants of Loan Repayment Performance of Smallholder Farmers: Empirical Evidence from Southern Zone of Tigray, Ethiopia. Int J Account Res. 12:376.

Copyright: © 2024 Adhana HN, et al. This is an open access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.